Introduction

Raising capital for a startup is a journey fraught with challenges and opportunities. For many startups, securing a Series A funding round is a critical milestone that can set the trajectory for future growth and success.

The “Road to Series A” workshop, which we hosted in collaboration with AWS for Startups, provided a wealth of insights for startups preparing for this crucial phase. As part of DFDF’s goals is to support and grow the startup ecosystem in the MEASA region, the Road to Series A is a key initiative towards this goal.

In this blog post, we’ll delve into the key lessons from the keynote presentations, offering a comprehensive guide for startup founders on the path to a successful Series A funding round.

1. The Current State of Raising Capital

The landscape of raising capital in 2024 has seen significant shifts. Global trends indicate a downturn in round volumes and valuations, with exit markets effectively shut. The time taken to close rounds has doubled, and the dynamics have tilted towards investors. Despite these challenges, sectors like AI, climate, and energy continue to attract attention, with $317 billion of dry powder across venture capital firms globally waiting to be deployed as of Q1 2024 (according to EisnerAmper).

The Importance of Performance

Gone are the days when potential alone could secure funding. Investors are now looking for tangible performance. In most cases, startups are now measured on revenue, revenue growth, unit economics and path to profitability, a new world for many founders.

2. Understanding the Founder's Journey

The keynote presentation by Chris Rangen, a global advisor to funds, CEOs, and founders, offered a comprehensive overview of the current investment landscape. Rangen highlighted the importance of understanding the big picture, emphasizing that

"You are always raising three rounds at the same time, just at different dates."

Chris Rangen

This perspective underscores the need for a long-term funding strategy that goes beyond the immediate round.

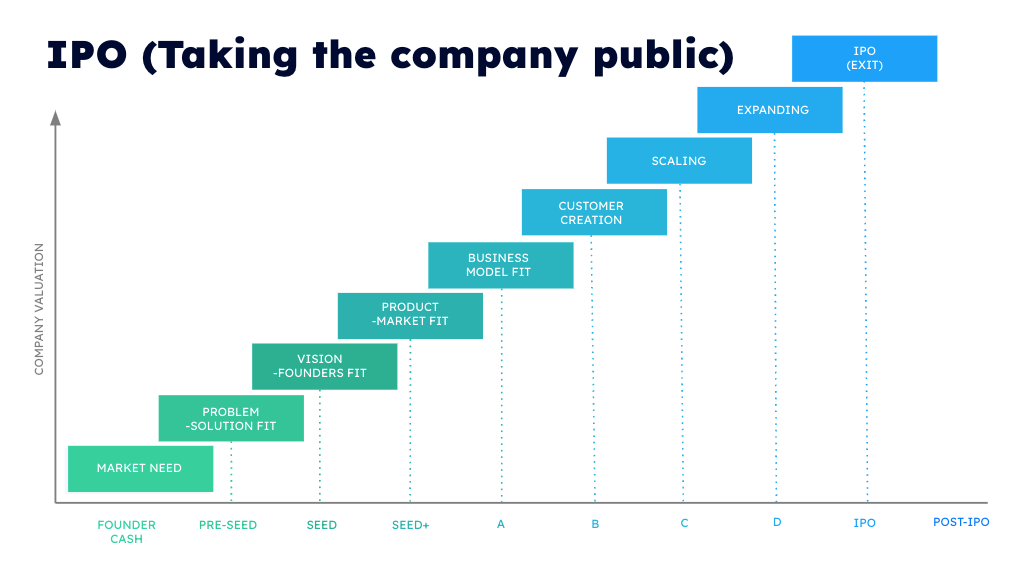

The founder’s journey from pre-seed to IPO is marked by various milestones, each requiring a different focus:

- Pre-Seed: Prove the market need and raise initial funds from friends, family, and angels.

- Seed: Establish problem-solution fit and secure accelerator investment.

- Seed+: Demonstrate vision-founders fit and the team’s capability to execute the plan.

- Series A: Achieve product-market fit, prove customers are willing to buy.

- Series B: Establish business model fit, demonstrate unit economics.

- Series C and beyond: Focus on customer creation, scaling, and expanding to new markets and segments.

Each stage requires a different strategy and a different set of investors, making it crucial for founders to understand where they stand and what they need to focus on next.

3. Tools for a Successful Series A Round

The transition from Seed to Series A is a significant step up — it involves more scrutiny and due diligence. Founders need to be prepared for more challenging requirements in terms of performance and governance in order to appeal to local and international investors. To help with this preparation, the workshop introduced various tools and frameworks to help the founders on their journey.

During the workshop, the attendees filled out printouts of these tools, following with the instructions, to help contextualize where their startups were at with respect to being ready for raising a Series A. We recommend founders who are reading this to download the tools and utilize them.

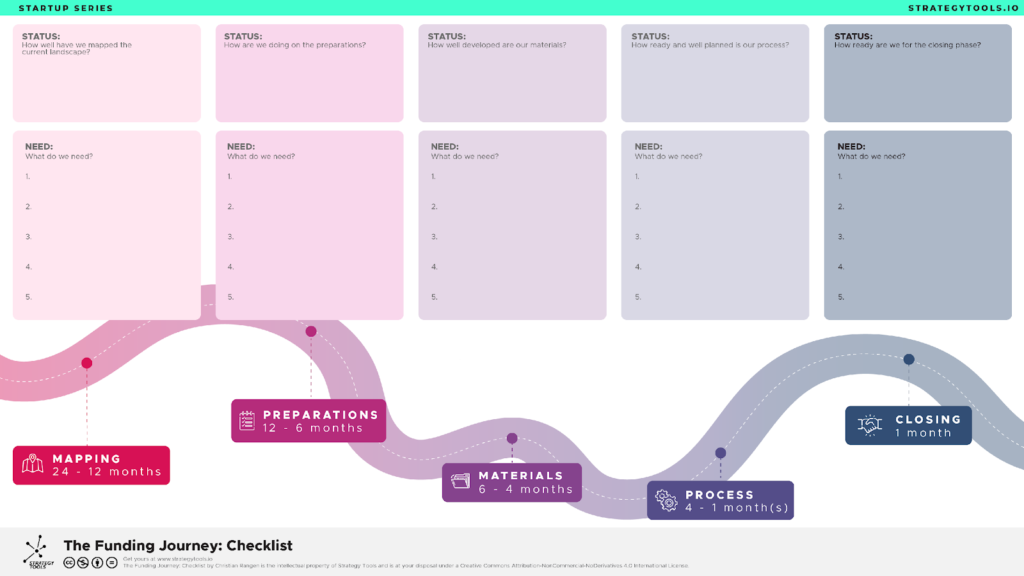

The Funding Journey Canvas

The workshop introduced the Funding Journey Canvas, a tool designed to guide founders through the 42 steps across 5 phases of raising a funding round. This canvas serves as both a guide and a playbook, helping founders to plan, execute, and track their progress.

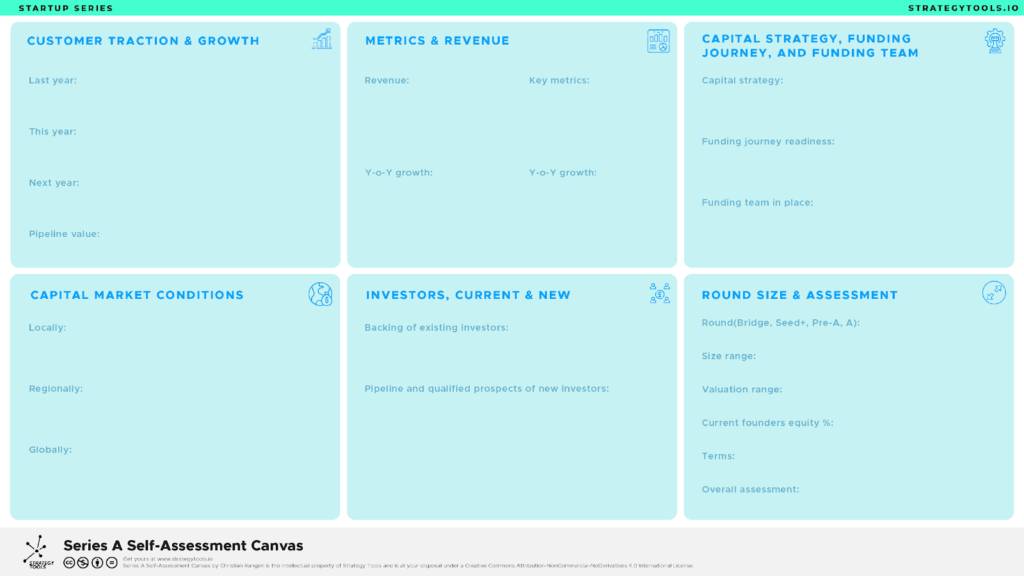

Series A Self-Assessment Canvas

Another valuable tool that helps founders assess their readiness for a Series A round by evaluating key aspects such as growth, team readiness, financial planning, investor relations, and more.

4. The Funding Journey

The journey to securing a Series A funding round is complex, involving multiple phases and steps. We outlined a comprehensive roadmap for success, broken down into the following five phases. This roadmap serves as a guide and playbook for startups, helping them navigate the intricacies of fundraising.

Phase 1: Preparation

The first phase involves preparing for the fundraising journey. Startups need to understand their investor universe, exit options, and the landscape of potential investors who are a perfect match for their business. A thorough analysis of the startup’s current position and potential exit strategies is crucial at this stage.

Phase 2: Strategy Development

In the second phase, startups must develop a clear fundraising strategy. This involves creating a detailed investor list, clarifying the fundraising strategy, building a robust financial model, and starting to engage with potential investors. The goal is to have a well-defined plan that aligns with the startup’s growth objectives and the expectations of potential investors.

Phase 3: Execution

The execution phase is where the rubber meets the road. Startups need to develop compelling pitch decks, set up a data room, and actively engage with investors. This phase requires a meticulous approach, ensuring that all materials and communications are polished and professional.

Phase 4: Closing

Closing the funding round is the culmination of the fundraising journey. This phase involves finalizing terms, conducting due diligence, and securing the investment. It’s a critical period that demands attention to detail and a focus on ensuring a smooth and successful closing process.

Phase 5: Post-Raising

After securing the funding, the journey doesn’t end. The post-raising phase involves leveraging the new resources to accelerate growth, execute the business plan, and prepare for future funding rounds. It’s a time for reflection and strategic planning, ensuring that the startup is positioned for long-term success.

5. Mastering Technical Due Diligence

A. Understanding Technical Due Diligence (Tech DD)

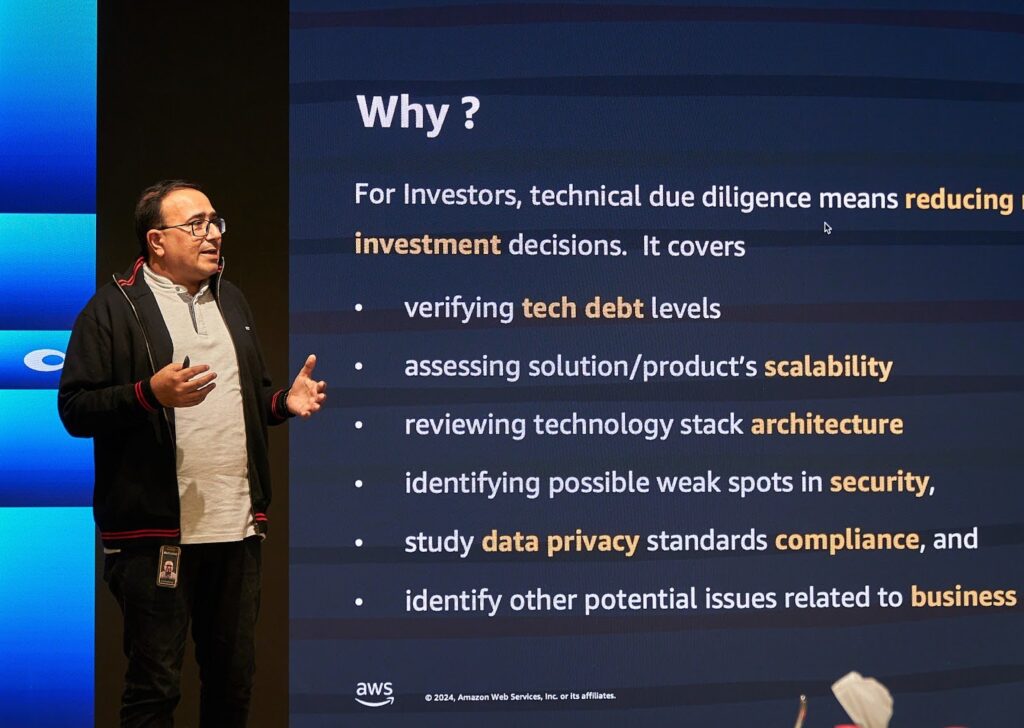

The next keynote, presented by Anshuman Nanda and Alexis Philippart de Foy from AWS, emphasized the importance of technical due diligence for investors. This process involves validating the technology assets, risks, and liabilities associated with a startup. Key focus areas include software and hardware architecture, security, scalability, APIs, and code quality.

Technical due diligence is a critical process that investors undertake to validate the technology assets, risks, and liabilities associated with a startup. It is an essential step in the investment decision-making process, helping investors reduce risks and make informed choices. For startups, undergoing tech DD is an opportunity to showcase the robustness and scalability of their technology, thereby increasing their chances of securing funding.

B. Focus Areas of Tech DD

The tech DD process encompasses several critical areas, including:

- Software and hardware architectures

- Scalability and performance

- Security measures and compliance

- Development workflows and processes

- Team expertise and capabilities

- Budget and resource allocation

- Verifying levels of technical debt

- Assessing the scalability of the solution or product

- Reviewing the technology stack architecture

- Identifying potential security weaknesses

- Ensuring compliance with data privacy standards

- Addressing other potential issues related to business operations

Startups must be prepared to answer questions related to these areas, demonstrating their understanding and readiness for growth.

C. The AWS Well-Architected Framework

A significant portion of the keynote presentation was dedicated to the AWS Well-Architected Framework, which provides a comprehensive guide for building secure, high-performing, resilient, and efficient infrastructure for applications. The framework is built around five key pillars:

- Operational Excellence: Focuses on running and monitoring systems to deliver business value and continually improving processes and procedures.

- Security: Concentrates on protecting information and systems, ensuring confidentiality, integrity, and availability of data.

- Reliability: Ensures that a system can recover from failures and meet customer demands.

- Performance Efficiency: Looks at using computing resources efficiently to meet system requirements and maintaining efficiency as demand changes and technologies evolve.

- Cost Optimization: Aims to avoid unnecessary costs and maximize the value of investments.

Startups should align their technology and processes with these pillars to demonstrate their commitment to best practices and operational excellence.

D. Preparing for Tech DD

To prepare for technical due diligence, startups should:

- Ensure their technology architecture is well-documented and aligned with business goals.

- Have a clear understanding of their team’s capabilities and roles.

- Develop and maintain comprehensive documentation covering product features, development processes, and architecture diagrams.

- Implement monitoring and alerting mechanisms to understand the health of their operations.

- Establish security protocols and compliance measures to safeguard against threats and adhere to regulations.

- Prepare for scalability and reliability by having strategies for handling increased demand and recovering from failures.

- Optimize performance and cost by selecting appropriate resources and regularly reviewing expenses.

6. Leveraging Generative AI for Growth

The next keynote, by Basil Fateen and Saubia Khan from AWS, highlighted the potential of generative AI in enhancing startup growth. Generative AI, a subset of machine learning, focuses on creating new data and has the power to transform various aspects of a startup’s operations.

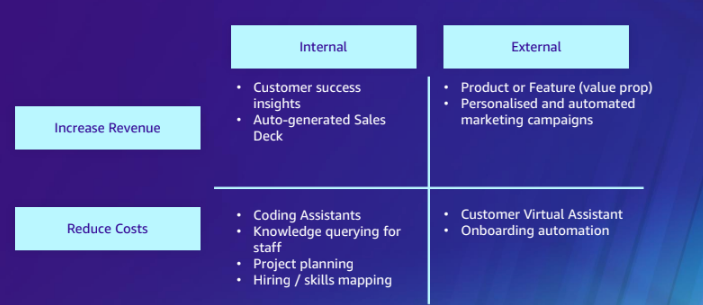

Startups can leverage generative AI to increase revenue through customer success insights and automated sales decks. On the cost reduction front, coding assistants, knowledge querying for staff, and project planning can significantly streamline operations. It’s essential to understand the token economics of Gen AI and how it can be integrated into your business model to maximize its benefits.

A. Understanding Generative AI

Generative AI, a subset of machine learning, focuses on creating new data that mirrors the characteristics of the training data. Think of it as a small jockey guiding a massive elephant on a journey – the jockey (AI model) directs the elephant (data) towards the desired destination (output). This technology has become possible due to advancements in algorithms, cloud computing, data availability, and GPU acceleration.

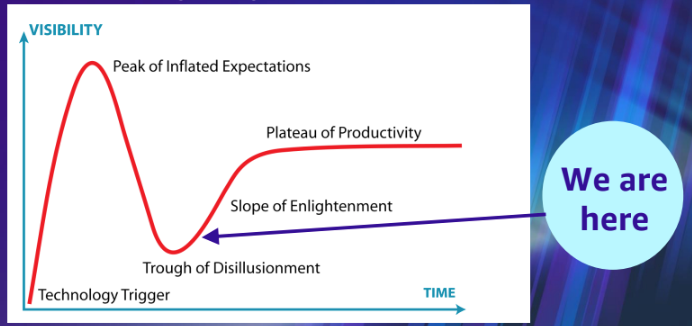

B. The Gen AI Hype Cycle

The hype cycle for Generative AI indicates that we are currently in a phase of heightened expectations, with the technology’s potential impact becoming more widely recognized. According to Clem Delangue, Co-founder and CEO of Hugging Face,

"2022 was the year of usage for AI, 2023 the year of revenue, and 2024 will be the year of profit and the economics of AI."

Clem Delangue

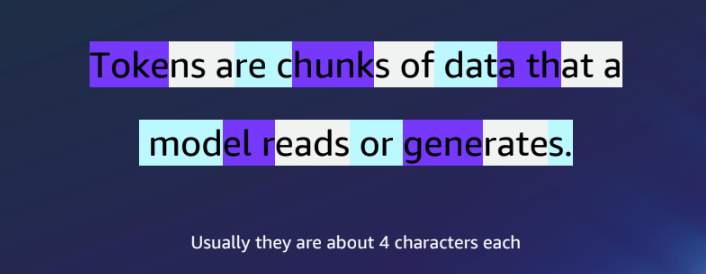

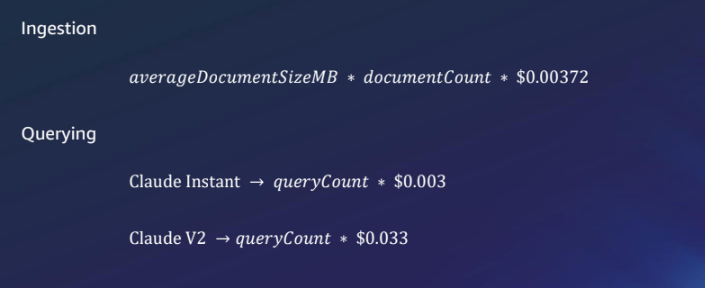

C. Gen AI Token Economics

Tokens, or chunks of data approximately four characters in length, play a crucial role in the economics of Generative AI. The cost of using Gen AI models, such as Claude Instant and Claude V2, is determined by the number of tokens processed, with pricing based on AWS Lambda, Amazon S3, and Amazon Bedrock prices.

D. Where Can Gen AI Add Value?

Generative AI can significantly enhance both internal and external business operations. Internally, it can provide customer success insights and auto-generate sales decks. Externally, it can enhance products or features, and enable personalized and automated marketing campaigns. Moreover, it can reduce costs through coding assistants, knowledge querying for staff, project planning, hiring and skills mapping, customer virtual assistants, and onboarding automation.

Conclusion

The “Road to Series A” workshop offered invaluable insights for startups preparing for their Series A funding round. Understanding the current funding landscape, leveraging emerging technologies like generative AI, ensuring technical robustness, and strategically planning the founder’s journey are key components of a successful funding strategy.

As startup founders navigate this challenging yet exciting phase, focusing on building strong relationships with the right investors, demonstrating aggressive growth, and being prepared for rigorous due diligence will be crucial for securing a successful Series A round. With these insights in mind, startups can approach their funding journey with confidence and clarity, paving the way for future growth and success.

If you are a founder with a passion for building innovative solutions in the Future of Finance or Future Economies industries, we invite you to get in touch with us.