Introduction

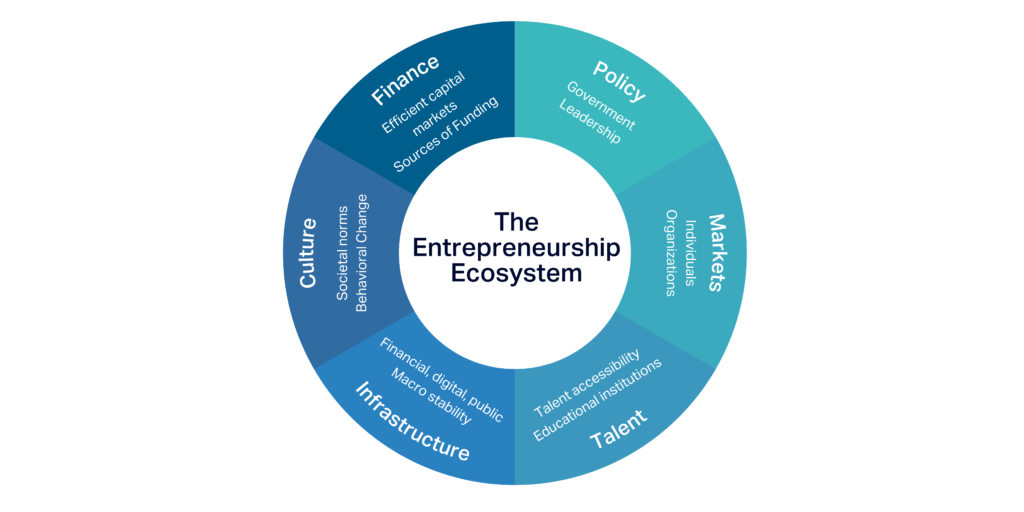

When fundraising for a startup, it is crucial to ensure that founders and investors align on the investment terms. Establishing a long-term relationship based on trust from the start is essential. Negotiation plays a significant role in this process, as both sides can find a middle ground where they feel like winners rather than adversaries. The goal is to strike a balanced agreement that benefits both parties without overpowering either side.

“As a negotiator, it is important to cultivate a reputation for fairness. Your reputation should precede you in a way that paves the path to success.” — Christopher Voss, former FBI hostage negotiator

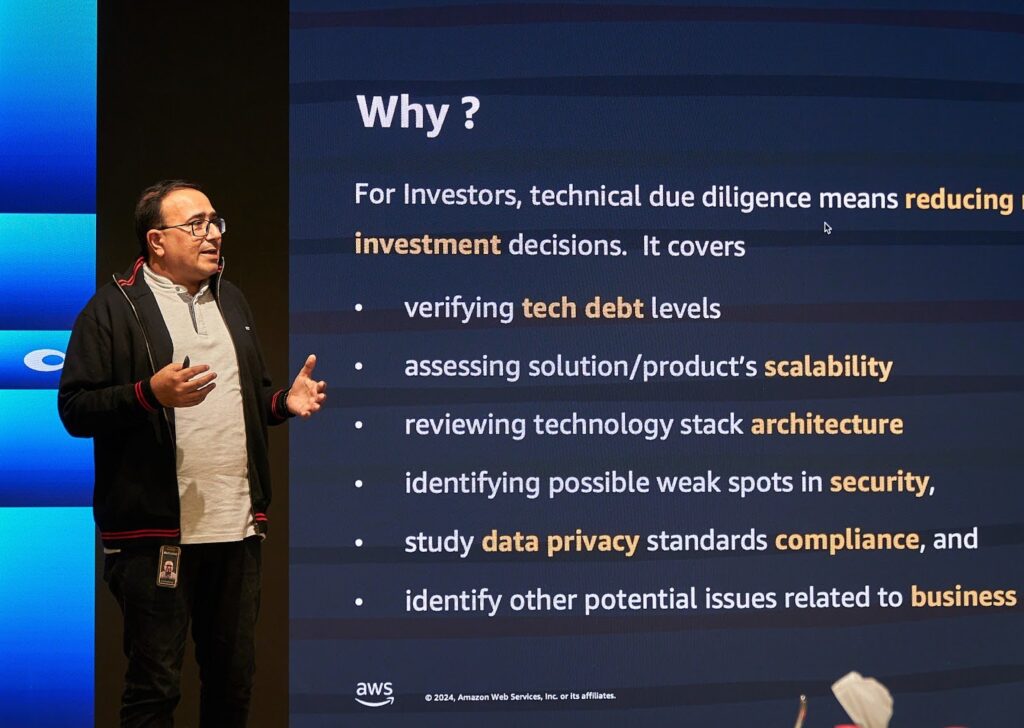

In this blog post, we aim to break down the key terms of an equity investment term sheet to help entrepreneurs and investors better understand the implications and impact of these terms. While the term sheet has become relatively standardized as an investment document, there are still some terms that can be extremely beneficial to investors in the short term but harm the company and other shareholders in the long term.

Valuation is not the only important term; other terms can hinder future financing rounds even more. Making changes to controls after signing investment agreements, which is typically when founders start considering engaging a lawyer, may be too late and more difficult.

Therefore, if you are a founder, it is advisable to work with a lawyer or seek professional advice to review the term sheet before signing it.

What is a Term Sheet?

A term sheet is an initial agreement that summarizes the main terms of an investment between a company and prospective investors.

Founders and investors should be able to agree on the major terms relatively quickly, or realize that the investment relationship is not feasible.

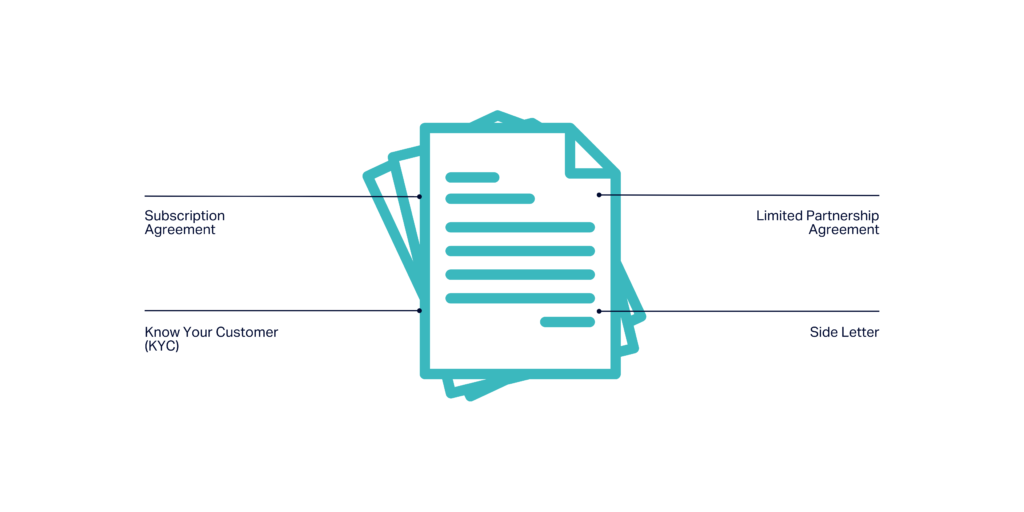

Most term sheets can be divided into three parts:

- Valuation and economic division of profits (key investment terms and rights attached to shares).

- Control and decision making (protective provisions, board structure, etc.).

- Investor protection terms (anti-dilution, warranties, etc.).

Term Sheets are Non-Binding, but…

Before we delve deeper into the different parts of a term sheet, it is important to note that term sheets are non-binding. This means they have no legal or binding force. While this might sound irrelevant, it is actually very important! The term sheet is a document that lays out the key investment terms, but neither the founder nor the investor are legally or contractually bound. This means that if you are a founder and think you will receive the investment promised to you by an investor just because you have a term sheet, this is a wrong assumption. The term sheet is just the start of the fundraising process.

Rather, all obligations will be concluded in the final investment agreements, after the investor has conducted additional due diligence to their satisfaction.

This also means that there might be a significant deviation, and possibly even a complete change, of terms (predominantly driven from the investors’ side). However, as a founder, do not get frustrated and think “this was not included in the Term Sheet,” as it is just an outline of key terms and not the entirety of the investment agreement.

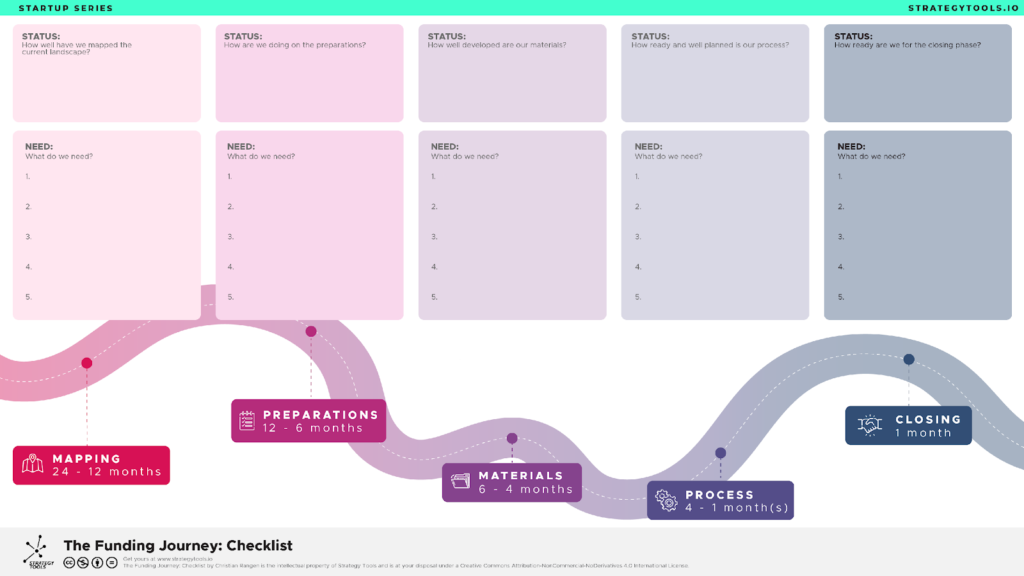

One more thing to be mindful of is a legally binding exclusivity period during the negotiation period, often referred to as a “no-shop” period. Some investors will spend a significant amount of time and effort diligencing the company, and would not like the founders to use their Term Sheet as leverage to find better terms from other investors. However, agreeing to this too early in your fundraising process, or agreeing to a very long exclusivity period, can rule out better opportunities from other investors.

A long exclusivity period could hurt the founder’s fundraising process if, for example, the lead investor that issued the term sheet spends months diligencing the company but does not end up investing. The founder will find themselves back to square one, having wasted precious time.

So, if you agree as a founder, make sure there is a reasonable timeline for the exclusivity. However, this is not to say that once you have a term sheet, you should shop it around and try to negotiate better terms from other investors on the market.

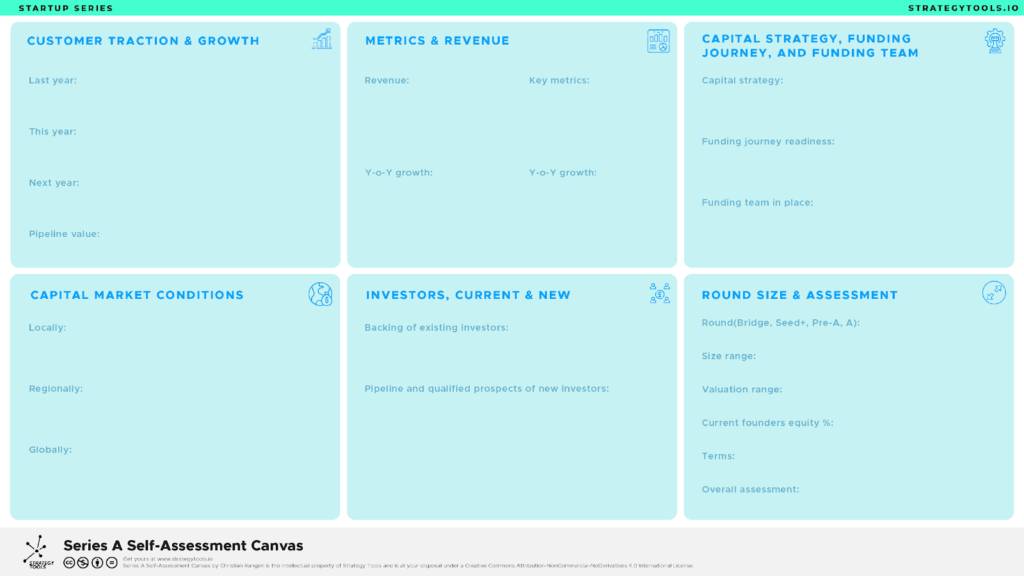

Valuation and Deal Economics

This is where we discuss the investment amount, valuation, share structure, price per share, liquidation preference, vesting of founder shares, and employee stock options.

This is the total dollar amount that the investors are prepared to invest in the company. Most of the time, founders will also state the percentage of the company that the investors will be buying into, unless not all investors are identified and the round is “open” for finalization. The investors coming into the round will own a part of the company on a fully diluted basis, meaning that all convertible notes and any options or warrants should convert prior to the new investors coming in.

A capitalization table (shareholding of the company) is usually included as a schedule/exhibit at the end of the term sheet.

Note: Capitalization tables are extremely important, and there are often discrepancies (although small) between the shares and ownership, largely due to convertible note conversions. Lawyers can provide support, but it is the responsibility of the founder and investors to ensure it is calculated correctly.

A company formed with its founders and employees will have issued Common Shares (Ordinary Shares) with equal rights. Investors coming in will typically require Preferred Shares.

Preferred shares have certain “preference” rights that rank ahead of the Common Shares and carry special preferential rights.

-

Price Per Share and Valuation

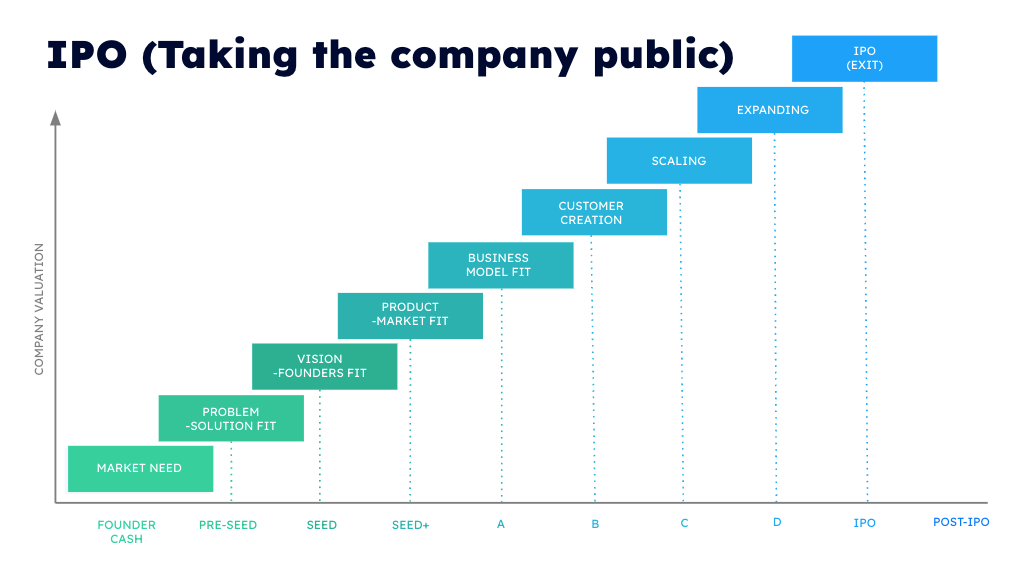

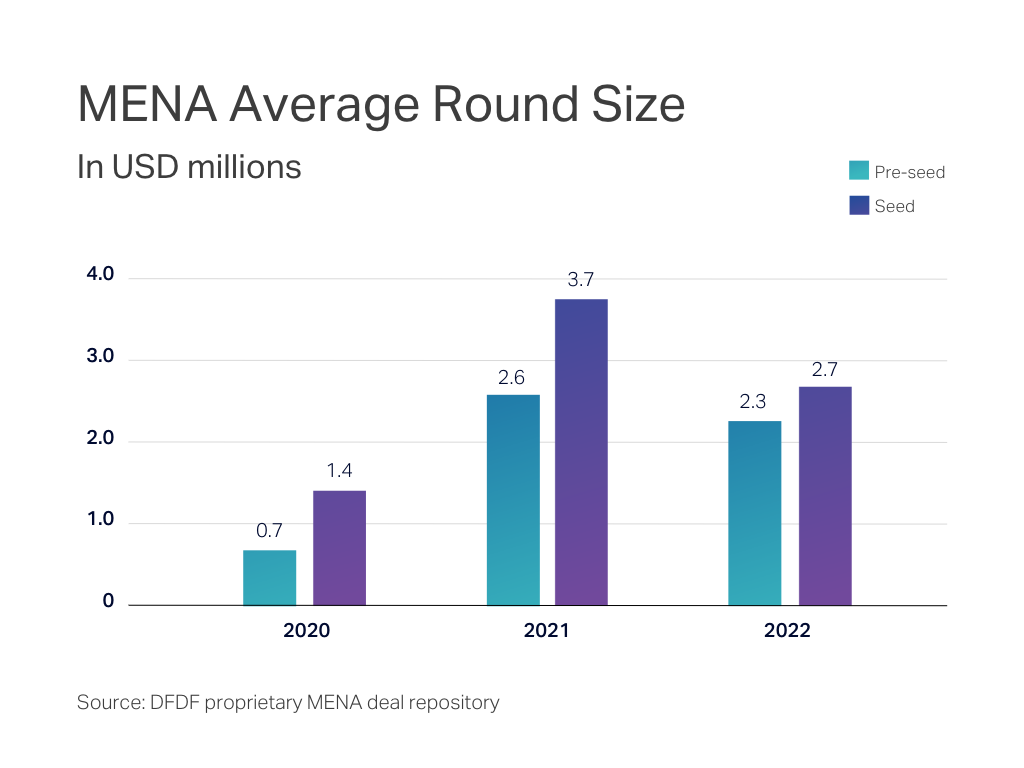

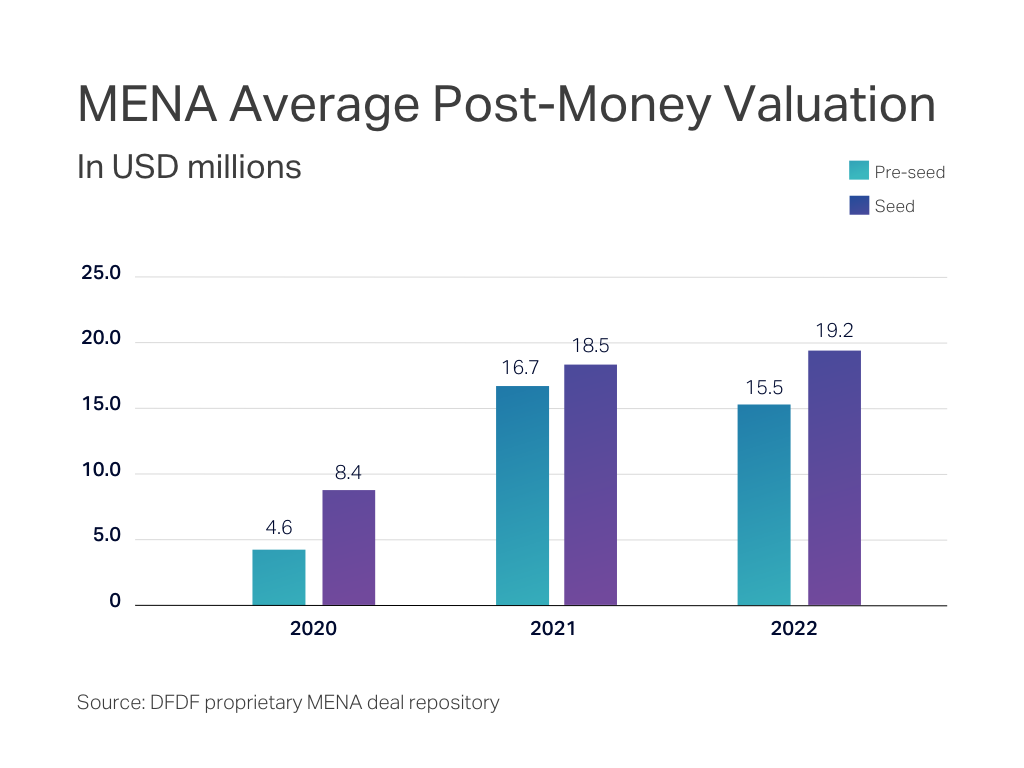

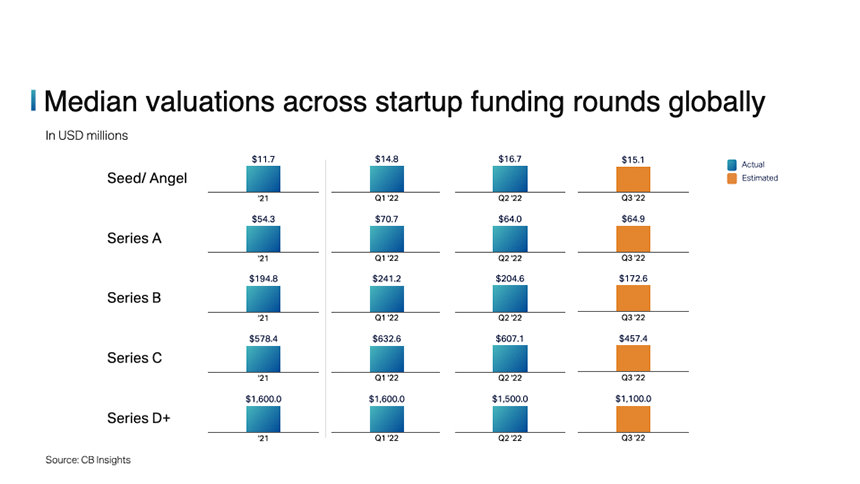

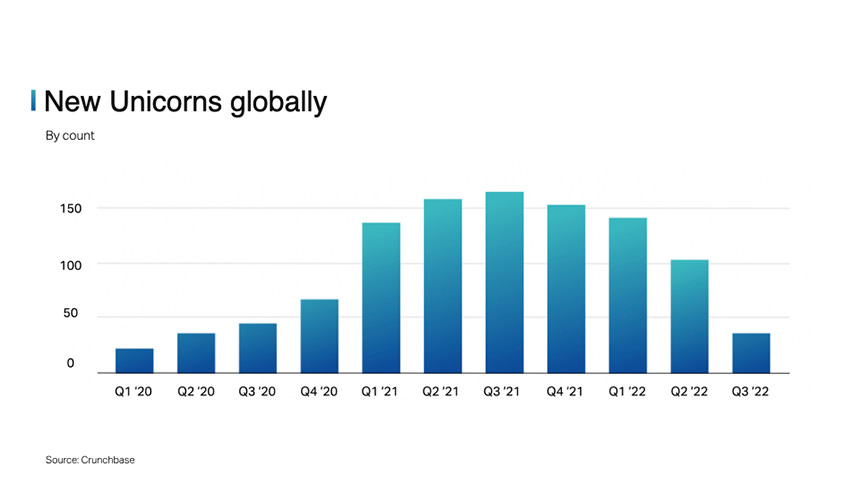

Another important element of a term sheet is the pre-money valuation, which is the value of the company prior to the investment round. The total cash invested and pre-money valuation determine the post-money valuation of the business. Valuing a startup is a complex topic, but one thing to note is that while financials from the previous year are objective, valuations are subjective.

Founders sometimes spend a lot of time negotiating valuations, but a general rule of thumb in venture capital is that a founder should not dilute more than 10-25%.

The price per share is calculated by dividing the pre-money valuation by the outstanding number of shares in the company prior to the investment.

Liquidation Preference refers to the order in which the company’s proceeds are distributed to shareholders in the event of a liquidation event, such as a merger, sale, or wind-up. It is the most commonly negotiated downside protection provision in venture financing.

A liquidation preference gives the investor the right to receive their money back before holders of Common Shares (held by the company’s employees and founders). In the event of a liquidation event, the investor who provided the most recent funding to the company has the first opportunity to recover their investment.

A liquidation preference is usually a multiple of the investment made by the investor to purchase the shares in the company.

A 1x liquidation preference means that, in the event of a liquidation, the preferred shareholders have the right to receive their full investment back before any distribution is made to the common shareholders. In some cases, if the total proceeds are insufficient to cover the liquidation preference, the proceeds will be distributed among the preferred shareholders of the same class on a pro rata basis.

It is important to note that larger multiples on the liquidation preference can significantly impact founders and employees, as they may be left with little to nothing unless there is a substantial exit or liquidation event.

Furthermore, it is important to consider whether the liquidation preference is participating or non-participating. A non-participating liquidation preference (most common) means that once the capital has been distributed to the investors according to the liquidation preference (e.g., 1x), the remaining shareholders receive the rest of the funds.

If the common shareholders would receive more per share than the preferred shareholders upon a sale or liquidation, the preferred shareholders can convert their shares into common shares and give up their preference in exchange for the right to share pro rata in the full liquidation proceeds.

On the other hand, a participating liquidation preference allows preferred shareholders to receive their investment back and also participate in the distribution of the remaining proceeds along with other shareholders, essentially “double dipping.”

For example, if an investor invests $1M for 25% of the company (valuing the company at $4M) and the company sells to an acquiring company for $2M with a 1x participating liquidation preference, the investor would receive $1M first and then 25% of the remaining amount, totaling $1.25M, leaving $750k for everyone else.

Understanding these nuances is important for founders to ensure they negotiate liquidation preferences appropriately.

-

Vesting of Founder Shares

Investors typically require that the founders’ shares be subject to vesting, even if they have been purchased for value or have already vested. The aim is to create an incentive for the founders to remain committed to the company. Investors back the founder and would like to see their continued dedication.

-

Employee Stock Ownership Plan

Employee stock ownership can take the form of Stock Options (such as ESOP) or Restricted Stock Units (RSUs). Key hires and sometimes all employees are awarded these incentives, which go beyond a salary and bonus, to foster a sense of ownership and encourage long-term commitment.

Both stock options and RSUs have vesting periods, meaning it takes time for an employee to gain ownership of the option or stock. The industry standard is a 1-year cliff (where the person doesn’t receive anything until completing 1 year at the company) and then vesting either annually, quarterly, or monthly over an additional 3-5 year period.

Stock options grant employees the right, but not the obligation, to purchase shares typically at a strike price (which can be the same as the share price of the last investment round, but is typically lower or equal to zero USD).

RSUs typically do not have a strike price; after vesting, the employee owns the shares. In addition to time vesting, key deliverables (specific KPIs assigned by managers) may need to be achieved to obtain the stock or options.

It is good practice to have a sufficiently large ESOP to hire key talent in the present while saving some for future hiring. Although ESOPs can be created with each funding round, having a sizable pool from the start is advisable.

Control and Decision Making

This section of the term sheet covers voting rights, protective provisions, board representation, and reserved matters.

With each funding round, there is usually a new composition of the board of directors. The board may start small and grow over time. Typically, a lead investor takes a board seat, co-founders take seats, and smaller investors may nominate a director. It is also common to have independent directors, which can be beneficial, particularly if they possess industry knowledge or extensive experience that adds value to the board.

Board compositions are complex and do not adhere to a one-size-fits-all rule. Here is a sample board structure per stage of the company:

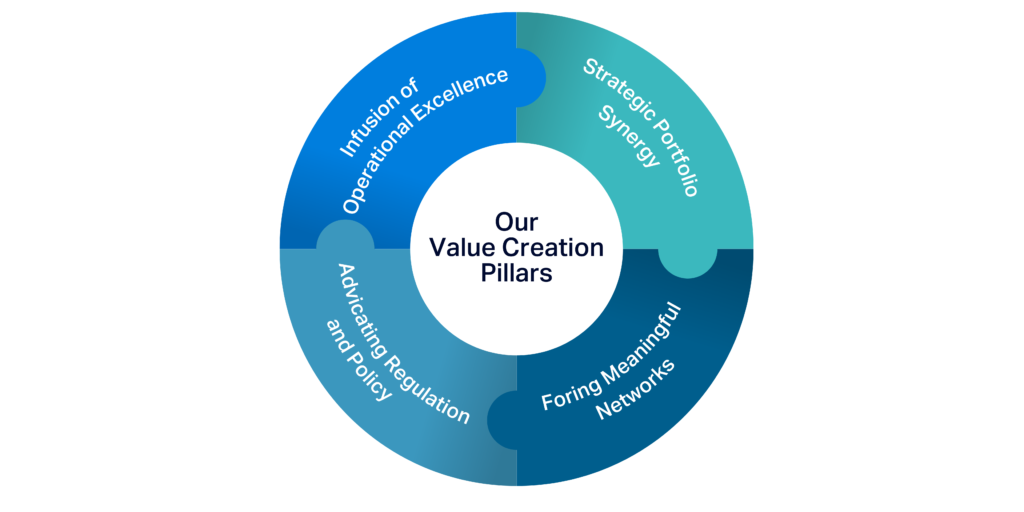

Founders should strive for a balanced board with the right investor representation. Investors should add value and bring additional support beyond capital. Board composition should be a well-thought-out process that serves the best interests of the whole company and all shareholders.

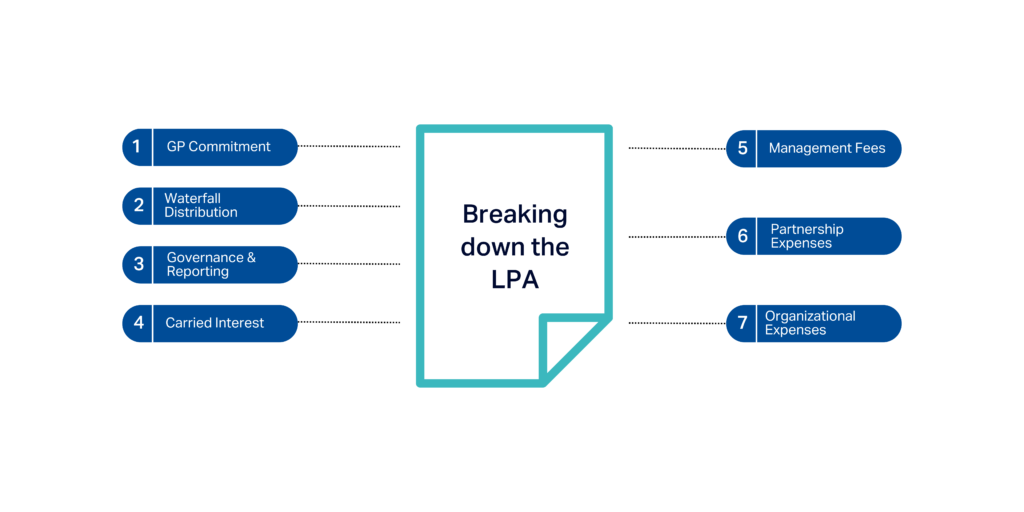

Investors often request special approval rights concerning significant matters that affect their investment. These rights and controls are usually referred to as Reserved Board Matters.

Certain key decisions with a significant impact on the company, such as a sale of the company, change in control (including the removal of the founder/CEO), issuing additional shares, amending key investment documents, or changing the main line of business, require approval by a certain number of shareholders and board members.

Reserved Matters are typically detailed in the final investment documents, with only a brief mention of the rights and approval thresholds in the term sheet.

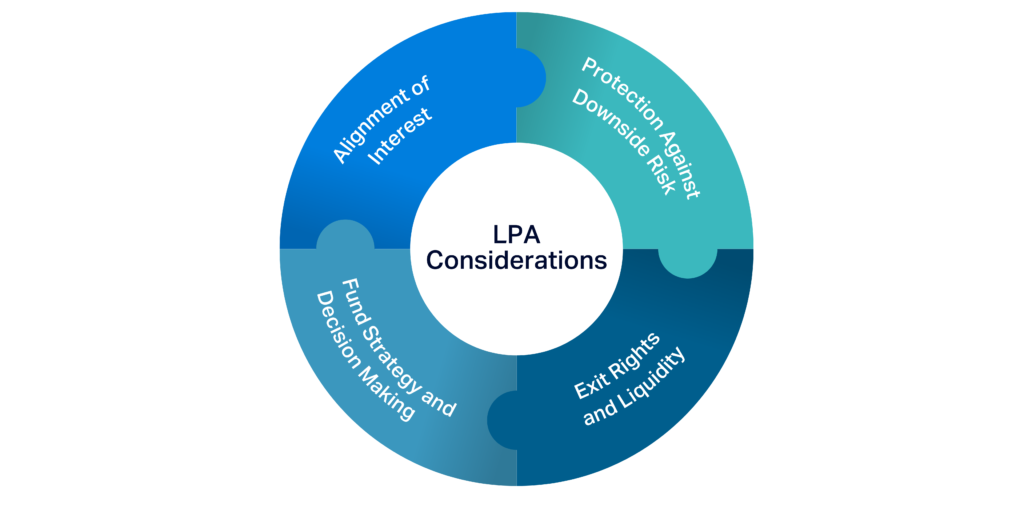

Investor Protective Terms

In addition to the above, there are several investor protection terms to consider in term sheets:

Anti-dilution provisions protect investors from the value of their investment decreasing if the company issues shares at a price per share lower than what the investors paid.

The two most common types of anti-dilution provisions are broad-based weighted average and full ratchet. Broad-based weighted average, the most commonly used in venture capital, recalculates the share price the investors paid by averaging out all previously issued and currently issuing securities. Full ratchet provisions automatically decrease the conversion price of existing preferred shares if the company sells shares at a lower price, ensuring the investors’ price per share is protected. Full ratchet provisions are not typically used as they can be costly for founders and future investors.

Investors may require certain conditions to be completed before investing (Conditions Precedent) or within a specified timeframe after the investment is finalized (Conditions Subsequent). These conditions can include restructuring the legal entity, organizing the organizational structure, or executing remaining legal documents.

Pre-emptive rights allow shareholders to exercise the option to purchase additional shares in any future issuance of the company’s stock. However, they are under no obligation to do so. Pre-emptive rights are particularly valuable for early-stage investors who enter the company at lower valuations. With subsequent funding rounds, they may wish to participate and maintain their percentage ownership in the company. Pre-emptive rights grant these early investors the “first look” opportunity to decide if they want to exercise their rights.

-

Drag-Along and Tag-Along Rights

A Drag-Along provision protects the interests of majority shareholders, enabling them to “drag” other shareholders into a joint sale of the entire company. This provision ensures that if the controlling shareholders find a buyer for the company, the smaller shareholders cannot block the sale and are compelled to participate, even if they would prefer not to.

Conversely, a Tag-Along provision protects minority shareholders, allowing them to “tag along” if a major shareholder decides to sell their shares. This provision ensures that minority shareholders are not left behind in the event of a major shareholder’s exit.

Conclusion

While there are several other provisions such as warrants, dividends, redemption, and information rights that can be part of term sheets, we have covered the most important ones in this article.

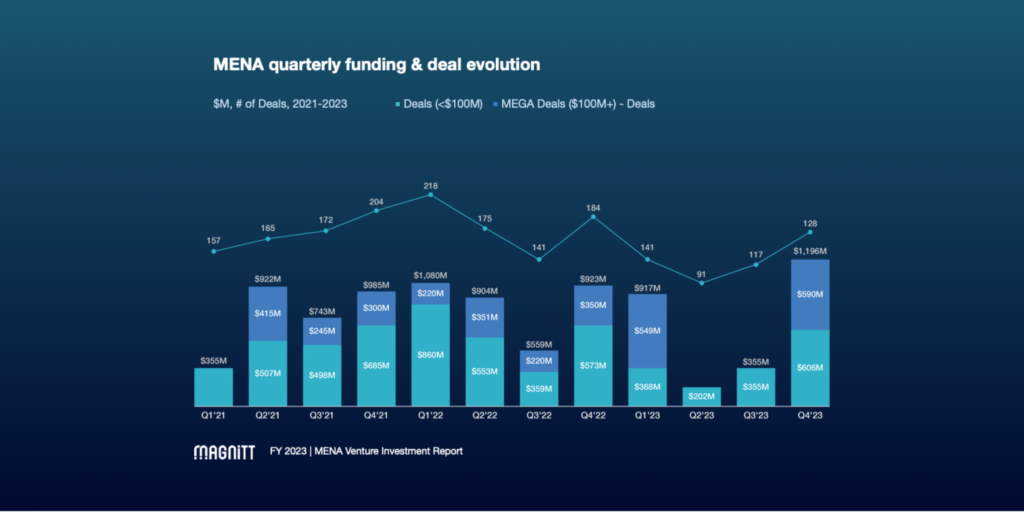

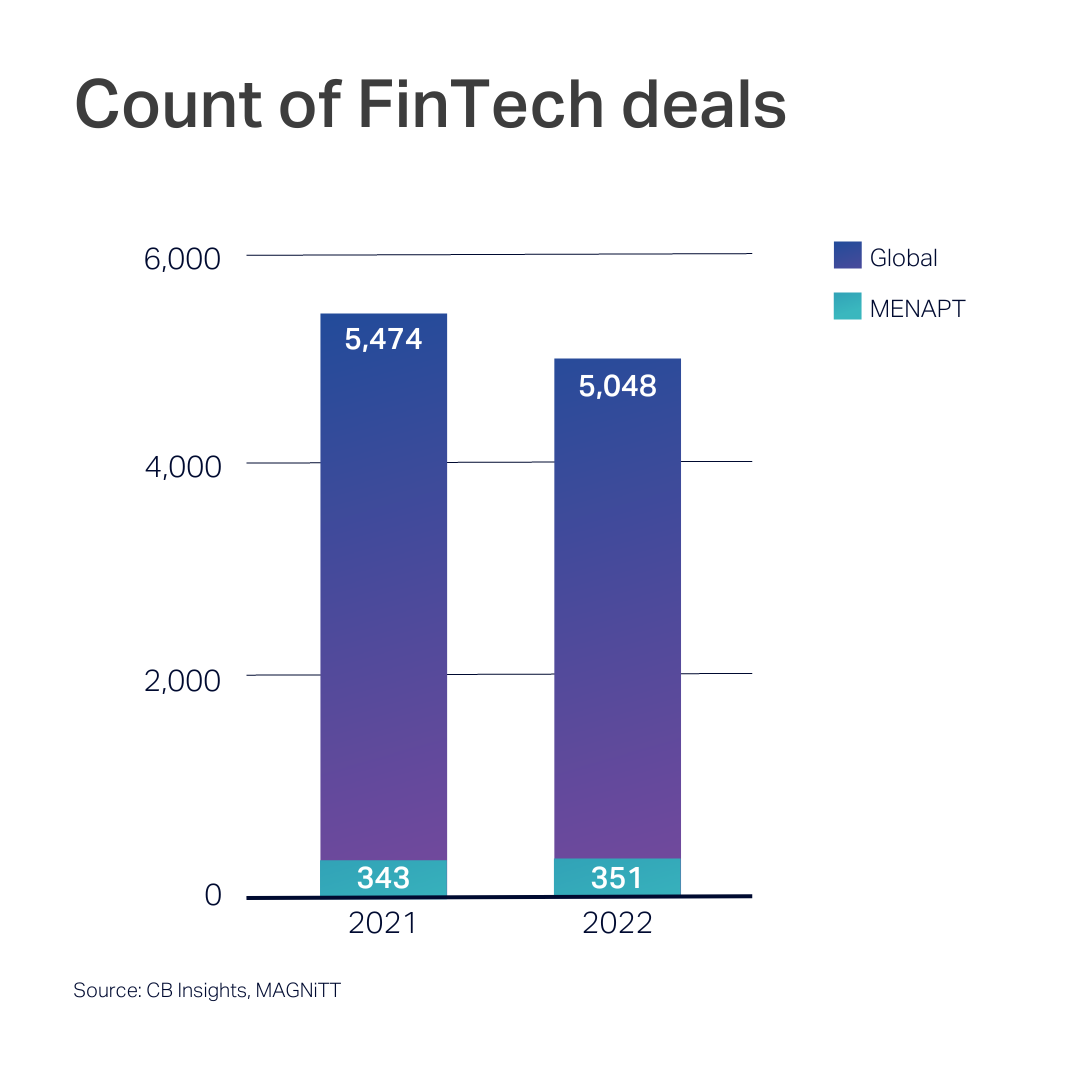

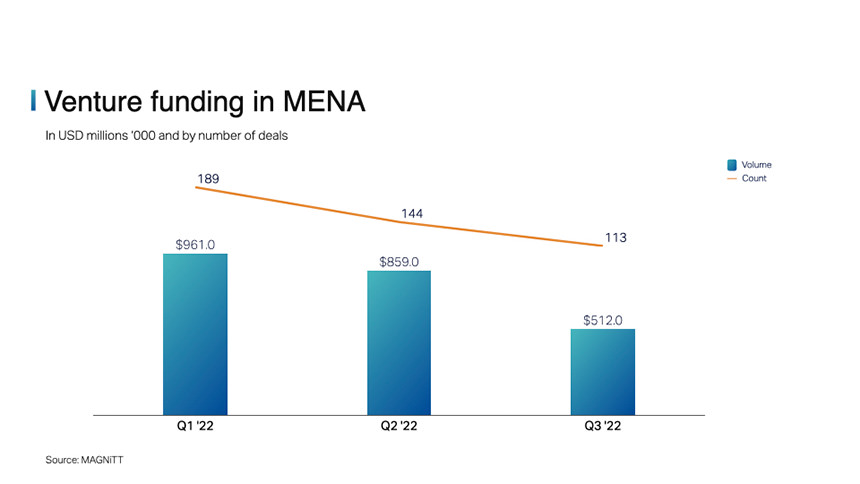

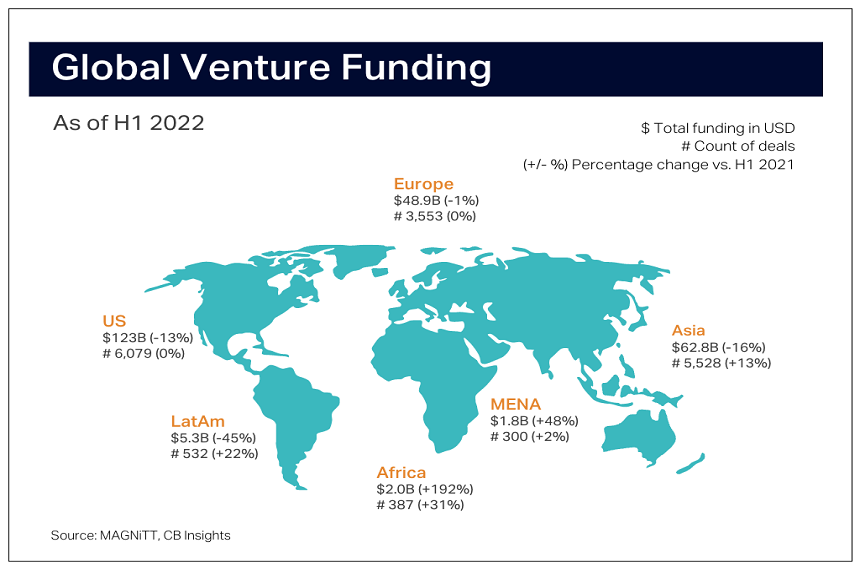

As standardization of term sheets becomes more prevalent in the MENA region, founders should be aware that each funding round may introduce more aggressive investment terms. It is crucial to understand that less entrepreneur-friendly term sheets can have negative consequences in subsequent rounds. Investors will not want to invest in a company and receive worse terms than previous investors.

Founders should aim to make term sheet negotiations a relatively quick process, as most of the time will be spent on the long-form investment documents. It always takes longer to close a round than one assumes.

In conclusion, if you are a founder and receive a term sheet, remember that it is just the beginning of the investment process, and nothing is guaranteed. Seek professional advice, work with a lawyer to review the term sheet before signing, and make sure you fully understand the implications. The investment you make in reviewing the term sheet will be worth it in the long run.

To support you on your journey as a founder, we have compiled a list of resources in the Toolkit section of our website. There, you can find a term sheet template and other investment documents to assist you.

Remember, a well-negotiated and carefully considered term sheet can set the foundation for a successful investment relationship between founders and investors.