Introduction: Fostering Startups Is More Important Than Ever

The venture capital (VC) industry in the Middle East and North Africa (MENA) region is undergoing rapid evolution. In 2022, startups in the region raised a record $3.94 billion across 795 deals, reflecting a 24% increase in investment value compared to the previous year and an almost four-fold growth rate over the past decade. Amidst this rapidly-evolving landscape, investors and founders find themselves at the crossroads of change and opportunity.

In this blog we cover why this change is important and its impact on the venture capital industry. We also cover the role that VCs firms play in this growth, with an emphasis on how they can be more efficient at allocating capital and making a bigger impact through value creation.

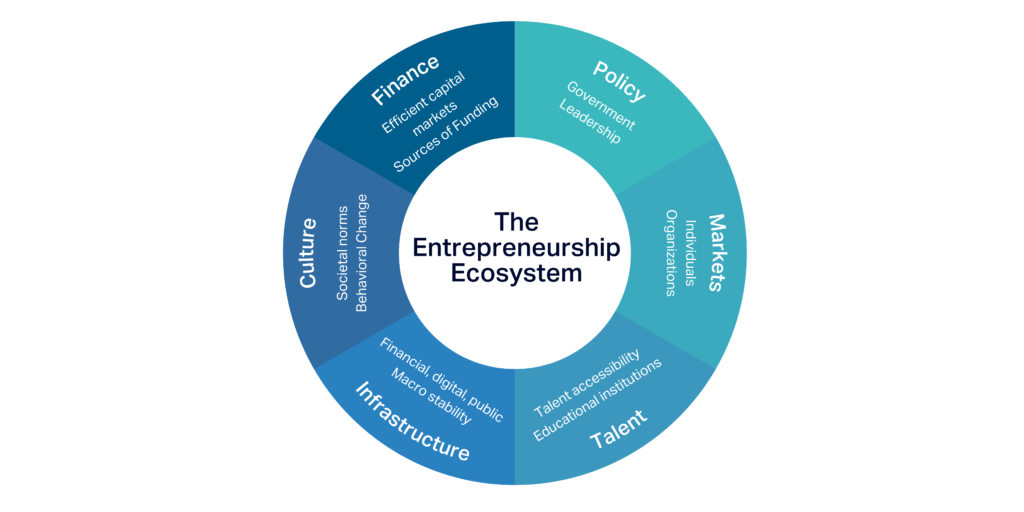

The 6 Pillars of Crafting a Thriving Ecosystem

As innovation becomes the lifeblood of economies, the following six domains are to be considered in order to nurture and support startups and the entrepreneurs that play an integral role in fostering growth and prosperity:

- Policy: Supportive regulations and frameworks promote entrepreneurship and have a trickle effect on other aspects of the economy such as financial, human, social, and intellectual capital.

- Markets: Networks to enable startups to connect with suppliers, potential clients, partners, and distribution channels.

- Talent: Access to a skilled workforce, mentors, advisors, and talented individuals who contribute to startup success.

- Infrastructure: Robust civil, legal, regulatory, macroeconomic, digital, and financial building blocks that attract innovators and investors.

- Culture: A culture that fosters risk-taking, innovation, and embraces failure as a learning experience.

- Finance: Diverse funding sources throughout the life cycle of innovation, from product development, to growth, scale and ultimately liquidity events in private and public capital markets.

It’s important to note that these domains are interdependent, and their impact collectively is far greater than any one of them on their own. For example, government policies that promote entrepreneurship, combined with a well-functioning market ecosystem, set the stage for startups to flourish. Additionally, a skilled workforce and supportive infrastructure can act as a magnet for startups. To state a third example, a robust infrastructure, including reliable digital connectivity and financial systems, makes it easier for startups to access diverse funding sources.

As such, understanding how they are interconnected and driving initiatives that foster all six areas collectively is essential for unlocking the full potential of startups and driving economic advancement.

Where Do VC Firms Fit Into Driving Startup Innovation

VC firms occupy a central position within the framework of the six pillars stated above that contribute to a thriving economic environment. Their influence is deeply interwoven with each element, fostering a symbiotic relationship that accelerates the growth of startups and drives economic advancement.

To start, both favorable policies (such as tax incentives) and regulations (such as intellectual property protection) attract VC investments. These investments, in turn, stimulate economic growth by fueling the expansion of startups into new markets, effectively linking the domains of policy and markets. Further, this injection of funds at pivotal stages facilitates the development of products and positions startups for successful market entry.

Beyond funding, VC firms provide mentorship, expertise, and strategic guidance. This enrichment of talent aligns seamlessly with the overall aim of cultivating a skilled workforce that contributes to startup success. Not to mention, VC firms are drawn to cultures that value risk-taking and innovation, mirroring their own appetite for investing in with manageable risks and high rewards.

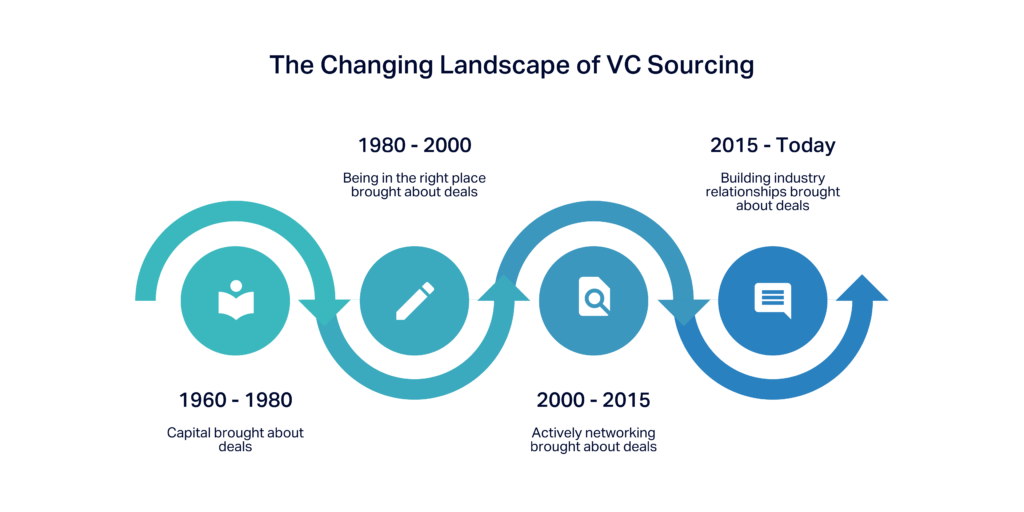

From Silicon Valley to MENA: The Venture Capital Evolution

Traditionally, venture capital was accessible almost exclusively to affluent families with capital. However, the last six decades have witnessed significant changes. VC firms were chasing too many deals in the same location at the same time. Consequently, they expanded beyond the initial hotspots of Silicon Valley and Boston. Now, there’s ample access to capital in emerging regions, like MENA.

Another shift in the evolution of venture capital has been in the way that deals are sourced. Whereas traditionally, the network trumped other methods of sourcing, with a preference for traditionally-acclaimed factors, VC investors are now relying more on outbound deal flow to generate more quality in pipeline. Knowing the founders well has gained prominence as a crucial aspect, and investment decision-making now incorporates new factors, such as perceived intellectual value-add.

The Art of Opportunity Sourcing

Whilst access to capital is crucial for startups to thrive and contribute to economic growth, as we’ve explained, the availability of said capital, including venture capital, is inherently limited. And so, establishing an efficient methodology for allocating this capital becomes pivotal to ensure that the most promising startups receive the necessary funds. By maximizing their potential for success, the trickle-down effectors of fostering innovation, creating jobs, and driving overall economic advancement becomes possible.

But — this is all easier said than done. Quality deal sourcing is challenging for venture capital firms due to the high failure rate for startups (which Startup Genome anticipate to be 90%), intense competition for promising opportunities, and the need to build relationships with founders while adapting to rapidly changing market dynamics — akin to a strategic quest for opportunities.

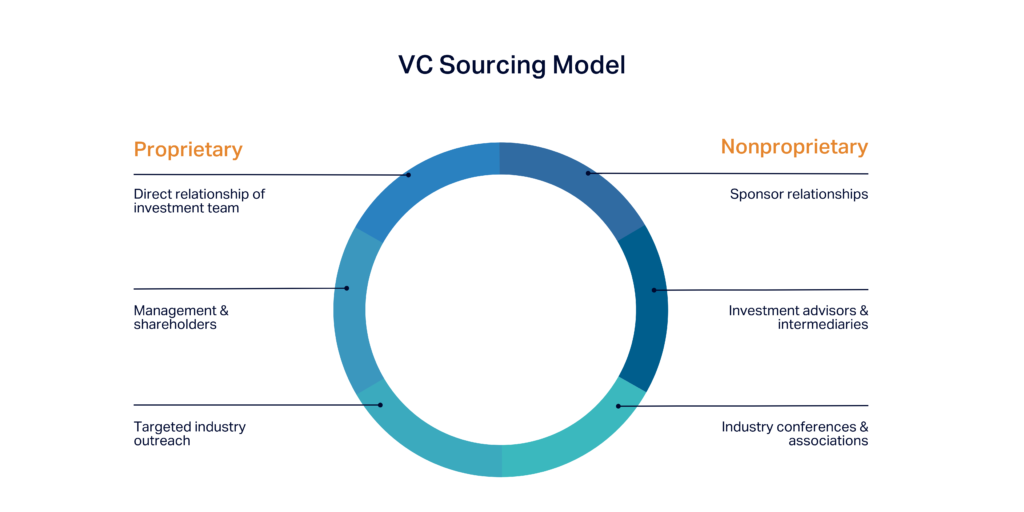

Sourcing can come from both proprietary and nonproprietary channels. The former includes direct relationships of the investment team, management and shareholders and targeted industry outreach. On the other hand, the latter includes sponsor relationships, investment advisors/ intermediaries, and industry conferences.

Upon identifying potential opportunities, a methodical evaluation and screening regimen ensue, culminating in a selection process aligned with the investment strategy of the firm. The process commences with the initial screening, which involves reviewing the startup’s addressed opportunity and assessing whether their team comprises the right individuals to lead the vision and execute the business plan. Subsequently, the due diligence phase follows, involving a deep dive into the startup’s industry and associated risks. This includes evaluating the product and analyzing the competitive landscape.

Moving forward, partner meetings are conducted, during which in-depth discussions are accompanied by financial diligence, and negotiations concerning the investment terms take place. Finally, the closing and financing stage arrives, during which the capital allocation is secured through the completion of legal documentation.

The Symbiotic Relationship: VCs and Startup Collaboration

Once deals are sourced and capital is deployed, VCs then assume the role of lifeblood for startups — especially in their nascent stages — bridging the chasm between innovative ideas and financial resources.

In the critical initial years, when startups encounter negative cash flows as they allocate substantial resources to product development, team building, and market penetration, venture capital emerges as a lifeline, ensuring operational continuity and growth.

This collaborative dynamic assumes an orchestrated cadence. VC investments typically transpire between the product development phase and the cusp of product launch. This infusion of funds during these formative stages galvanizes startups to scale their operations, ultimately cementing their position in the market. Furthermore, as startups achieve a certain scale, the necessity for additional funding arises to propel aggressive expansion into new markets to capture market shares and grow the overall top line.

A Post-Profitability Landscape: The Journey Beyond

Even in the aftermath of profitability, startups persist in their quest for further capitalization. This pursuit stems from the imperative to maintain their competitive edge, safeguard their early mover advantage, and continue pioneering innovation.

The strategic acquisition of funds at this stage not only facilitates expansion but also bolsters startups in their ongoing quest for innovation. In instances where startups are trailblazing in uncharted territories, additional funds are imperative to preempt competition and assert market leadership. This strategic capital infusion reinforces the startup’s pivotal role in the broader ecosystem.

The Paradigm of "Smart Capital"

It’s not solely VC firms that exhibit selectivity in their investment choices. Increasingly, founders have the privilege of choosing their investors, often assessing who excels in offering “smart capital” as a pivotal criterion in their decision-making process.

The notion of “smart capital” has garnered prominence as startups have underscored the requirement for strategic, value-enhancing investments that extend beyond mere financial infusion. Smart capital connotes an investment that encompasses multi-dimensional support, including strategic guidance, market access, regulatory expertise, human capital, and mentorship. Its features include the following:

- Strategic Guidance: Investors offer industry knowledge and mentorship.

- Industry Networks: Investors connect startups with potential stakeholders.

- Operational Support: Investors assist in optimizing business processes.

- Market Access: Investors open doors to new markets and distribution channels.

We encourage VC firms to look to provide smart capital, beyond mere funding, to enhance the growth trajectory of more startups in the region — ultimately, fostering a mutually beneficial relationship that positions to ecosystem as a whole for long-term success.

Why VCs are Uniquely Suited to Drive Startup Growth

Venture capitalists, beyond their financial role, emerge as key catalysts for economic progression. Their distinctive risk appetite sets them apart from conventional funding avenues, positioning them as vanguards of nascent startups and novel ideas.

- Backers of Future Titans: Venture capitalists substantiate startups at their inception, fostering the emergence of new industry leaders. Unlike conventional avenues, venture capital amplifies the impact of new entrants, fueling innovation.

- Active Guardianship: Venture capital endows startups with active ownership, characterized by operational guidance and strategic direction. VC firms provide a robust support system while founders retain the reins of leadership.

- Job Creation and Economic Upliftment: VC-backed startups burgeon into significant contributors to employment and Gross Domestic Product (GDP), driving economic vitality and job prospects.

- Cultivating Novel Arenas: Ventures fostered by venture capital often spearhead uncharted sectors, catalyzing economic evolution by unlocking untapped markets.

- Holistic Returns: The influence of VC investments reverberates beyond financial gains. Employees vested in Employee Stock Ownership Plans (ESOPs) reap outsized benefits, thus amplifying the spectrum of wealth distribution.

This collective impact extends to future generations, shaping the contours of business landscapes, fostering entrepreneurial vigor, and recalibrating innovation paradigms. Venture capitalists materialize as architects of transformation, propelling economies towards greater resilience and dynamism.

Conclusion: Why It’s Important for VC firms to Drive Change and How DFDF Can Support

In conclusion, the realm of venture capital unfolds as an intricate tapestry woven into the broader fabric of the entrepreneurial ecosystem. This engagement, characterized by strategic navigation, symbiotic collaboration, and multifaceted impact, surges beyond financial transactions to effect profound economic transformations.

The partnership between venture capitalists and startups stands as a testament to the collaborative potential for driving innovation, stimulating economic growth, and shaping the contours of future entrepreneurship.

We, at DFDF, are focused on value creation, in addition to capital deployment, to drive growth within the region’s VC industry. If you are a part of a private or public organization that is committed to the same goals, please get in touch — we’d love to hear from you.