Introduction — The Need for Targeted Venture Education Initiatives in Dubai

Last month we brought together a diverse group of aspiring investors — from seasoned professionals at Shorooq Partners and COTU Ventures to our own Venture Fellows and bright minds nominated by DIFC, Dubai Chambers, e&, ADQ, Mubadala. Over three action-packed days, the participants weren’t just learning about fund management – they were putting their skills to the test in a fund management simulation, building connections, and shaping the future of the UAE’s VC ecosystem.

The goal was simple: split into teams and create a fund, then compete with each other to achieve the best returns for investors.

IRL, the stakes of launching a venture capital fund are high. That’s mostly because, though venture capital historically has yielded returns that outperform other sectors, the risks are high as well. So, for aspiring venture capitalists, practicing what it takes to launch a successful fund, in a safe environment (such as a simulation) prepares them for what to expect when they place real bets in the real world. As the saying goes, practice makes perfect.

Since it’s part of our fund’s strategy to be an anchor in Dubai’s VC ecosystem, we decided to introduce a program to equip the next generation of venture capitalists in the emirate. In this blog post, we cover how our pilot intake went, as well as some of our participants’ feedback.

Before we dive deeper, we would like to extend gratitude to our program sponsors Amazon Web Services (AWS) and Knowledge Fund, as well as our venue host Area 2071, for their generous support.

Breaking Down the Program Structure

Ahead of the program, 40 participants were divided into 8 mixed groups. It was important to the experience that participants did not form groups of their choosing to get them used to working with people whom they had not met before — just as they would in real life.

After the kick-off presentation (which we broadcasted live on LinkedIn to our wider community), participants were introduced to their fellow team members and were asked to make it official — well, within the game. They were asked to elect a team leader, assign other roles amongst each other (presumably after a discussion of each person’s key skills), give their fund a name, and head off to the race!

“The simulation is quite fun because I feel we get to choose our own roles… I became the Managing Partner and I'm getting to see the day-to-day life of the Managing Partner — the meetings, the amount of work, and multitasking.”

Zebo Furqatzoda, Program Associate at Shurooq Partners

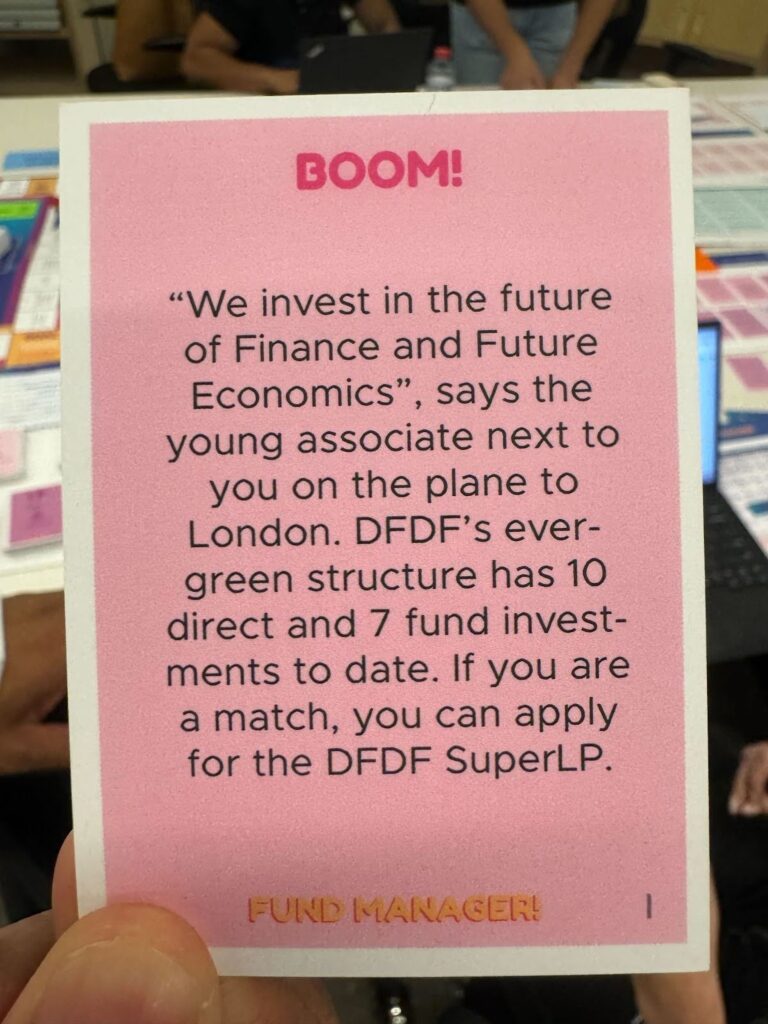

Following, over three intense days, participants navigated through 15 years’ worth of simulated real-life scenarios, whilst working with startups, scale-ups, and funds that exist in real life. This allowed participants to experience how their mock funds would have performed with realistic parameters built by design.

“We just closed our first fund and we invested in 6 companies so far. We're going to invest in 15 more before we close our second fund.”

Talal Khatib, VC at BECO Capital

Overall, the simulation not only imparts knowledge about the intricacies of fund management but also allows participants to step into the shoes of key roles, fostering a deeper understanding of the challenges and responsibilities involved.

“We learn a lot about the entire life cycle of setting up a fund, investing the fund, and, hopefully, exiting the fund as well… We've just gone through the fundraise of our first fund. We're about to go through the fundraise of our second fund. We started deploying out of the first fund and we have some amazing companies already.”

Khaled Lababidi, Operating Partner at Arbor Ventures, on the second day of the program

Congratulations to the participants of Enterprise Ventures for making their way to the top of the leaderboard by the end of the program!

About Strategy Tools

The architects of the program are the bright minds at Strategy Tools, who have been running this program all around the world in collaboration with ecosystem leaders. They are experts at creating visual canvases, tools, and simulations around complex topics such as corporate strategy, venture capital, and innovation, to aid in learning and development.

“We're super, you know, grateful to be learning the in and out of, like, fund management.”

Kenzie Falcoz, Head of Platform at Outliers Venture Capital

Thank you to Chris Rangen and his team at Strategy Tools for leading our pilot program experience this year!

DFDF’s Role In Fostering the VC Ecosystem in Dubai

We believe it’s important that the basics and the fundamentals of running a fund are taught, exercised, and experienced. Ultimately, VC is not just about raising a fund and deploying capital into good deals as much as it is about how you harvest those deals over time, add value, and eventually provide liquidity and returns to your General and Limited Partners.

The truth is, this is something that not everybody in venture capital in the Middle East has been able to experience yet because they haven’t experienced the full life cycle of a fund, given the regional ecosystem is still nascent. And so, we believe that bridging this experience gap with other forms of knowledge-rich experiences, such as this program and our Venture Fellows program that we run in parallel, are important to nurture the local ecosystem.

“It's been a rigorous three days of tension, learning how to do very different things we haven't done before; but, more importantly than not, working to collaborate and value create together as multiple funds in the ecosystem here today.”

Nader AlBastaki, Managing Director at Dubai Future District Fund

Conclusion: How to Get Involved

We’d like to extend an open invitation for stakeholders looking to partake in nurturing the VC ecosystem in the UAE — from aspiring or current venture capitalists, to funds looking to upskill their team, to corporations looking to build their venture expertise — to contact us if they are interested in joining future intakes of the Fund Management program. Together, we can nurture the local and wider regional VC ecosystem.