Introduction

In November 2025, we hosted a hands-on masterclass alongside Strategy Tools, designed to help founders across the region do one thing: scale with confidence.

The two-day masterclass in Dubai brought together ambitious VC-backed growth-stage founders in teams of five, who were tasked with scaling a fictional tech company to a successful exit. Throughout the simulation, they met with hundreds of investors, read hundreds of term sheets, and worked on key topics like foundational equity, AI, fundraising strategies, liquidity, and exit planning. This made the masterclass practical, immersive, and focused on outcomes. For founders, it represented an opportunity for learning through doing and a safe space to fail fast (and adapt their strategy accordingly).

To open the experience, participants were introduced to a structured gameplay format using different “card set” types, each representing unique founder decisions. From equity allocation to product strategy, every decision had consequences. The tension between priorities like geographic expansion, AI optimisation, and fundraising focus surfaced throughout the journey, forcing founders to weigh trade-offs in real time.

The masterclass tackled some of the region’s most pressing founder challenges:

- How do you attract the right investors, at the right time?

- How do you navigate dilution across multiple rounds?

- What does a smart secondary or acquisition or IPO exit strategy actually look like?

- How do you move from early traction to global scale?

- How do you plan for geographic expansion?

- How do you assemble a best-in-class board?

- How do you leverage AI to accelerate scaling?

This article takes you through some key takeaways from the experience.

Most Startups Don’t Scale. Here’s Why.

The fundraising landscape has shifted dramatically. As of Q4 2025, only 2% of startups are in the top tier that attract inbound term sheets and competitive offers. Around 15–20% can raise decent rounds with the right process. The rest? They face stalled momentum, down rounds, or worse, a hard stop.

This isn’t about luck. It’s about playing the venture game with clarity, strategy, and speed.

Startups that succeed know how to:

- Craft a compelling equity story

- Identify the right investors at the right time

- Run a fast, focused fundraising process

- Maintain revenue velocity

- Leverage AI

- Assemble the best boards

- Identify strategic acquisitions

- Align their business model to capital markets

Stage Matters

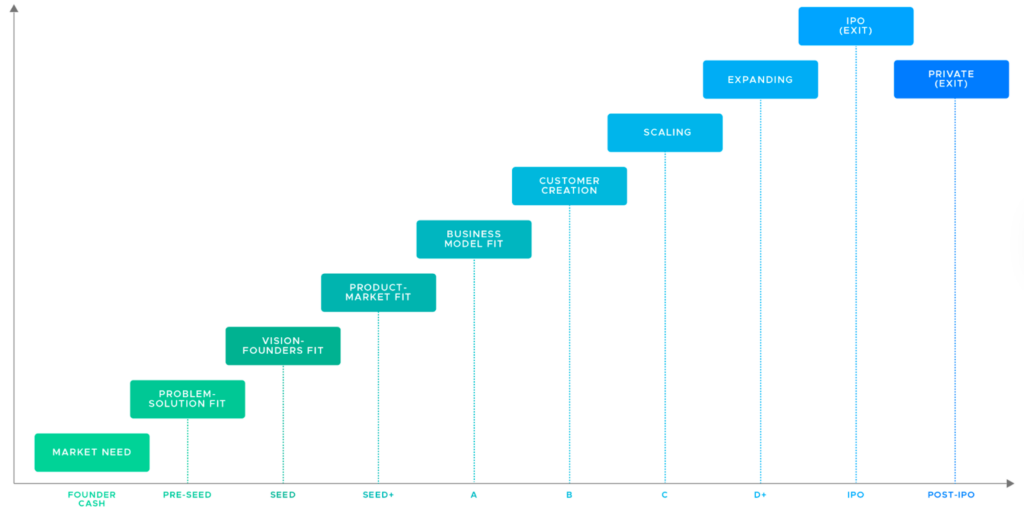

The masterclass walked teams through the Founder’s Journey, from proving market need, to scaling, expanding, and eventually exiting.

Each stage has a unique set of funding instruments, investor profiles, and key objectives. For instance:

- Pre-seed to Seed: Focus on proving problem–solution fit and founder–vision fit. Raise from friends, angels, and accelerators.

- Series A–B: Prove product-market fit and scalable unit economics. Convert SAFEs. Get serious about cap table strategy.

- Series C+: Build customer creation engines. Attract late-stage VC, family offices, and prepare for partial liquidity.

- Expansion + IPO: Use asset managers and investment banks. Start thinking about secondary exits, governance, and margin expansion.

What stood out in the workshop was how founders learned to map their fundraising and scaling strategy through the lens of card types. These included pivotal decision cards like “Global Expansion vs. Profitability,” “AI Integration Timing,” and “Secondary vs. Strategic Exit.” This not only simulated real-world tension but showcased how each choice can radically reshape outcomes.

The canvas frameworks used in the workshop helped founders map their equity journeys in real-time, giving them actionable insight into what it takes to raise smarter and scale faster. It also forced thinking about when to raise, what an ideal investor profile looks like at each stage and the scale of investor funnel required in order to enable choice of which investor to accept.

Hint: target a minimum of 100 screened investors for each fundraising round and build a relationship prior to needing funds. The fundraising never stops.

Map Your Dilution Out

When fundraising is done well, everyone (founders, investors, debt providers, employees) is a winner when a business performs. Founders need to forecast their dilution at each stage and plan for ESOPs early on while realizing the impact of secondaries and liquidation preferences. The workshop ran through a few scenarios of how fundraising can affect founder outcomes in drastically different ways.

Hint: You can build a fantastic business but if you raise on poor terms at bad times and don’t structure your ESOPs well you can end up with very little at the end.

Build A Great Board To Help Steer The Ship

The best founders assemble stellar board members (sometimes supplemented by equity-incentivised advisors) to add value at all stages of company evolution. You need a board that can help unlock doors and accelerate your go-to-market but also that can advise and support on finance and fundraising, ensure the right governance and checks are in place as well as support on big picture macro strategy and markets. In the workshop, founders mapped out their goals for what the perfect board would look like using the board map canvas.

Hint: Be proactive about engaging the right board and advisors. Identify who your top targets would be for each category and reach out to engage them.

Have An Exit Plan From Day 1

Great founders have a plan for their exit scenarios from very early on and think beyond IPO as the only exit route. Identify who your strategic buyers could be and what their rationale for purchasing could be (e.g. relevant corporates looking to diversify revenue streams, access new data or larger competitors without a presence in MENA). Outline why your company makes a better acquisition target than others in the space In the workshop, founders used the exit routes framework to outline all of the exit routes to potential investors. This was prefaced by some outcome analysis where founders had to think through a variety of long-term outcomes for their business and assign probabilities.

Hint: Founders have two sets of customers… the customers they sell their product/ services to, and their investors. Have your exit plan ready for investors so you can pitch what their return scenarios look like.

International Scaling: Local vs Regional vs Global Tech

The masterclass differentiated between three types of companies:

- Local businesses that optimize for profitability and raise small equity rounds

- Regional tech startups that use grants, SAFEs, and early equity to grow across the GCC and MENA

- Tech companies with global ambitions that build international teams from day one and raise capital from global VCs

Differentiating between these three company types forced founders to address how they might think bigger, to build companies with globally-relevant products and ambitions to optimize exit outcomes.

Hint: Global expansion can drastically improve valuation multiples and opens up new suites of investors.

Summary

In summary, some of the most powerful insights that emerged from the masterclass were the following:

- Run your fundraising like a sales process with a funnel, CRM, and conversion targets

- Align your cap table to your growth story (not the other way around)

- Invest in your equity narrative early, especially when entering global capital markets

- Secondaries can unlock retention and liquidity at the right stage

- Your exit strategy starts on Day 1

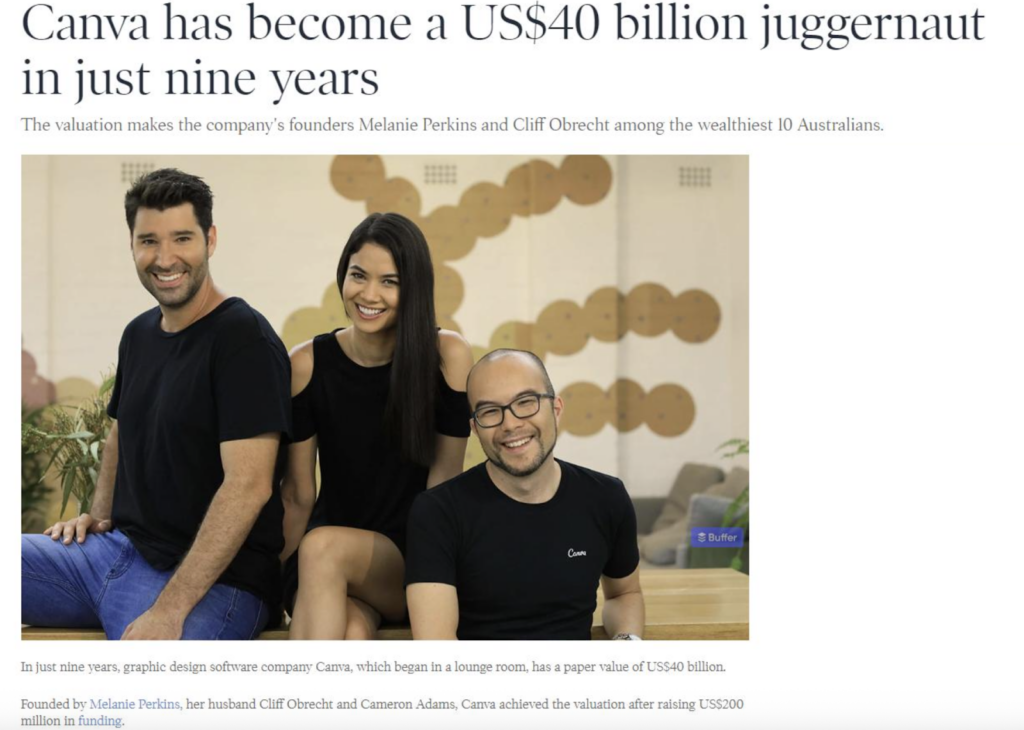

Case Study: Canva’s Journey

17 Rounds, 43 Investors, $40B Valuation

One of the most powerful case studies shared was Canva’s ascent. Seventeen rounds of funding, forty-three investors, and a $40B valuation. It didn’t happen overnight, it was orchestrated, round by round.

What made Canva stand out? A repeatable fundraising machine, a compelling narrative, an investor pipeline managed like a sales funnel, and a mindset tuned to global ambition.

This same approach is replicable for MENA founders, especially those building globally scalable technology businesses.

The Global Faculty Behind The Masterclass

We’re proud to have supported this initiative alongside the team from Strategy Tools.

Chris Rangen

Global advisor to high-growth startups, VC funds and national fund-of-funds. Chris has been on the inside of 400+ equity financing deals ranging from pre-seed to post-IPO. As an early investor, board member and advisor he has helped scale companies to IPO, M&A and secondaries, while also seeing multi-million dollar deals blow up in the last minutes because of immature teams and unprepared founders.

Chris also works closely with VC funds, family offices and angel networks on investments and paths to successful outcomes. He is also visiting faculty at 10+ business schools, teaching VC, entrepreneurial finance and strategy.

He is also co-founder and chairman of Link Capital, one of the most active early-stage funds in Northern Europe. When not working with founders, he has worked with 250+ emerging fund managers, to build better VC funds around the world.

Scott B. Newton

Advisor to accelerators, family offices, venture and PE funds, Scott has advised both companies and investors from pre-seed to post-IPO transactions. Working across the Americas, Europe, MENA and Asia, Scott has been on the inside of deals across cultures, structures, shaped $100M outcomes for investors and founders alike.

Today, Scott splits his time as an investor, advisor and faculty, teaching entrepreneurial finance, value creation and venture capital. Scott does extensive work with boards, C-level and family-owned businesses, including portfolio construction, venture investments and assessing 100s of startups every year.

He is also visiting faculty at top business schools in Europe and the United States.

Sanjana Raheja

Advisor to founders, accelerators, and early-stage global investors seeking opportunities in the Middle East, Sanjana has worked on the inside of startup building, market expansion, and venture evaluation across the region’s fastest-growing sectors. She has supported founders from pre-seed to growth stage, shaping business models, unit economics, and go-to-market strategies while strengthening investment readiness and helping teams identify and correct operational and financial pitfalls before they become derailments. Her experience spans Careem, Talabat, two YC-backed startups, and LvlUp Ventures, giving her a unique lens across both operator and investor ecosystems.

Today, Sanjana works across venture scouting, strategic finance, product development, and ecosystem design with a mission to make MENA’s startup landscape more expansive and inclusive. Alongside democratizing venture knowledge through her IG channel @offtherecordsanj, she serves on the Executive Board of e7 generation (a Ma’an social enterprise) and mentors students at NYU Abu Dhabi, supporting the next generation of founders and analysts through hands-on guidance in strategy, finance, and venture thinking.

As a fund committed to strengthening Dubai’s position as a global innovation hub, DFDF plays a catalytic role in building a robust venture ecosystem in the emirate. A thriving VC ecosystem depends on clear paths to exit and the liquidity that comes with it for founding teams, VCs, and LPs alike. By supporting programmes that equip scale-up companies with the skills to grow towards this goalpost, we aim to contribute to a stronger, more sustainable ecosystem for all stakeholders. Through masterclasses like this one that we’ve co-hosted with Strategy Tools, we seek to deepen investor conviction in the region’s potential and continue supporting the next generation of innovators.