Why have so many tech companies been laying off staff?

We’ve previously written about the sharp drop in valuations across both public and private companies that have been taking place since the second quarter of 2022 (see previous blog post here). As a result, lowered expectations of business earnings coupled with more conservative business risk assessments continue to be the lethal duo that clouds the venture capital industry going into 2023.

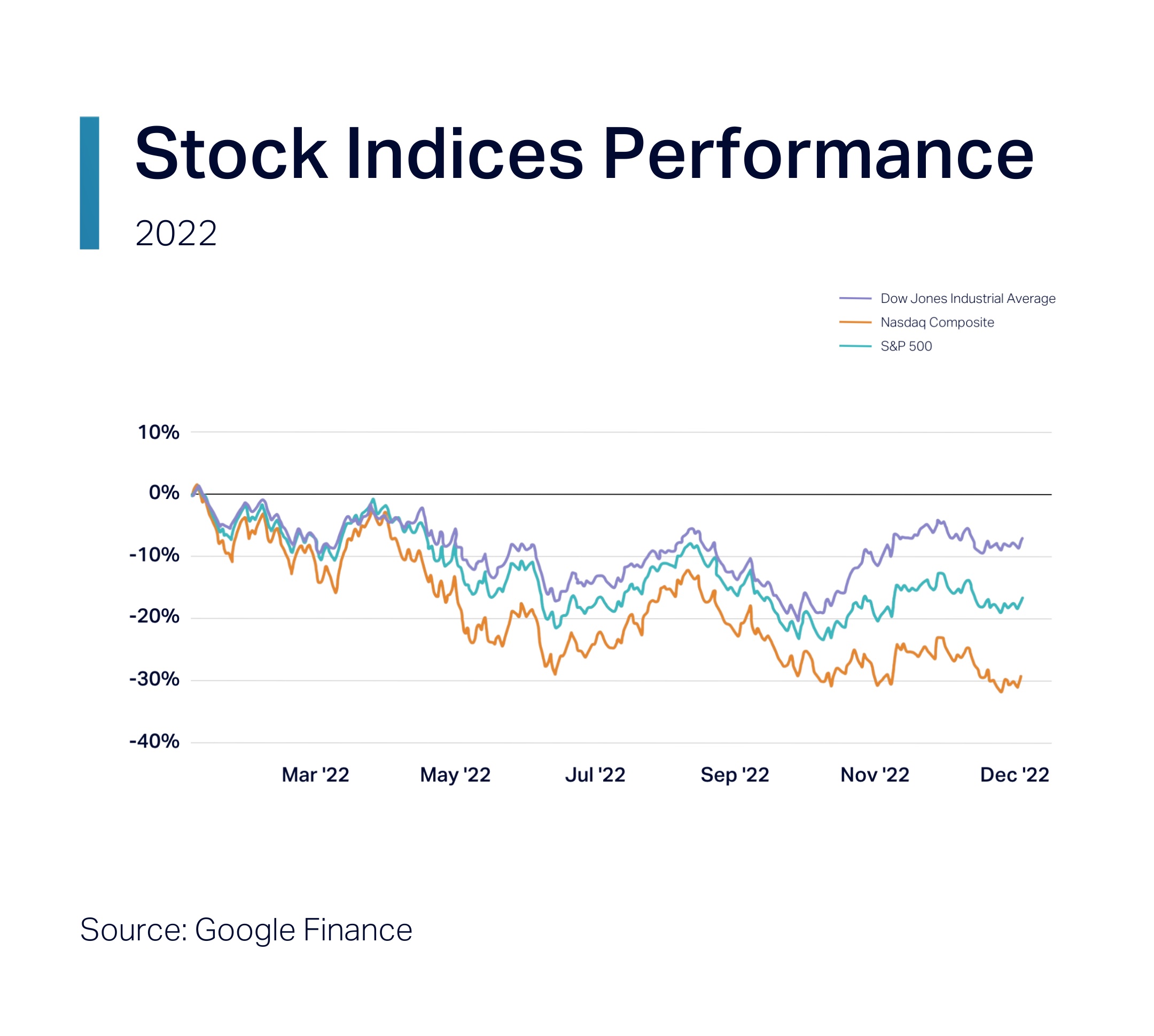

Across publicly-listed company valuations, when stock prices tank across the board this indicates that the value of equities is taking a beating overall. Take, for example, three of the most referenced stock market indices’ drop in 2022 — the Dow Jones Industrial Average fell ~8.7%, the S&P 500 lost ~19.4%, and the Nasdaq Composite dropped ~33.1%.

Under pressure from the media and shareholders to bump up stock prices, public company CEOs are looking to their P&L statements to find areas of opportunity. Often, cutting costs is a first measure, and as staff payroll is an expense category that is quick to cut off, people’s jobs are fast to take a hit.

Now, as public market companies are seen as “seniors” to private companies, coupled with pressure from their existing and prospective investors, Founder-CEOs of startups (usually private companies), are taking caution to extend their runway. And so, over the last 6 months, we can see that they’ve been hesitant to raise capital at the expense of bringing their companies’ valuations down (in “down rounds”) along with the public market trends. As these companies are likely founder-run as well, they’d be less inclined to sell their businesses altogether in the anticipation of cashing out at a higher exit. In turn, this has left them to restructure their business expenses to extend their operating runways. And, as often people constitute a large portion of operating expenses (whether it’s full-time employees or even part-time consultants in the age of the Gig Economy), layoffs are inevitable.

Which industry is being affected the most?

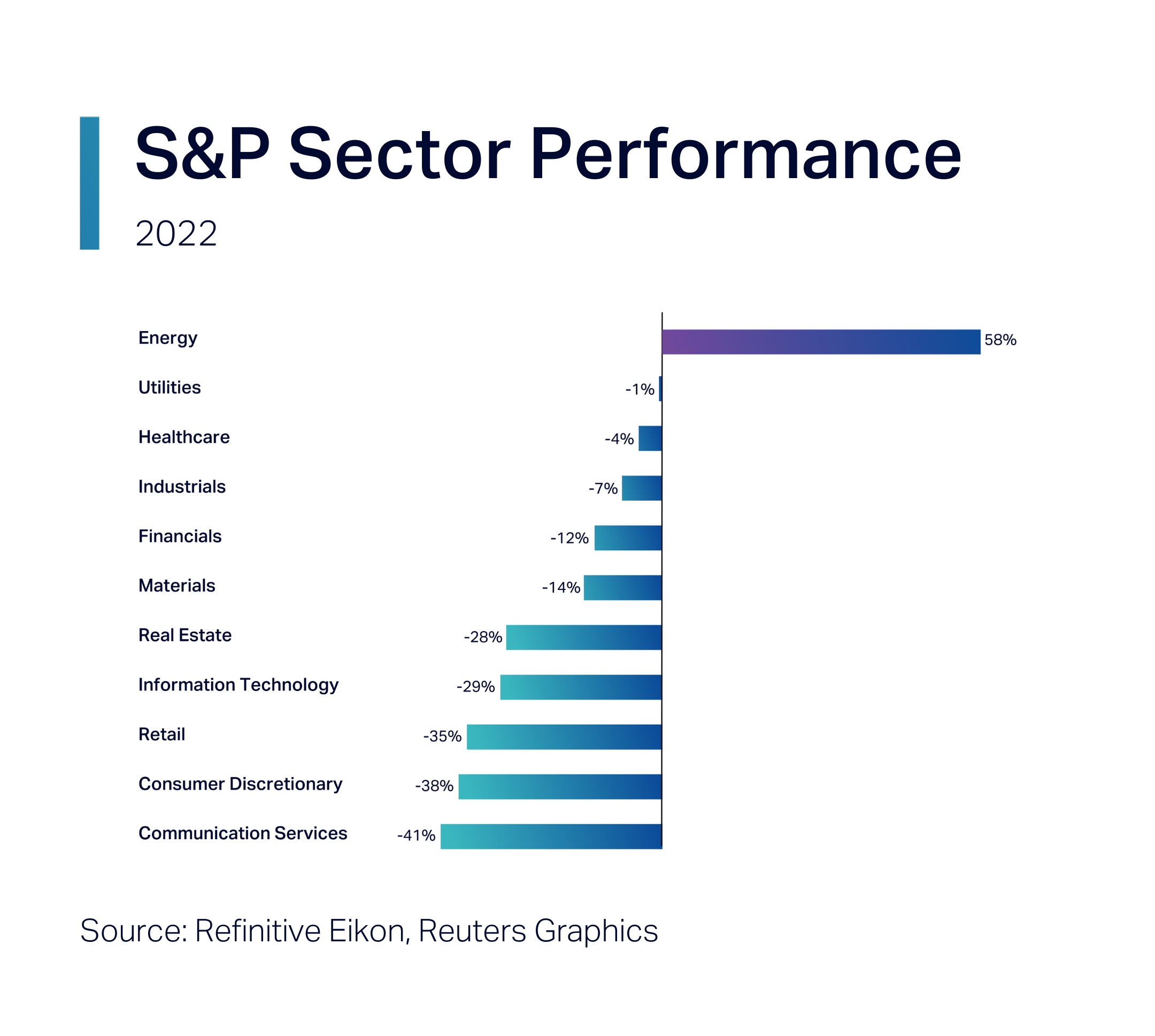

According to Reuters, growth stocks (a.k.a. Tech companies) saw the sharpest drop in value. This indicates that companies within this sector that IPO-ed in the last few years likely went public at over-inflated valuations — and hence, their stock valuations are being corrected the most amongst more traditional industries (e.g. Energy companies). After all, their gains had been historically unparalleled, meaning something had to give.

Many of the companies that have made headlines recently by announcing layoffs have, in fact, been public tech/ growth companies. These include Meta (11,000 jobs), Amazon (18,000 jobs), Salesforce (9,090 jobs), Twitter (3,700 jobs), Robinhood (1,013 jobs), Shopify (1,000 jobs), and Peloton (4,084 jobs). Closer to home in MENA, SWVL also laid off 50% of its workforce in November 2022 (400 jobs).

Will the layoffs impact growth in 2023?

When taking a top-down approach, without a driving force to push revenues upwards, you can anticipate the rate of growth of companies that announce layoffs to be impacted. After all, new product launches take time and capital. However, that doesn’t mean that given the current economic circumstances, companies can not take the opportunity to look at their profitability metrics.

Now, in some cases, CEOs can argue that the staff expenses being trimmed are just excess “fat” being cut off — meaning the company is over-staffed and can continue to produce the same output (i.e. hit the same revenue levels) with fewer people. Take, for example, Twitter’s new CEO, Elon Musk, cutting 60% of staff when he took over the company towards the end of 2022 — the company is arguably still operating the same. Though the company’s revenues are hindered by other factors not relating to staff (for example, fewer ad investments by companies who are not aligned with the new company direction), which would impact profitability overall, the fact remains that you can still log on to your account and post a tweet, just the same.

Will we continue to see more layoffs?

Given the bear state of the market at present, CEOs can anticipate the same investor sentiment going into 2023 that last year ended with. This means that we’re likely to see more layoffs across the growth economy, probably even companies that appear to be doing well financially and are growing.

In the unprecedented age of growth that we’ve seen since the financial crisis in 2008, the Founder-CEOs that would have started their companies during this era would not have experienced making business decisions during a downturn… yet. Assuming many powered through denial by the end of 2022, the time has now come for these CEOs to make tough decisions regarding staffing. On the surface, it may seem like there are two paths they can choose to trek down: either freeze hiring or lay off staff. However, we wonder if the path of freezing hires will inevitably meet along the path of laying off staff. If so, then leaders can go straight down the path of letting people go in an effort to find their new operating model faster (and thereby get on their toes quicker). This choice also allows companies to be more generous with the people they lay off.

Should you be worried amidst all the layoff news?

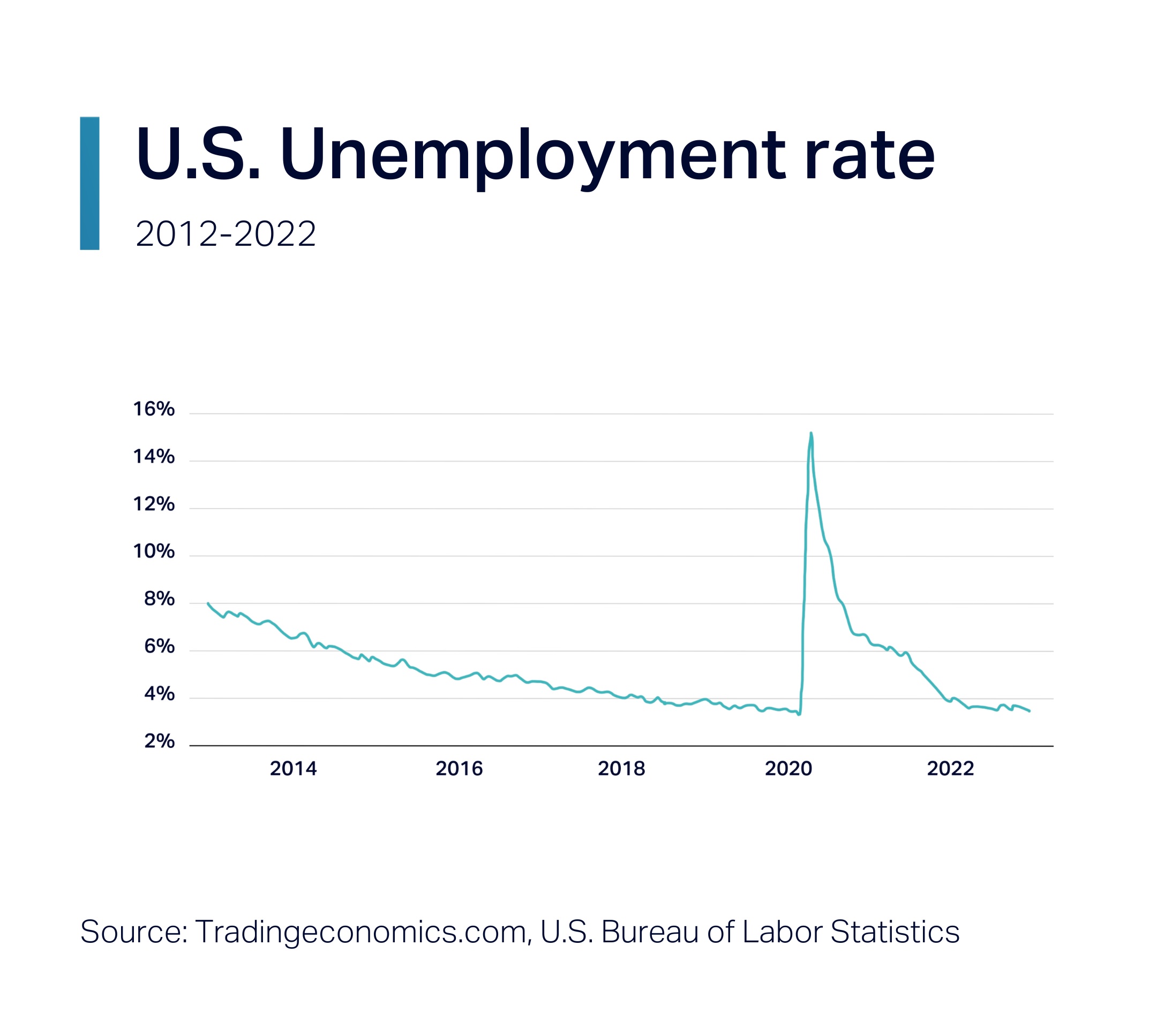

Though many tech companies announced layoffs last year, the job market overall is not in a dire state. Take job market indicators in the United States, for example, where many of the tech companies that have announced layoffs are headquartered. According to Crunchbase, more than 91,000 people were laid off across the tech industry in the U.S. However, as of December 2022, the country’s unemployment rate was at 3.5%, which is lower compared to the long-term average of 5.73% and is at a 10-year low.

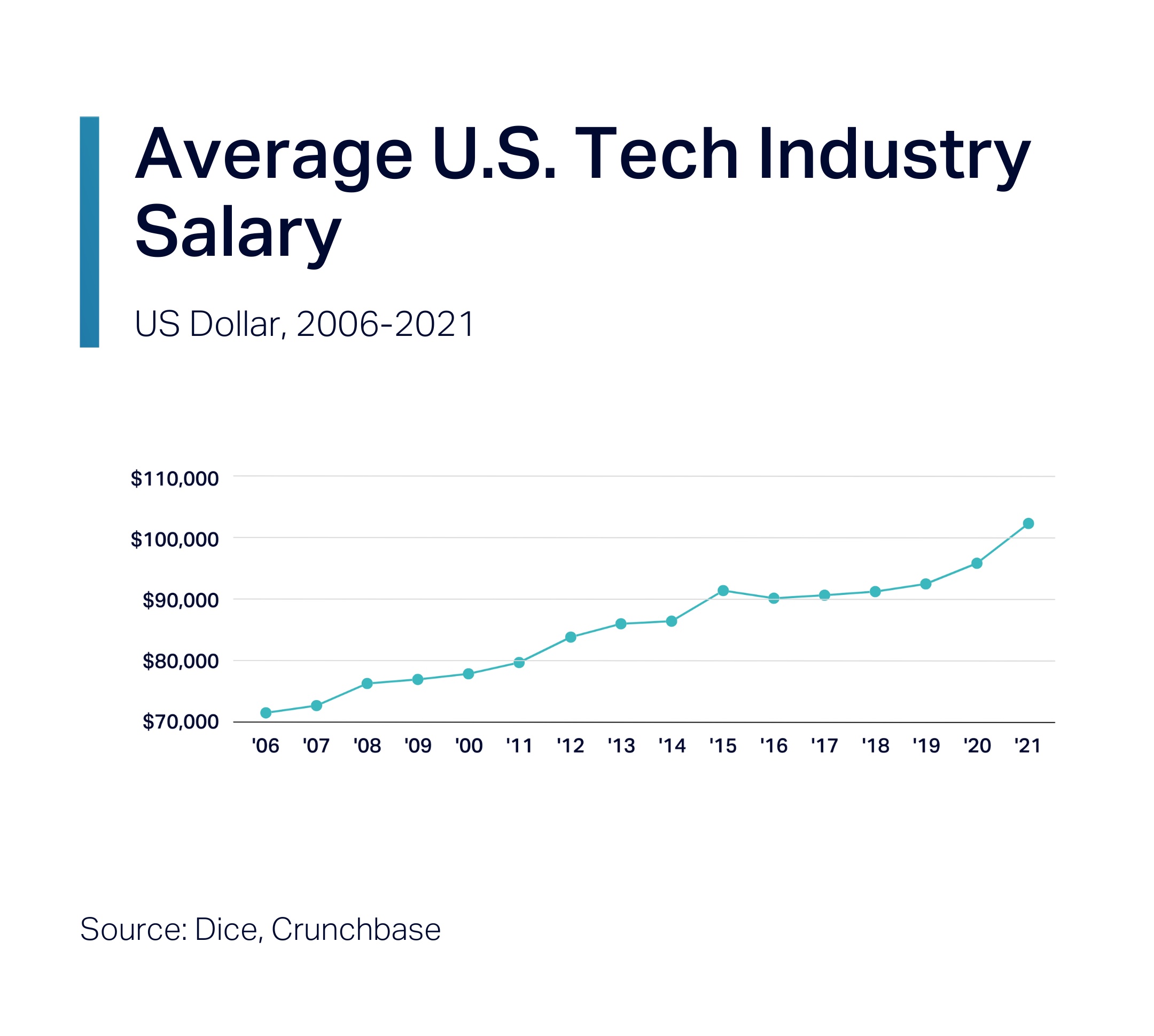

In fact, according to Revelio Labs, 70% of people in the U.S. who’ve been laid off across the tech industry since March 2022 were able to find another job within three months. In fact, Revelio Labs also reports that 52% of these people have been able to find new jobs at higher salaries, meaning that the growth in tech industry salaries that has been steadily on the rise (up 42.6% on average from 2006 to 2021, according to Dice) is not slowing down any time soon.

This, coupled with the historically-low unemployment rate across the country, means that in spite of the layoffs, talent is not being left redundant from work — instead, they’re being shuffled to other employment opportunities. As the skillsets required to work in tech are often white-collar in nature, this reshuffling brings with it an opportunity to sprinkle some innovation magic in traditional industries that may not have been disrupted so heavily yet.

Overall, strong employment metrics also indicate that people are able to meet their personal financial plans and obligations, leading to strong consumer sentiment — and it’s this strong consumer demand that tech companies will rely on to ensure that this season of layoffs will be more constructive than detrimental to their businesses. Further, amidst looming recession talks, this also indicates that a true economic slowdown may in fact just be speculation.

What’s the path forward for startups in MENA?

If you’re the founder of, or investor in, a startup in the Middle East that is well-capitalized, the layoffs that are taking place worldwide are a ripe opportunity to attract global talent. If you’re based in the U.A.E., you’d be attracting job candidates with the existing appeal that the country has built to attract talent from abroad, being recently ranked the most attractive country for talent in the Arab region by IMD World Talent Ranking.

In addition to seizing the opportunity to build out your team, we suggest that you take the time to identify other risks you may be facing or could be vulnerable to in an unpredictable economic environment, and be prepared for a worst-case scenario. Then, identify what changes you can make to your financials to improve cash flow as a bracing cushion.

Meanwhile, take the time to address what this global trend means to your existing employees. Be transparent about your business trajectory and communicate with them clearly about what your staffing plans are during this time. And should the case be that you are taking on a hiring freeze or planning for a layoff round, then put together a plan to ensure that staff morale is not clouded with seeds of demotivation. Further, for staff that hold company ESOP (and, therefore, have an interest in the company’s valuation), share with them what your short and medium-term growth plans are so that they don’t jump ship to another company that is simultaneously seeking to hire talent during this time.

The truth is that bull markets follow bear markets; and so, the future of your company is not fated for doom and gloom if business fundamentals are carefully considered in the meanwhile.