Introduction: The Numbers Behind The Tough Half-way Mark

At the halfway mark, global VC funding reached $144 billion, representing a 51% decline compared to the same period last year when the total amounted to $293 billion. Additionally, there have been a few noteworthy setbacks this year, most notably the collapse of Silicon Valley Bank, which had a ripple effect on the VC industry worldwide. The industry was further shaken by numerous layoffs across tech firms, with 151,054 workers affected at US-based tech companies alone, according to Crunchbase.

As a result, the VC industry may appear like it’s retracting as we enter into the second half of 2023. However, in today’s discussion, we will delve into what all of this means for founders seeking capital this year.

Fundraising Will Be Easier Said Than Done

Given the current economic climate, capital has become expensive, with the target range for the Federal Funds Rate being 5.25-5.50% at the time of this issue, compared to 2.25-2.50% at the same time last year. This doesn’t present an encouraging environment for founders looking to fundraising — on the surface of things, at least — and especially for founders who don’t have solid business fundamentals in place.

This makes the fundraising process daunting for investors as well, as they hold back on capital deployment, fearing they won’t achieve the same returns on their investments if they wait until after the current bear market emerges from hibernation. Limited partners (LPs) and general partners (GPs) in VC firms are also likely to prefer participating in subsequent funds with longer time horizons.

However, it’s worth noting that even if the year closes below $100 billion, as anticipated, it would still be higher than the levels seen in 2017-2020. This suggests that 2021 was fueled by hype, and 2022 was a period of normalization. Although year-on-year funding has significantly dropped, if pricing and expectations align, we are likely to witness robust VC deployment for the right startups towards the end of the year.

All this to say that despite the overall year-on-year slowdown, investment rounds are still happening and VC firms are still investing in startups as mandated. In fact, James Ephrati of Lightspeed Venture Partners estimates that global VC dry powder has amassed to $580 billion (as reported by Crunchbase). Closer to home, Wamda reported that MENA startups have already raised $1.6 billion halfway into the year.

Investors are also extending their runways and reserving rescue capital for their portfolio companies. During volatile and downward trending markets, capital allocators tend to prioritize capital preservation. However, in early-stage VC, down markets are believed to be the best time to deploy capital. The rationale behind this is that early-stage startups have lower burn rates and can manage their free cash flow more effectively. They are also less dependent on excessive VC funding, allowing them to align their traction with their valuations.

Given the availability of capital, venture capital remains a viable option for founders seeking to fundraise in the second half of 2023. This is particularly true for founders based in emerging markets (Middle East, Africa, Pakistan, Turkey), where deals under $1 million accounted for the majority (51%) of all VC activity in 2022, according to MAGNiTT. However, it is crucial to have all your business fundamentals in check and ensure that your business model makes economic sense.

A side note to founders: Some venture capital firms, such as DFDF, offer a unique advantage by focusing on creating value beyond capital deployment, such as access to mentorship and industry connections. You can read more about our approach to value creation here.

Raising Capital From The Public Markets Is Not So Attractive Either

As for late-stage “scale-ups” hoping to go public this year, their plans are likely to face further delays due to the sluggishness of the IPO markets in the past 12 months. CB Insights reported a 31% drop in global IPOs in 2022 compared to 2021. Consequently, investment activity in late-stage deals during Q4 2022 hit its lowest point since Q2 2018, as reported by PitchBook. As a result, growth startups will also be seeking ways to extend their capital within the private markets.

In light of these circumstances, investors are now seeking solid fundamentals and sensible investment terms for both early and late-stage startups. They want to ensure that these companies have a clear path to profitability and are not overvalued. This cautious approach is evident in the significant decrease in valuations for growth-stage private startups observed last year. For instance, Klarna experienced an approximate 85% drop in valuation from $45.5 billion to $6.7 billion, while Instacart saw a decline of about 38% from $39 billion to $24 billion. In response, founders are implementing cost-cutting measures to extend their runway and avoid down rounds or structured rounds.

Venture Debt As An Option For Mature Companies

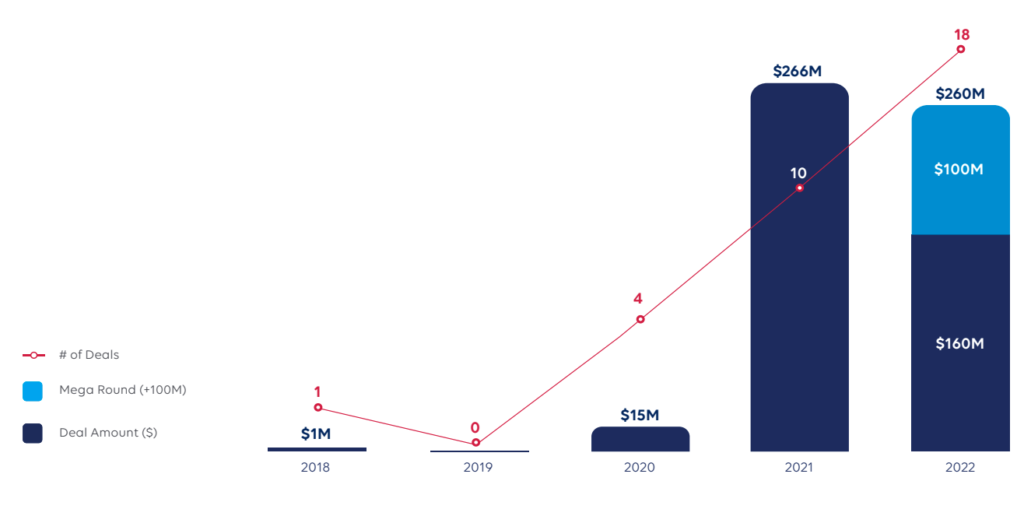

A funding method that is gaining traction is venture debt, as reported by Shuaa Capital and MAGNiTT. In 2022, venture debt reached a total of $260 million across 18 deals in the Middle East and North Africa. This figure has been steadily increasing since 2018, with a total of $500 million provided to startups in the region over the past five years.

Venture Debt Funding in MENA

Source: MAGNiTT & Shuaa

In contrast to traditional venture capital, where startups exchange a portion of their company for capital, venture debt involves receiving a loan from venture capital firms or specialized lending institutions. These loans are specifically tailored for early-stage, high-growth startups to finance working capital or capital expenditures such as machinery, equipment, or specific projects.

Venture debt is commonly used by startups between funding rounds as a way to obtain liquidity without diluting equity. However, this option is only viable when a company’s financials are truly healthy.

But why not borrow directly from a bank? While traditional banks may offer conventional loans, they may be hesitant to grant access to capital for tech startups that are often not profitable on paper. Additionally, the terms and conditions of venture debt typically favor the lender, considering the higher risk involved, compared to traditional bank loans offered to established financial institutions.

The Emergence of Private Secondary Markets As An Option

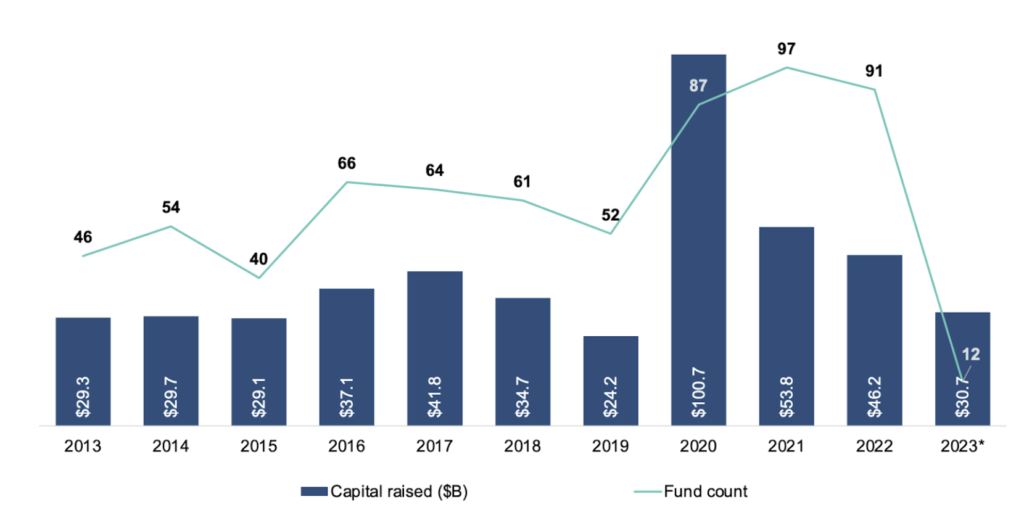

Another increasingly popular fundraising option is the utilization of private secondary markets. Just in Q1 this year, fundraising across secondaries crossed two-thirds of last year’s annual total (at $30.7 billion, according to Pitchbook).

Secondaries Fundraising Globally

* As of 12/31/2022

Source: Pitchbook

These markets allow founders and their shareholders, including investors and employees with ESOP (Employee Stock Ownership Plans), to sell their shares to other investors. This can be an attractive choice for startups that have already completed their initial fundraising rounds but want to avoid raising venture capital in the current economic climate, as it carries the risk of a down round. This can serve as a retention strategy, particularly during a time of industry-wide layoffs (read more about our take on what the layoffs mean for the wider industry here).

Secondary markets are gaining popularity among startups, leading to the establishment of several platforms worldwide to facilitate secondaries. Some secondary market platforms that facilitate the trading of private secondaries globally include Forge Global and EquityZen. In the Middle East and North Africa (MENA) region, Zest Equity is developing the secondary market infrastructure. They recently launched their platform to the public, enabling startup founders and investors to list their equity for purchase on a secondary basis.

It’s important to note that raising funds through secondaries differs from crowdfunding. Crowdfunding involves soliciting small investments from a large number of individuals through online platforms.

Fundraising Will Continue In The Second Half Of 2023

In conclusion, the fundraising landscape in 2023 presents challenges for founders seeking capital, but there are viable options available. Venture capital remains a valuable avenue, especially in emerging markets with smaller deals dominating the scene. Startups need to focus on solid fundamentals and sensible investment terms to attract investors looking for clear paths to profitability. Late-stage startups may face delays in going public due to sluggish IPO markets, leading growth startups to explore capital extension within the private markets. Investors are prioritizing companies with healthy financials and realistic valuations, and startups are implementing cost-cutting measures to preserve runway and avoid down rounds. Additionally, venture debt and private secondary markets are gaining traction as alternative fundraising methods, providing liquidity and opportunities for shareholders to sell shares to other investors.

Overall, while fundraising in 2023 may be challenging, founders have various avenues to explore. It is crucial to have a strong business foundation, demonstrate profitability potential, and carefully assess the available options. Venture capital, venture debt, and private secondary markets can all play a role in helping founders secure the necessary funding and support for their startups.

If we, at Dubai Future District Fund, can be of help to you as a founder, please get in touch with us — we’d love to hear from you.