Moving on from a founders’ market

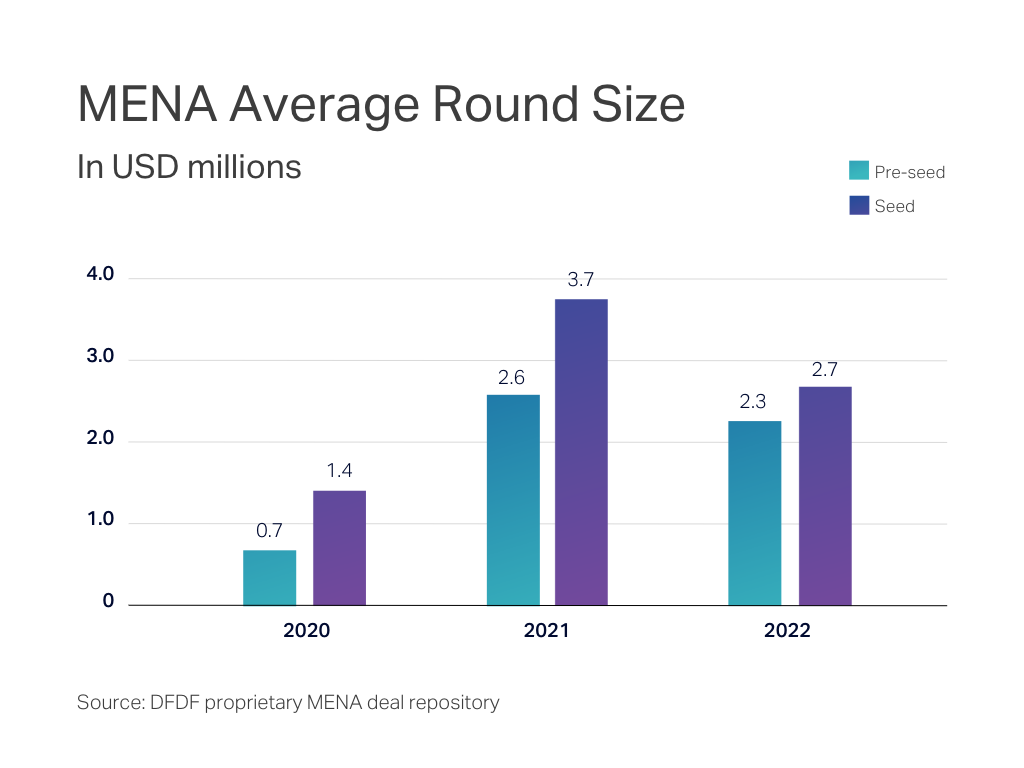

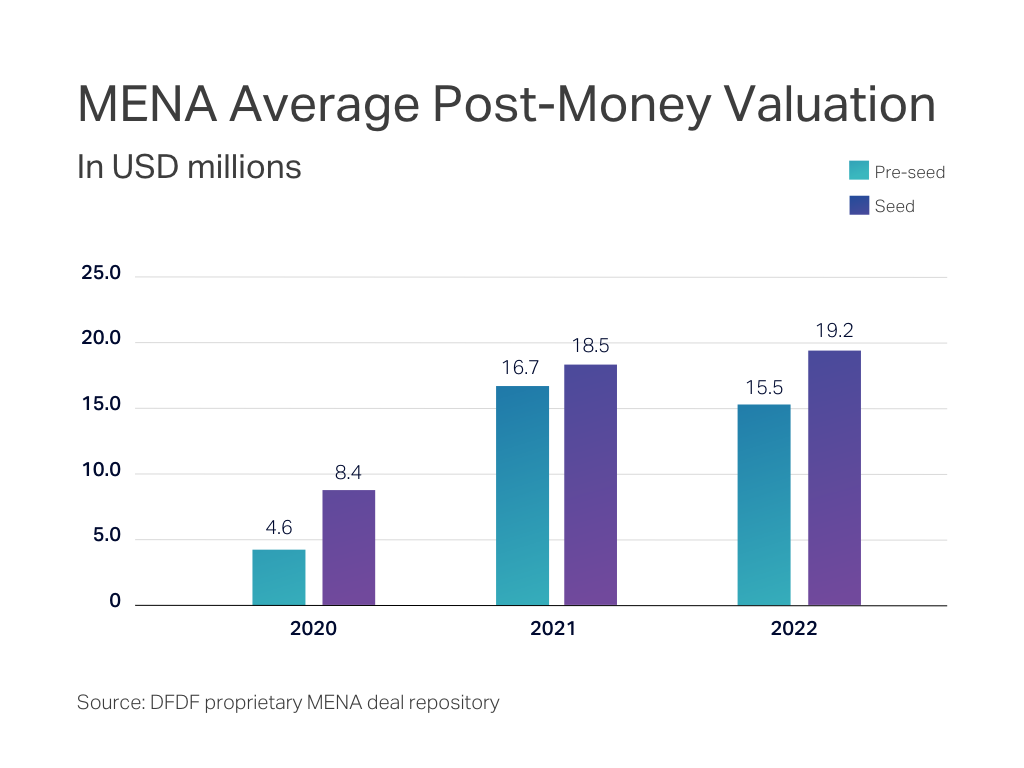

The year 2021 can be looked back as a “founders’ market” where founders had the luxury of practically being able to price their startups themselves from the get-go. Subsequently, the market saw Pre-seed rounds and valuations soar drastically. In addition, given record-level valuations in 2021, there was exceedingly more capital chasing limited opportunities; and so, investors became price-takers in the market. As a result, the markets saw an unprecedented injection of capital, and unfortunately, the price-setting process became a lost art.

In 2023, we’re entering a year where round sizes and values are moving back to their pre-2020 levels, where Pre-seed valuations would not only be products of sound business fundamentals but also result in meaningful round sizes that are based on well-thought-out fund requirements that aim to shed light on retaining the process of pricing a company when it’s yet to take flight — or in other words, when revenue multiples cannot be applied in the pre-revenue stage of a venture.

Before we dive in, it’s imperative to remind founders that Pre-seed valuations do not have much bearing on the company’s exit valuations in the following 5-7 years. Rather, the only impact the price has is to the extent founders give up their ownership for a reasonable amount of capital that can propel the business forward. To think of it differently, if you’re looking to raise $2 million for your Pre-seed round at a $10 million post-money valuation, there’s a possibility that a $1 million round at $5 million post-money value makes more economic sense for all stakeholders involved

How to value Pre-seed companies

We see price-setting of Pre-seed ventures as a two-fold process run in parallel by founders and investors:

(1) A quantitative and founder-led process of estimating and optimizing the fund requirements, reflecting the business requirements of capital to reach the next stage of business but also leaving sufficient equity with founders for dilution to come in at the growth phase,

(2) A qualitative and investor-led process of assessing business fundamentals in the venture to achieve rapid scale.

If diligently followed, we expect the outlined process to bring in a balanced price outcome — one that compliments the founder’s interests by supporting optimal dilution and gives enough upside to investors factoring in for business fundamentals.

1. Estimating and optimizing fund requirements

Post-money valuation = Round size / Dilution

The above equation is perhaps the single most important objective for founders and investors to optimize at the Pre-seed stage. While it is a collective process, the onus lies on founders as they have control over the most scientific input in this equation — i.e. round size or fund requirement. Hence, we highly recommend that founders present a dynamic business plan at this stage, as it really serves as the basis to optimize the equation.

Without getting into the details of a strong business plan, it’s always helpful for founders to focus on the key cost inputs to the business that are critical to build the product as compared to “nice to haves” that can be focused upon later. In comparison, the “need to haves” should be based on independent assumptions, whereas the “nice to haves” can perhaps be derived as an output of the final round size that transpires.

The resultant summary of the business plan would be a 3-5 year forecast with a clearly visible fund requirement for operational burn and capex (if any). Ideally, you should be able to come up at least two scenarios with different fund requirements and corresponding growth forecasts, each of which covers at least:

· 18-24 months’ runway with planned operating expenses without any revenues accruing,

· 24-30 months’ runway with planned operating expenses in the business plan and assuming revenue accrues as per plan.

At this stage, both investors and founders are in a good position to run two simultaneous sanity checks to further optimize the equation.

For investors, it’s worth digging into the financial model to assess the founder’s likelihood of achieving medium term targets, and then proceed to apply reasonable exit multiples to come up with an exit valuation. If a $15 million entry valuation will lend only a 3x value appreciation in 5 years in the best case, it’s not an attractive return potential for a VC given the risk.

For founders, it’s worth focusing on their target dilution by managing the fund requirements. If your base case forecast requires $2 million, how do you prioritize where to spend the cash in the next stage and only take $1 million instead of $2 million? For a standard ~20% dilution, the post-money valuation automatically drops from $10 million to $5 million — that is more likely to bring in a lot more investor interest. Another recommended exercise is to assess if the round size can lead you to a position of revenues and product developments that enables your next funding round to be a ~3x appreciation in value for investors based on standard industry benchmarks.

It’s a worthwhile exercise to really think about what it is that the customer wants — adding another feature to the product might make it cooler, but is it really going to drive sales and justify the expense?

2. Assessing business fundamentals

Before we really understand the business fundamentals that go into the price setting process, it’s worth emphasizing what goes into the decision making from investors to arrive at the point of wanting to price the business. At the risk of being too simplistic, there are 3 broad questions we, as investors, seek answers to at the pre-seed stage:

· Is there a need in the market for such a product? (i.e. pain point and value proposition)

· How big is the market for you to capture and the corresponding dollar potential? (i.e. market size, revenue model, and target customers)

· How well-suited are you to capture that opportunity in the market? (i.e. Founding team, product/tech, and the competitive landscape)

Once these questions are answered and there is enough comfort around an opportunity, it really comes down to assessing what sort of premium or discount do we attach to the price in order to make it an attractive investment opportunity from an ROI perspective.

Below we discuss a few fundamentals that we as investors would associate a premium:

a. Founding team

There really is no substitute for a strong and well balanced founding team today. Every other process in a company can be imported or outsourced except for the founding team’s vision, experience, and ability to execute. For example, if you are a team of three founders that cover operations, management, and product/tech, the use of funds is likely to be subsidized to a certain extent as founders’ salaries would be lower than market salaries. Hence, it’s justifiable to expect a premium in this case which is often reflected through a lower dilution.

Along similar lines, if you are a solo founder, it’s always worth considering the extra dilution to employees through ESOPs to give them more skin in the game.

It also comes down to the industry or vertical of the venture. If the founders are building a venture that requires deep domain knowledge (deeper tech verticals like quantum computing, energy management, biopharma), investors are likely to add a premium to the price. This is primarily a demand/supply factor, since there is simply a limited set of founders that can execute in the vertical. However, if you are a founder building a more generic venture that requires more of execution capabilities rather than technical know-how, investors might discount the price and seek to acquire a larger share of the company to assist in execution.

b. Defensibility of the technology

An early-stage company with internally-developed architecture that sits within the premise is always going to be more valuable than a one with its mesh created by an external vendor.

At a deeper level, we also look for underlying architectures that make a product difficult to replicate, or in other words give founders a 12-18 month head start over their competitors. Take, for instance, a product that relies on AI as a core functionality. Until and unless there is a meaningful and substantial proprietary dataset that has been generated or acquired over the years that can train the models, it’s very likely that competitors with access to datasets could build it faster and better. Similarly, keeping everything else constant, there is a significant premium for a product with true machine learning functionality (self learning ability) as compared to a workflow automation tool built (static ability).

c. Scalability of the business model

Business models designed for product-led growth through minimal sales and marketing effort, rapid customer adoption and network effects (Calendly and Canva are great examples of this), are much likely to see a premium over business models that need a sales-led approach with some level of customisation for each customer. If the product is designed to rapidly scale in a capital efficient manner, it’s justifiable to pay higher since we can expect the delta to be recovered sooner than later.

The second thing worth mentioning is a business’ ability to use non-dilutive capital for scaling. If you are able to build a highly predictable revenue cycle by pinpointing certain expenditure or working capital requirements that will bring in revenue, it opens up the possibility to continuously use debt facilities for scale.

d. Economic feasibility

While it is perfectly likely that ventures would be pre-revenue or yet to achieve consistent revenues at the time of Pre-seed rounds, it’s important to show a sustainable business supported by positive unit economics. A business with very thin unit economics cannot warrant a high range of valuation as compared to a capital efficient business with high gross margins. Simply put, the net amount retained on each amount of revenue after cost of sales must be factored in the price setting process. This is reflected in listed trading multiples where SaaS businesses trade at a premium to low margin trading businesses with respect to EV Revenue multiples, particularly ones with a stickier customer base and higher probability of long term agreements vs one off purchases.

For consumer companies that are building futuristic hardware, subscription models bring in a sense of predictability. A business with one time or one off sales requires a process of continuously acquiring new customers — i.e. more sales and marketing spend ahead.

The path forward for founders raising their Pre-seed round

As closing thoughts, price setting at the early stage is not just about arriving at a mutually agreeable price, but also establishing a deeply ingrained relationship between founders and investors. Pre-seed investments are equally about founders deciding the most suited investors on their cap table, and that requires time and continuous conversations. Each Pre-seed business is likely to undergo some sort of pivot or evolution; and hence, the more involved your lead investor is the better it is to navigate through the business model changes.