At our recent 2024 AGM, our CEO Sharif El-Badawi shed light on the evolving dynamics of venture capital at the company’s annual general meeting.

In this blog post, we’ll recap his insights, as presented at the event, offering valuable perspectives for investors, startups, and ecosystem enablers seeking to understand and navigate the new norms of venture capital, particularly in the UAE and the wider Middle East, Africa, and Southern Asia (MEASA) region. We’ll also cover Sharif’s top 5 areas of tech that he’s bullish on, going into 2024.

The State of Venture Capital Across UAE, MENA, and Beyond

1. Startups: Catalysts for Job Creation and Sustainability

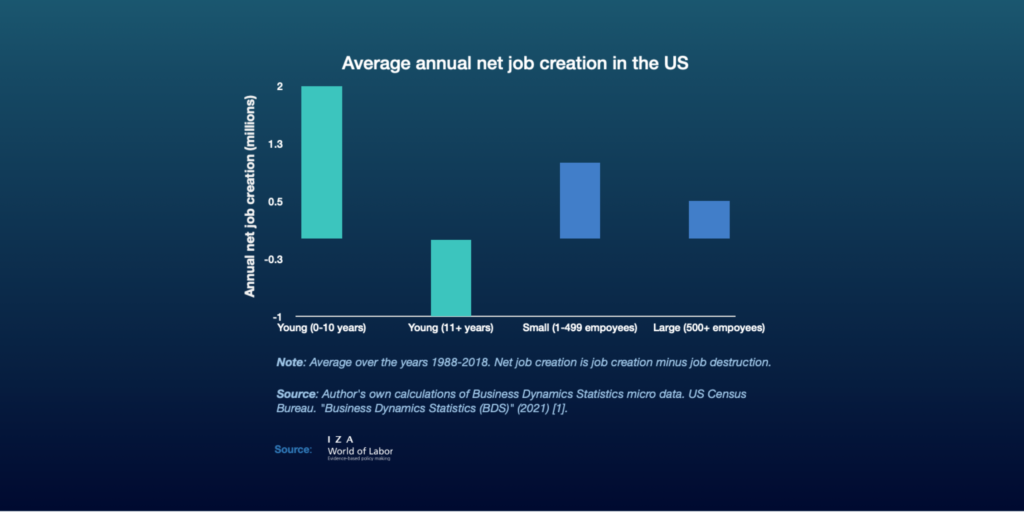

Startups play a crucial role in job creation and sustainability. Data shows that the vast majority of net new jobs come from startups and small businesses, with a majority from innovative small businesses. This number reaches around 60-70% of all jobs in most developed countries according to the OECD.

The UAE and Dubai have historically been entrepreneurial hubs, with a significant number of small businesses contributing to the GDP. This trend is consistent with mature markets like the US, where new companies create most of the jobs.

2. MENA vs. Global VC Deal Flow

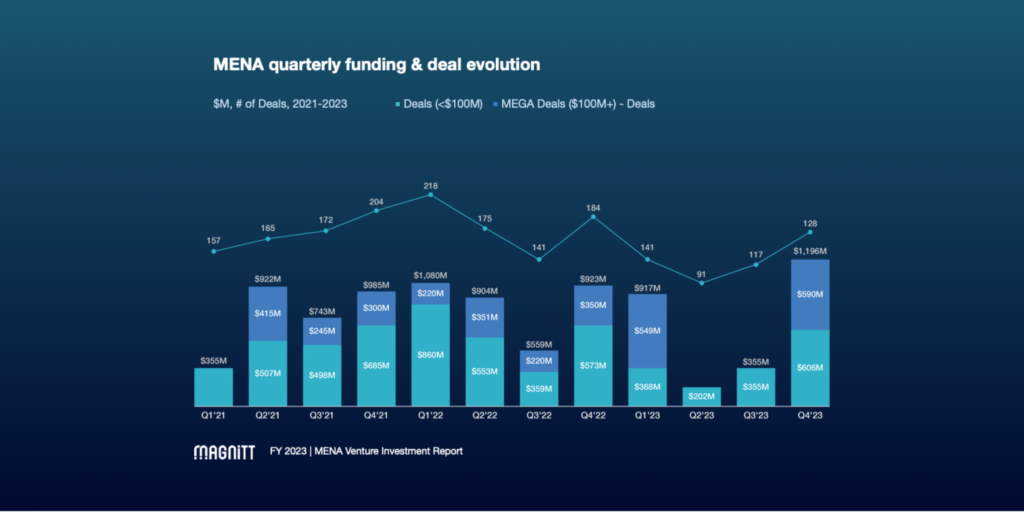

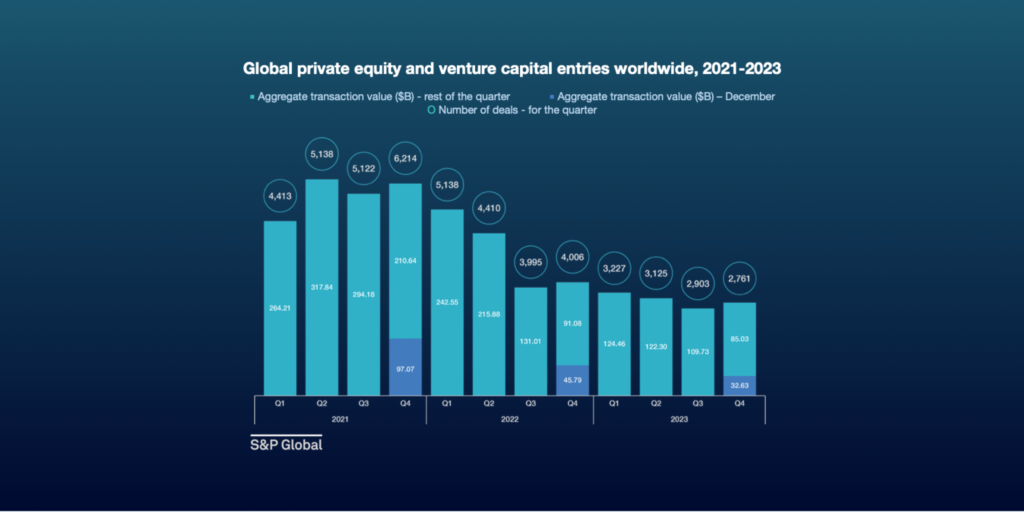

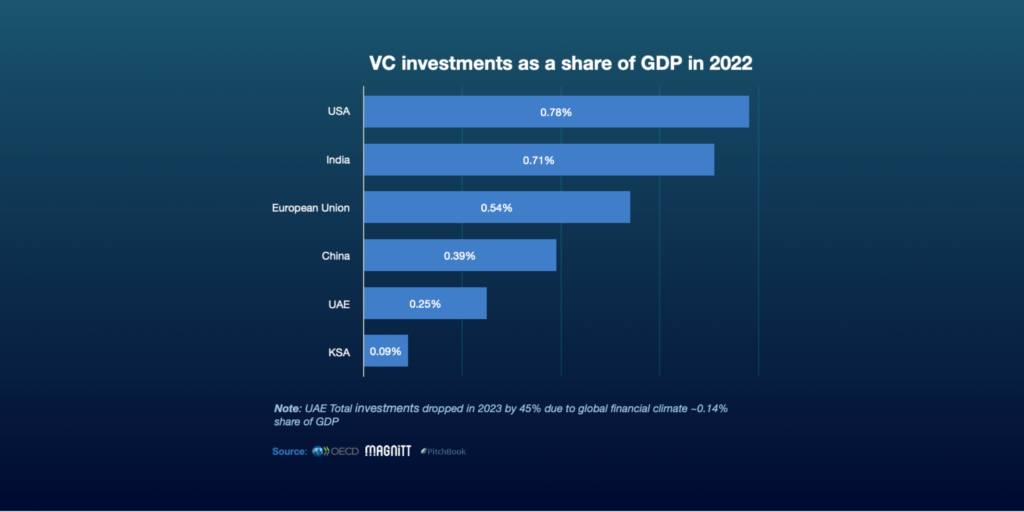

The MENA region, particularly the UAE, has shown resilience in venture capital activity compared to global trends.

While mature markets experienced a decline in VC deal flow due to economic downturns, the MENA region rebounded sooner and continued to grow. This growth is attributed to government motivation, increased interest rates, inflation pressures, and a robust pipeline of capital.

3. UAE Investment Rounds and Exits

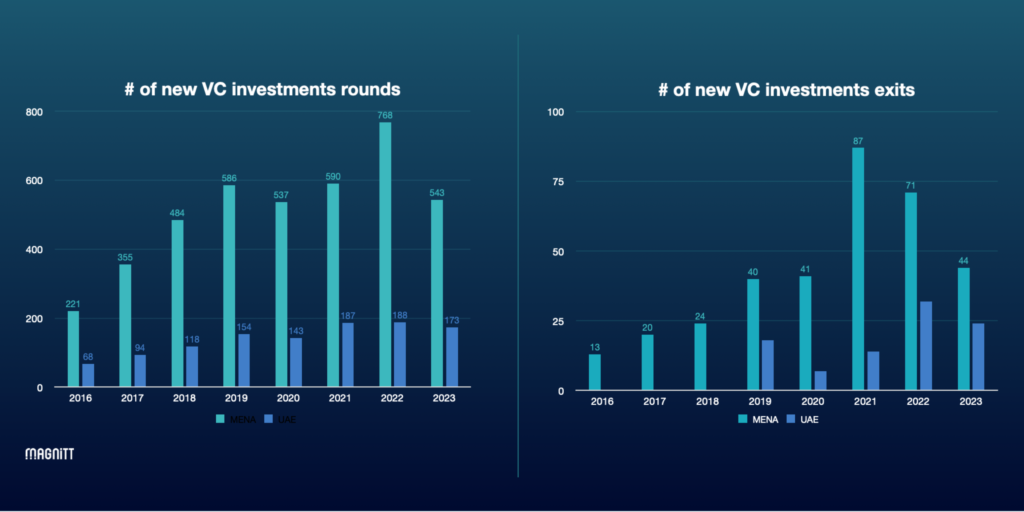

The number of UAE investment rounds has plateaued relative to the region, signaling a need for increased focus and resources to sustain growth according to MAGNiTT.

However, UAE exits remain healthy, with a history of technology exits since the 1980s. The frequency and size of exits have increased in the last five to seven years, indicating that exits are possible and happening in the region.

4. Sustaining Momentum: The Need for Continued Investment

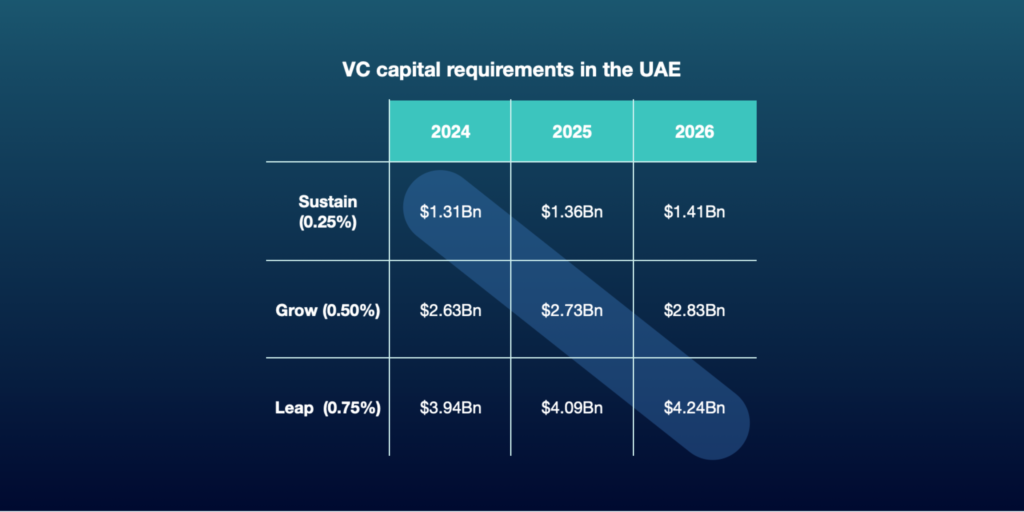

In 2022, UAE total VC investments reached $1.26 billion.

To sustain momentum, a minimum of $1.31 billion is required in 2024. This underscores the importance of continued investment to support the growth of the venture capital ecosystem in the UAE. This number is poised to balloon to $4 billion by next year if the UAE expects to leap forward.

Top 5 Tech Trends Shaping the Future

1. Sustainability and Clean Energy

Sustainability is a core focus for the Dubai Future District Fund, with an emphasis on three lenses: business practices, startup economics, and the planet. The push for sustainability addresses the need for sound underlying economics, responsible growth, and environmental stewardship. Clean energy and sustainability solutions are becoming increasingly vital for the future of the planet.

2. Artificial Intelligence (AI) and Robotics

AI and robotics are poised to revolutionize most industries. These technologies offer the potential to enhance efficiency and effectiveness across a variety of sectors. The focus on AI and robotics aligns with the goal of investing in deep tech and leading-edge technologies to drive innovation in the region.

3. Financial Services and Fintech

The future of finance is a significant area of focus, with fintech playing a crucial role in transforming financial services. The emphasis on fintech includes various subsectors, such as regulation tech and legal tech, which are important for compliance, governance, and data sharing.

4. Healthcare

Healthcare innovation is essential for addressing regional and global health challenges. The focus on digital health, precision medicine, and therapeutics is critical for advancing healthcare solutions. Investing in healthcare innovation is aligned with the goal of improving outcomes and enhancing the quality of care.

5. Agri-tech

Agri-tech is vital for addressing food sustainability and security. Given the unique environmental conditions in the region, technology plays a crucial role in ensuring food supply and sustainability. The focus on agri-tech is aligned with the goal of developing solutions that are relevant and impactful for the region.

Conclusion: Navigating the New Norms

As the venture capital landscape continues to evolve, stakeholders must remain agile and forward-thinking. Embracing sustainability, focusing on strategic investment areas, and fostering global collaboration will be key to thriving in the new norms of venture capital.

If you are a founder with a passion for building innovative solutions in the Future of Finance or Future Economies industries, or a member of the government interested in being a part of our wider value creation efforts, we invite you to get in touch with us. Together, we can build a sustainable future that leverages the power of technology and entrepreneurship to drive positive change.