Your purse strings may need some tightening

Fundraising for startups in current market conditions (which we’ve recapped in a recent post here) may not be a smooth ride. Investors are nervous, given falling company valuations worldwide. Subsequently, their decision-making processes are stretched while they gain comfort in your business fundamentals. So what can you, as a founder, do in the meantime?

Early-stage startups can take a queue from distressed assets as they exhibit similar characteristics. Both face the challenge of growing while being efficient with resources that are often limited. As such, there are lessons and principles that can be extracted and applied in navigating your startup.

Let’s mull on this for a minute and explore how to manage a startup as a distressed business. The core issue of a distressed asset is often its ability to manage its cash flow in a healthy way. In this post, we’ll explore managing cash flow in a startup on a 13-week rolling basis and how to create a financially lean organization.

Keep it lean, keep it clean

It is a common misconception that VC investors are only interested in top-line growth, and perhaps there was a time and place when this was indeed a true reflection of the industry. However, as investors’ knowledge and collective experiences evolve, as does the ecosystem, they tend to expand their focus to assess the founders’ ability to extract top-line growth and manage bottom-line economics effectively. Capital efficiency (i.e., cash in vs. cash out or value appreciation per dollar spent) is as important of a metric as top-line growth. As a founder, ensuring lean financial controls increases your chance of funding, as it provides a sign of confidence to investors. This holds truer in a down market situation like we’re in now.

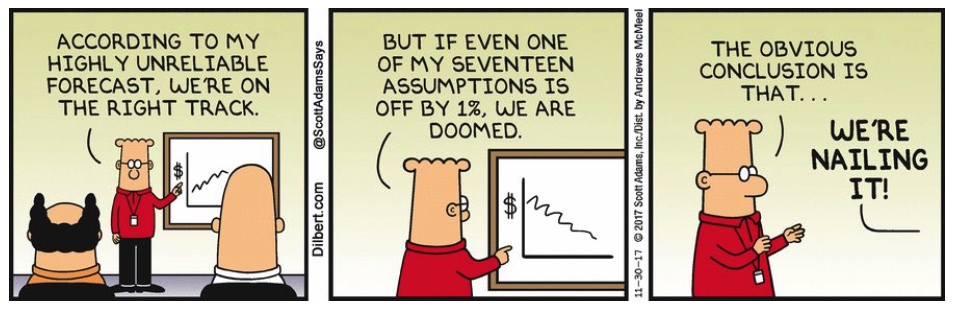

Back to the topic, the first unique characteristic of an early-stage startup is the negative cash flow expectations. Early-stage startups don’t typically have a sustainable inflow of liquidity (cash) to work with and are, therefore, operationally and strategically inefficient with limited economies of scale. So, when things go wrong (which they tend to happen, right?), it can be tough to get through these tough times without appropriate planning and cash flow management. Our first disclaimer: sometimes even proper contingency planning cannot get a business out of a hole.

To be clear, though, this hole is indifferent to business growth metrics; startups with strong adoption and user growth metrics can still find themselves in a cash crunch that can kill the business when burn is up. So, it is better to preempt and build a lean organization upfront.

Make data a currency

Nonetheless, most founders’ default mitigation approach is raising additional capital. But what if this option is not a viable one? What if it leads to unnecessary dilution of founders’ equity? What if it reduces stakeholders’ confidence in the founders’ or their ability to execute their plans? Some of those issues may have nothing to do with the business’s overall attractiveness, defendability, or scalability, so why risk sending the wrong signal to the market? And more importantly, what can you do to avoid the pitfalls of this situation?

The first piece of advice that I tend to share with founders from my experiences is a relatively common one in the business world: data is key. Showing what you know and what you plan to do thoroughly helps set the base case for investors and as a reference point for unplanned anomalies. From a cash flow perspective, the 13-week rolling cash flow model (See this fantastic online template from Wallstreet Prep) is typically adopted in turnaround situations to provide visibility of the company’s short-term options (the period is short enough to rely on data). It allows practitioners to step back and identify ways of revising their short-term cash position and runway (clarify cash pressure points and determine the financing needs) to allow them time to replan their long-term position. Subsequently, practitioners may renegotiate contract terms, prioritize receivable collections, and defer ‘non-business critical’ spending. More importantly, it is a tool for open discussion with shareholders (transparency is key) who want to see capital discipline or alignment towards the objective of being capital efficient. Nothing prevents an investor from investing more time/money in a founder than cash-burn indifference.

The rolling 13-week cash flow forecast is not only a down-market tool; instead, it provides insight into your business’s cash standing regardless of the economic climate. For example, it allows you to identify excess cash and help fund further expansions or extend your runway through lean management; subsequently reducing your dilution and increasing the shareholders’ value capture of your business. Managing cash flow is an ongoing mindset and not a tool to adopt purely in critical business moments. Rather, businesses need to focus on growth fundamentals that will make them successful. In the short term, thriving and maximizing value extract is of the essence.

Our 8 Tips to build an effective cash flow model

Here are our top tips for building a 13-week cash flow model that will keep your business weathering the bear market:

1. Include one week of actuals, the next 2-4 weeks on a daily basis, and the final 9-11 weeks on a weekly basis.

2. If your business has a high number of inflow and outflow nodes, apply the 80/20 rule to visibility over essential receipts and payments by contract value.

3. For each supplier, vendor, or customer, consider historical patterns (not relying blindly on contractual dates) for inflow and outflow dates. In addition, assess whether any of your business-critical vendors offer favorable discounts for early payment(s) to optimize ongoing margins.

It is, however, important to remember that if you find yourself in a position of distress through macroeconomic factors, your external stakeholders would be experiencing the same environment (i.e., consider contingency on historical patterns in-line with macro drivers). In short, apply assumptions with the latest information and consider external factors (we’re all in the same boat!).

4. Model downside scenarios for the next 3-6 months and develop mitigation actions for key trigger points. Prioritize mitigating measures that will not affect the longevity or the survivability of the business and remain agile as the situation is highly dynamic and may constantly evolve. You’re better off avoiding long-term commitments in turbulent conditions.

Here are some additional actions you can take if survivorship is at stake:

5. Stop discretionary spending. This entails extracting ideas (your team knows best — someone may surprise you with an innovative idea!) to prevent halting business-critical activities to overcome cash shortage.

6. Postpone growth CAPEX and renegotiate payment terms on all outstanding contractual agreements.

7. Build an early payment offer to your customers — the aim is to focus on your cash position and later refocus on short-term profit. Also, accessing cash sooner avails more capital for growth and subsequently appreciates the shareholders’ and founders’ equity value. For e-commerce businesses, negotiate to extend the payables period or consider consignment in the short term.

8. Ensure your cost base is flexible as follows:

a. Apply the lean-sigma approach to “must-have” vs. “nice-to-have” agreements (including tech-enablement and other supplier agreements), cancel nice-to-have agreements, and renegotiate must-have agreements.

b. Defer hiring and leverage freelancers/ fractional services for business-critical tasks (always have someone on standby and keep them engaged through smaller pieces of work throughout the year to ensure rapid onboarding and full context on day 1).

c. Lengthen payment terms on large leases (e.g., property) and assess whether any of your vendors give you favorable discounts for early payment (apply the 80/20 rule again by reaching out to key vendors and requesting an early payment discount). It goes without saying, do not sign new long-term agreements when in distress, even if highly discounted, since your aim is to ensure at least six months of liquidity).

Deploy a Sheriff to town

Notwithstanding the above, to ensure the accuracy of forecasts and plans, founders must ensure only one person is authorizing payments. Where the business cannot hire a full-time CFO due to cash requirements or limitations, leverage a fractional CFO. A fractional CFO may give your business the experience and /or knowledge set of an FTSE 500 CFO at a fraction of the cost. Some may even accept stock options as compensation.

In addition, full traceability of payment and cash flow logs must be adopted by founders, again on a “live” basis (e.g., Google Docs: Online Document Editor | Google Workspace), to avoid version issues. Further, we suggest that founders create a communication channel (e.g., through Slack or Teams) to discuss and align on what payments to make and to prioritize business-critical expenses.

Ensuring quality and depth of controls on business financials does play a big part in giving investors confidence in your ability to handle their capital. It is vital to bring knowledge and experience from day 1. However, the founders must, in parallel, implement an appropriate “out of office” or /”unavailability” plan to avoid slowing down critical business operations.

Keep communication channels open

As the saying goes, “cash is king” — and so founders stand to benefit from controlling cash and identifying short-term action plans, which they’d need to monitor, reforecast, monitor, reforecast, and repeat. Communicate these actions regularly with key stakeholders (both internally and externally) to show traceability of planning and thinking to minimize them challenging your business decision-making or cash-burn discipline. Instead, these efforts will help you refocus discussions on key mitigations to overcome the trying year ahead in VC and reach a consensus on a business direction.

When the time is ready for your business to fundraise and you feel that the Dubai Future District Fund can support your startup, please get in touch — we’d love to hear from you.