Introduction — The Importance Of A Robust Deal Lifecycle

The process by which a startup is considered for investment by a venture capital (“VC”) firm is called a deal lifecycle, with “deal” referring to a startup investment opportunity that makes its way to a VC’s portfolio. Having a robust deal lifecycle is paramount for venture capital funds to make well-informed decisions about which investment opportunities to pursue — and, effectively, where to deploy their capital.

A deal lifecycle that is not well-defined can result in missed opportunities, ineffective screening, and uninformed investment choices for venture capitalists — all of which are missteps that can lead to unrealistic valuations, weaker portfolio performance, and limited value addition to portfolio companies. Not to mention, venture capitalists may encounter elevated risk exposure and difficulties aligning investments with their long-term strategies.

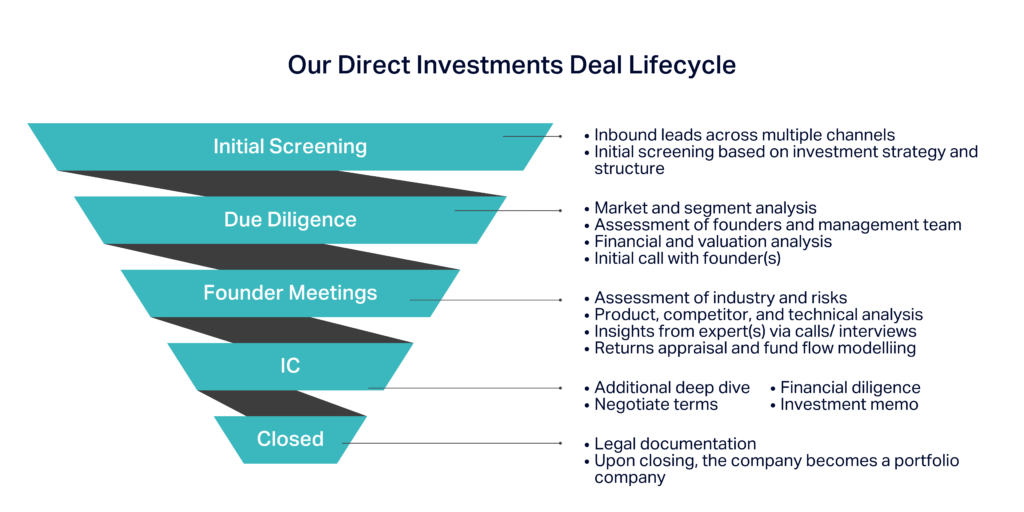

At DFDF, we have put together what we believe is a well-defined deal lifecycle to help us make investment decisions and, thereby, deploy our capital as effectively and efficiently as possible. Our goal is that, in the long run, this will enable us to play a pivotal role in fostering innovation and growth within the regional venture capital ecosystem.

In the subsequent blog post, we will take you through our deal lifecycle, led by our Managing Director Amer Fatayer, in an effort to provide transparency around what we believe it takes for startups to receive a direct investment from us and to share our thoughts on best practices when it comes to making investment decisions about VC deals. We hope that founders find this information helpful in preparing for discussions with VC firms when fundraising, as we also believe that investors will derive value from learning about our deal process and investment decision-making criteria.

Step 1: Our Initial Screening Process

The start of any direct investment deal in our lifecycle begins as a lead at the very top of our funnel. We source leads from several channels, including:

- Our extensive network of founders and VC funds

- Ecosystem stakeholders, including accelerators

- Opportunities where corporate venture capital arms seek to participate in funding rounds

- Our target list that we compile based on industry news and our team’s insights

- Founders who complete the application form on our website

To be considered further for investment, every lead, once captured in our funnel, is screened firstly for fit against our investment mandate and innovation in either the Future of Finance or Future Economies sectors. For the opportunities that are deemed suitable to our mandate, they then undergo further screening and evaluation.

Step 2: Our Due Diligence Approach

For promising opportunities that meet our investment mandate criteria, the investment team delves into deeper due diligence and evaluates the startup based on the following aspects:

- The idea: What problem is being tackled, and how does the product or service being developed address it?

- The business model: How can the idea be packaged into a viable business?

- The team: Do the people executing the idea have what it takes to make the business successful?

- Timing of the idea: Are the market conditions right for the business to become successful?

- Funding: What are the team’s capital efficiency and funding capabilities?

- Scalability: Can the product or service be sold at scale with the current tech stack?

- Defendability: How easy is it for competitors to replicate the idea?

- Differentiation: What’s unique about the idea compared to other solutions in the market?

This initial due diligence aims to capture vital insights and nuances about the opportunity and its wider, positive impact on society. By exploring these key aspects, the team seeks to grasp the essence of the opportunity and whether it’s a must-have in the world.

Step 3: Meeting Founders of Prospective Direct Investments

If an opportunity proves intriguing and aligns with our investment thesis, once the due diligence has been completed, it gets discussed during one of our weekly team meetings.

During these sessions, team members share their perspectives, experiences, and insights across various aspects of the funding request, problem statement, value proposition, team, and business model. Together, we answer out loud questions like:

- Would we want to buy it if we were their customers?

- What would we want to see to make it stickier?

- Would we personally pay to address this pain point, if we feel it at all?

- What do we believe is the true market size, based on our understanding of who really buys this product and how fast the penetration is?

In addition to hashing out the above amongst our team members, we speak to industry experts to validate our due diligence findings. These experts could be acclaimed subject-matter-experts, other founders, or founders in adjacent business models. In some cases, we even speak with founders who failed to build this product, to understand their challenges at the time.

If the team collectively deems an opportunity promising, it is further discussed in a partner meeting to decide whether the venture proposition requires further evaluation or can proceed to be presented to the Investment Committee (IC).

Getting to this stage usually also entails arranging face-to-face meetings with the founders of the ventures being considered to gain a more thorough understanding of the opportunity at hand. During these meetings, we assess the founders’ abilities and readiness for execution.

Step 4: Considering Opportunities With Our Investment Committee

Once a deal has been cleared for consideration by our team, we prepare to present it to the final decision-makers — our Investment Committee (IC).

We present these opportunities to the IC through an Investment Committee Memo, a comprehensive document reflecting the investment team’s analysis and evaluation, intended to guide the IC’s decision-making process. This document helps them make a go/no-go investment decision on the startups based on several factors, including the following:

- Introduction: What product/service does the company offer, what problem does it solve, and what is its business model?

- Thesis fit: What is the company’s sector, company stage, and geographical focus, and does it fit into our investment thesis?

- Investment rationale: What excites us about the opportunity, the company’s potential to capture market trends, and its competitive edge?

- Value proposition: What’s our understanding of the company’s offer and customers’ willingness to pay?

- Product and business model evaluation: How is the company pricing its offering and how does it plan to generate revenue from its customers?

- Core management assessment: What’s our assessment of whether the team is capable of delivering the company’s plans?

- Go-to-market strategy examination: What’s our assessment of the company’s sales approach and predicted conversion ratios?

- Traction review: What has the company achieved across various metrics?

- Market evaluation: What’s our review of the industry trends that the company operates in, globally, regionally, and locally?

- Competition analysis: What’s our review of local and global competition and how the company anticipates differentiating itself and maintaining this?

- Valuation and deal terms: What is the company’s funding history, its current funding plans, its current ownership structure, and its current investment ask, along with our evaluation of its current valuation based on our understanding of the industry multiples?

- Financial scrutiny: What has been the company’s recent financial performance, its future forecasts, and its financial model robustness, along with our evaluation of its forecasts based on our understanding of market trends?

- Return analysis: What are the company’s potential returns and exit potential?

- Technology assessment: What’s our technical evaluation of the company’s infrastructure and adaptability?

- Risks: What are the issues that may concern the company, and how do they plan on mitigating them?

- Appendix: Any other information that is important about the company.

Step 5: Making It Past The Deal Finish Line

Once the IC decides that an opportunity is suitable for direct investment, our team proceeds to close the deal with the startup — happy days for everyone involved! At least once all the paperwork is sorted, ofcourse. Note that each investor, institutional and otherwise, will have their own set of expectations when negotiating legal terms. With this regard, we focus on the balance of ensuring the business is not crippled or slowed down, whilst ensuring good governance.

However, our involvement with the startups in our portfolio doesn’t end once we’ve deployed our capital. Similar to some of our peers, we prioritize building long-term relationships with our portfolio companies — our process includes in-depth discussions about mutual expectations and how we can support each other beyond just capital infusion. That is to say, we consider the potential for synergy and collaboration (e.g. government contracts or partnerships with our shareholders) as a key factor in our investment decisions, to make the business more successful. This forms part of our broader value creation strategy, which you can read more about here.

We are able to determine areas of how we can contribute to our portfolio startups’ success and drive value creation where we ask our portfolio of startups to share their performance metrics. The same reporting process forms part of our broader governance and compliance process, which you can read more about here.

Conclusion And Our Invitation To Innovative Startups

In summary, the venture capital deal lifecycle entails a well-orchestrated journey combining data-driven analysis with thoughtful reflections. This process culminates in strategic investments with the power to shape the future of innovative businesses. Embracing this comprehensive approach empowers venture capitalists to make informed decisions, forge lasting partnerships with visionary founders, and contribute to the growth and success of startups that will define tomorrow’s industries.

If you are the founder of a startup that is innovating in the Future of Finance or Future Economies, please apply to be considered for a direct investment or reach out to our investment team members.