What the looming recession means for venture capital globally and in the MENAPT region

How does the impending recession affect VC?

Scrolling through virtually any business news or media outlet these days is a bit of a downer for most individual and institutional investors. The headlines reflect the pessimistic market sentiments and have readers speculating the worst — the possibility of a major recession.

The Econ 101 definition of a recession is two consecutive quarters of reduced trade and industrial activity. Economists at leading banks like Morgan Stanley and Citigroup predict that a recession, by definition, is probable, and in fact already well underway since the beginning of the year.

Venture Capital has had a record-breaking year in 2021 with $630 billion invested globally (according to CB Insights). Not to mention, new unicorn births accelerated — there were 62% more unicorns by Q1 2022 year-on-year compared to Q1 2021, at a total of 1,070 globally.

Now, we all know what’s on the other side of the top of a hill, and in a similar fashion, economic cycles have periods of “uphill” movements called booms followed by “downhill” runs called busts. More of Econ 101 should be coming back to you now.

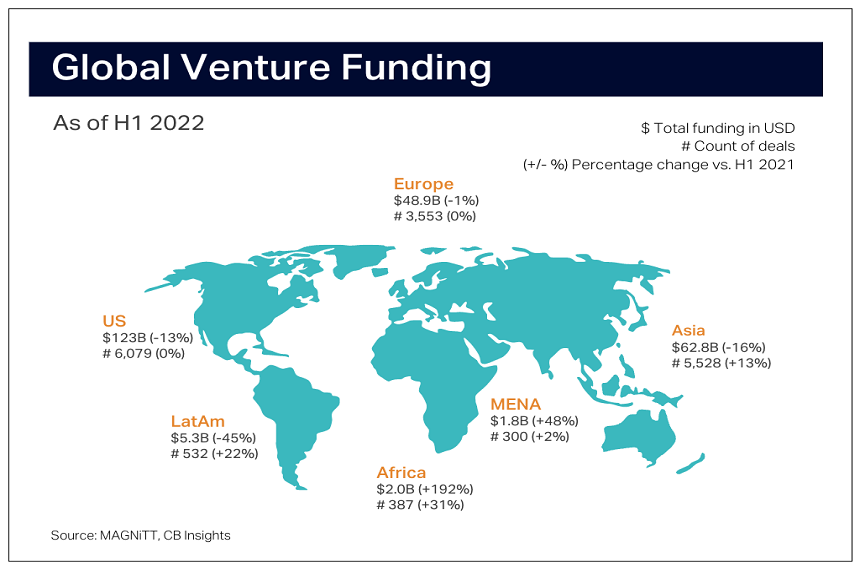

In Q1 this year with $143.9 billion of capital raised across 8,835 deals, venture funding dropped by 21% compared to Q1 last year, and by 19% compared to Q4 last year. Further, in Q2, $108.5 billion of capital was raised across 7,651 deals, according to CB Insights, which is a 27% drop compared to Q2 last year, and by 26% compared to Q1 this year. This brings the total funding for the first half of 2022 to $252.4 billion, which is not even half of 2021’s full-year count of $630 billion, despite us being halfway through the year.

What went wrong globally?

In 2020, when the world was hit with a not-so-little pandemic stirred by the Covid-19 virus, the world went into panic and governments around the world stepped in to support people by offering various types of stimuli. However, as the economic downturn was short-lived (it lasted2 months), people found themselves with higher disposable income, which in turn increased spending.

Meanwhile, due to lockdowns around the world, the supply of goods was, well, tight — to put it mildly. Brands were simply not able to keep up with the demand by increasing supplies, causing the prices of goods to go up — aka inflation. In fact, inflation is currently the highest it’s been in over 40 years in countries like the United States and the United Kingdom, at 8.6% and 9.1% respectively. Similarly, inflation across Arab countries is expected to average around 7.5% this year (according to Arabian Business).

Now, some inflation – usually around 2% – is not a bad thing, as it indicates economic growth. But, there is a line at which it becomes unhealthy for the economy — and this year, it crossed that line. In the US, this drove the Fed to issue interest rate hikes in an effort to curb this inflation —- the largest interest rate hike since 1994, with more on the way. In the UAE, the federal government has also raised interest rates in line with the US.

During this time, venture capital will not come to a halt. The reduction in investment activity will, however, make the cost of this category of capital more expensive across the market in general. This is important to ensure correction in the market when company valuations seem to be “over”-inflated.

How does the drop in global VC activity affect startups?

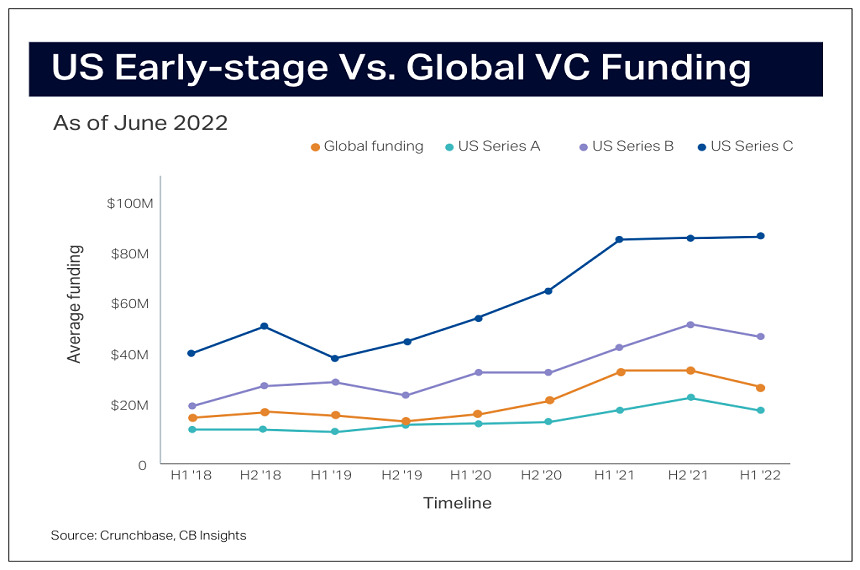

This slowdown seems to be in the number of deals, though, as opposed to the funding levels raised, particularly for early-stage startups. In reality, Crunchbase reports that the average startup rounds raised so far in 2022 are not dramatically down compared to 2021 in the US across Series A, B, and C funding rounds. Moreover, CB Insights reports that the average deal size globally so far this year is $21 million, which is just 16% lower than the global average of $25 million last year. That being said, early-stage deals comprise the majority of deals so far this year — at 62% globally compared to mid-stage, late-stage, and others (according to CB Insights). The way this can be interpreted is that investors are being more selective about which companies they invest in, those startups that do get funded will raise at valuations centered around business fundamentals over hype.

As for late-stage companies, they’re being propped up on many of their investors’ coffers as existing portfolio companies, since additions to the collection are now fewer (yet another dynamic in the drop of funding as deals vs dollars). A bit of a double-edged sword for being on top of the pyramid, late-stage companies will also be hit the hardest as prices come down and are compressed, since their pricing delta is higher (given that later-stage companies are “bigger” by definition).

Effectively, during a period of economic downturn, startups that are early-stage (particularly rising their Pre-seed and Seed rounds) will see a lower delta of change, since they don’t have high burn rates (yet) and, therefore, are closer to running efficient capital with a nearer line of sight to breakeven.

How has this impacted VC in the Middle East, Africa, Pakistan, and Turkey?

Though venture capital at a global level seems to be slowing down so far in 2022 compared to the halfway mark last year, the same may not be true in the Middle East, Africa, Pakistan, and Turkey (MENAPT) region. According to MAGNiTT, the number of deals across the region has gone up in the first half of 2022, compared to the first half of 2021, to a total of 856 deals. Additionally, the total value of funding across these deals has gone up across the board, comparing the same time periods, except for Turkey, to a total of $5.45 billion. This is just 2% of the expected global VC funding for the first half of the year, but the opportunity is strong and growing, based on the reported stats.

To shine a spotlight on two of the most active countries in the region, based on VC activity — in the first half of 2022, UAE-based startups raised a total of $645 million, whilst Saudi-based startups raised a total of $561 million (according to MENA Digital News).

Is the MENAPT region unfazed?

In spite of the MENAPT region seeing the same shakeup in inflation and central bank interest rates as the rest of the world, the VC numbers don’t resemble the same slowdown in economic activity. The rest of the year will allow us to conclude whether the region is lagging behind the global slowdown in VC activity, or whether it’s just immune.

This insulation is largely driven by the following:

(1) Boom in regional economies — The same rise in oil prices that’s hurting other regions (particularly Europe and the UK) is proving to be a shield protecting investor confidence in the Middle East, given the region is one of the world’s largest oil producers.

(2) Flush venture environment — Though the region’s VC industry contributed to just 2% of global activity, there is a substantial push from the region’s private and public sector entities (particularly existing VC coffers reserving capital to “save” their existing portfolio companies) to build on the moment of growth that the region’s startup ecosystem has built up over the past decade.

(3) Nascent ecosystem — The region’s investors, entrepreneurs, and ecosystem enablers have not experienced a market downturn like this yet and this lack of historical context is somewhat of a mask on venture capital’s ability to see what’s down the road clearly.

However, the world’s finance system is very connected — take all the institutions and consumers in the Middle East who’ve made investments in the public and private markets in the US. Eventually, as investor pullback starts, everyone across the board will be affected, beyond institutions’ balance sheets, through to consumers’ purchasing power.

A positive way to look at an economic recession is forward and into the future where there will eventually be an upturn again. And so, founders and investors across MENAPT should not ignore the global signs — but for now, it’s best to brace for impact.

Our recommendations for funds during this time

As companies in the public markets are currently taking a hit as both the number of deals and proceeds have dropped in 2022. According to Ernst & Young, the global IPO market saw a 54% decrease in the number of deals and a 65% decrease in proceeds in Q2 2022 year-on-year.

In contrast, 2021 had a record number of IPOs in 2021 across most major markets. This, combined with falling growth stocks, implies that equities are in a bear market and a steep recovery is not likely. This gives good reason and precedent for investors to diversify away from public markets and growth-stage startups, and start investing in early-stage startups instead. And the truth is, for investors, it’s actually a better time to invest. As capital drops, so will the return on capital that goes in now, compared to capital that went in last year. In emerging markets, this may be even more the case as there is more untapped opportunity

Meanwhile, as the consumer market sentiment is not as healthy as it used to be given the high Consumer Price Index currently in play, startups will have to revisit their revenue forecasts and make more conservative assumptions. Keep this in mind when asking for hypergrowth at all costs from the startups you’ve invested in.

Our recommendations for startups during this time

As valuations are conservative at the moment for private fundraising, you’d want to preserve the capital you have available to you at the moment as much as you can. Starting with your costs, re-evaluate your burn rate, especially if it’s higher than your revenues. In times when the economic situation is out of your control, focus on steering what’s within your control in your favor — your costs. Costs are required for your business to operate, simply put, but you can be smarter about how you spend.

You need to finance payroll to have the headcount to execute your strategy, fund marketing spending to acquire new customers, and continuously improve your customer-product interface. But, beware of spending too much to meet the promises of hyper-growth made to investors. In short, be more conservative in the way that you spend your money and focus on building rather than scaling

Further, plan for the worst when it comes to sales. Revisit your revenue forecasts and make more conservative growth assumptions, and don’t assume a quick recovery. Your refreshed estimates should reflect your revised costs.

Lastly, keep in mind that fundraising will be more difficult, and even more so if you are still cash flow negative because investors will want to invest in business models that are more proven (i.e. profitable). Demonstrating an ability to refocus on fundamentals and unit economics will prove favorable when pitching to investors for funding — and are, in fact, a safer path to growth. If you do need the capital meanwhile, consider financing options aside from traditional VC, such as crowdfunding, micro-VCs, or revenue-based lending options.