FinTech funding across MENATP powers through the global VC slowdown

Venture capital has softened its foot on the accelerator pedal last quarter. Globally, Q2 2022 venture captivity has declined more than 20% for a second straight quarter, according to CB Insights, across all sectors. In the same quarter, for the first time since Q4 2021, FinTech startup investments accounted for less than 20% of all funding, whereas in Q1 one out of every 5 dollars of funding went towards FinTech deals.

This comes after FinTech funding started to cool off in Q1 earlier this year, with global funding for the sector closing in at $28.8 billion in Q1 — down 18% compared to Q4 last year. Of this, $999 million was invested in FinTechs across the Middle East, Africa, Pakistan, and Turkey (according to MAGNiTT), accounting for about 3.4% of total global FinTech funding.

Though VC FinTech deals in the region are a small portion of global funding into the sector, the prospects of FinTech startups shine brighter than the other sub-sectors of tech. That’s because, in the region, the financial industry is an industry that is more familiar than others. Familiarity breeds understanding, which — in turn — brings comfort to people looking to enter into the space, whether they’re founders or investors. Therefore, the opportunity to fundraise as a FinTech startup in the region is ripe, as evidenced by the numbers.

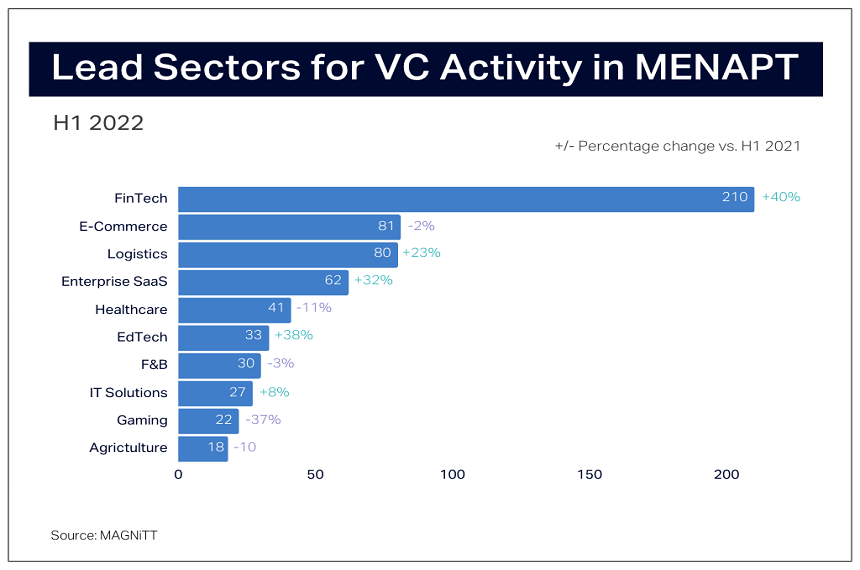

Across the Middle East, Africa, Pakistan, and Turkey, FinTech funding remained strong in the first half of 2022, accounting for the majority of venture capital deal count and volume raised. A total of $1.6 billion was raised by startups in this sector across the region, across 210 deals, according to MAGNiTT, which is a 40% increase in deal count and a 223% increase in deal volume compared to H1 2021. These deals accounted for 68% of all $2 billion of VC deals in Africa during this time period — 34% of all $1.8 billion deals in MENA, 3% of all $249 million deals in Pakistan, and 1.5% of all $1.4 billion deals in Turkey.

Further, UAE-based lender Mashreq anticipated in February this year that by the end of the year, more than 800 Middle East FinTech startups will raise a total of $2 billion in venture capital (as cited by The National). Therefore, the FinTech opportunity remains attractive to investors looking to close deals with startups doing business in the region.

International FinTech valuations get lean for the summer

After a very active 2021 when it came to venture capital activity across all sectors, as venture funding reached its annual peak of $630 billion last year (according to CB Insights), valuations have come under the spotlight in 2022 given the trying economic circumstances of high inflation and interest rates worldwide.

Shining the spotlight on FinTech private market valuations — take Klarna, for example, a Sweden-based FinTech company in the buy-now-pay-later consumer payments space that closed a funding round at a $15 billion valuation in July of this year, an 85% drop from its previous fundraising round last year at a valuation of $45.6 (according to TechCrunch).

This drop in valuations can be seen for late-stage FinTech companies globally, across all sub-sectors, however. CB Insights reports that the median post-money valuation for late-stage companies has dropped from $1.6 billion to $1.4 billion YTD in 2022. In contrast, mid-stage FinTech companies are seeing so change in this metric so far this year (from $0.5 billion to $0.5 billion across the same time period comparison), while early-stage FinTech startups are actually seeing an increase (from $38 million to $46 million across the same time period comparison).

And now to move the spotlight over to FinTech public market valuations — stock prices picked by Pitchbook to represent high-growth companies in this sector have fallen 59% in Q2 2022 from their peak. Moreover, data from CapIQ shows that forward revenue multiples for public software companies in the FinTech categories have dropped from 15x in May 2021 to just under 5x in May 2022. In fact, FinTech has seen the largest drop in this metric than any other industry.

Combined with declining public markets overall, this means that valuations in the private markets, going forward, will be drawn closer to business fundamentals as opposed to market hype, funneling investments into startups with more sustainable business models.

Implications of reduced FinTech valuations globally to investors and founders

With over $1.4 trillion sitting in VC portfolios as unrealized value, billions stand to be wiped away if sizable drops in valuation multiples continue, according to CB Insights. However, the correction of over-inflated valuations will be a good thing for venture funding, as it will ensure a more balanced focus on growth as well as profitability when it comes to steering startup direction.

This is in contrast to the commonly-accepted state of venture capital in the last few years, which was mostly focused on a grow-at-all-costs mantra. This will also prompt late-stage FinTechs that were considering going public to likely refrain from doing so until the public markets recover, and instead, remain private for longer. Ultimately, when they do decide it’s time to go public, their financial statements would be in a better position to achieve positive returns for those future shareholders.

After all, as we’ve seen repeatedly in venture funding history, higher valuations and high burn rates, at the expense of sound bottom-line metrics, are not always good for founders. When markets shift, these high-flying companies are reliant on external capital infusions that may not be available anymore, causing them to incur further dilution (if they’re able to raise) or even worse, trigger layoffs or die. In addition, a venture market that is disciplined helps separate the signal from the noise and encourages founders to focus on unit economics and sensible business fundamentals.

Advice to FinTech founders is to focus on core profitability in order to reduce the perception of your startup as risky in the eyes of investors (they’ll want to reduce their exposure to risky assets during a time of high-interest rates and talks of economic recession). You would have to drive profitability by increasing revenues (looking at maximizing existing revenue streams and exploring new ones) and decreasing costs. Essentially, back to business basics.

The MENAPT region swipes right on FinTech

Though venture capital overall is cooling off in MENAPT halfway through 2022, the case for FinTech in the region remains strong, as we’ve evidenced through funding volume and count numbers reported for H1, unlike declined investor appetite in other parts of the world. Notable FinTech funding rounds in the Middle East so far this year include Tabby’s $54 million Series B in March, Foodics’ $170 million Series C in April 2022, and most recently Tamara’s $100 million Series B in August — albeit these types of rounds are often inclusive of debt.

This means that capital availability for MENAPT’s FinTech startups will remain consistent for the second through Q3, 2022, in spite of other region-specific challenges such as tighter consumer finance regulations that restrict direct-to-consumer opportunities across certain vertices such as lending, payments, and cryptocurrency trading.

As these investments will be made in parallel to global correction in over-inflated private and public market tech valuations, it’s more likely that the capital that is being deployed will be done on more fundamentals-based valuations into startups with more sustainable burn rates. It can be anticipated that this refocusing on investment due diligence would, in turn, lead to higher returns for venture capital firms and their LPs; subsequently driving more LP investments into VCs.