When it comes to industry shifts and how they play out over time, it is essential to keep a pulse on both existing technology trends and emerging ones, such as Web3. Over the past year, we have considered several blockchain, metaverse, and crypto deals, and we would like to share with you a consolidation of ideas we have put together in this process about how these unique open-source software businesses will evolve over time.

The typical open-source software company is exactly that: a legal business association that produces open-source software. A DAO, or decentralized autonomous organization, is simply a software-defined business association that produces open-source software. When defined in this way, the parallels become clear, along with the possible issues. But before addressing the roadmap, we must start by understanding the dynamics of Web3 and ordinary SaaS businesses.

Laying the Groundwork Assumptions about Web3

To explain the mechanisms of the Web3/ethereum ecosystem, let’s consider a use case: smart contracts. Smart contracts are often made open source when published, although it’s not required. When a new smart contract (decentralized project) is published, developers often publish the source code as well to increase trust and transparency.

For example, anyone can look at the smart contract source code of projects like Uniswap or OpenSea. This aligns closely with what open-source software projects do—they publicly release their software, allowing others to fork it and deploy it to provide value as they see fit. This is similar to what open-source SaaS businesses do.

Do Open-Source SaaS Businesses Work?

For those who aren’t familiar, an open-source software business model can take different forms, but companies in this vertical typically develop unique technology and release it for free. The code is public and available to anyone, enabling others to build upon it and fostering innovation.

Although some venture capitalists are skeptical about open-source software businesses, several success stories prove that this model can be highly successful. Companies like MongoDB (MDB) and Elastic (ESTC) have reached massive valuations using this model. There are still others such as cockroachDB (valued at $270M) and MariaDB (valued at $200M). Docker (est. $2B) remains one of the most important infrastructure software companies ever created despite 90%+ of docker users potentially never paying to use the open-source software itself.

There are also derivative models built on top of existing open source software. GitHub and GitLab were built from the original open source git protocol. Companies like mlab (acquired for $70M) and scalegrid were built as hosted versions of existing databases. Travis CI leveraged container technology early to build one of the best continuous integration services in the industry. Cloud providers like Amazon Web Services have even created proprietary hosted versions of Redis (take a look at Amazon’s MemoryDB).

So, is giving away your product a bad thing? The answer is: it depends. While there are risks involved, open-source software companies have found ways to create and capture value. Users find tremendous value in these projects, and communities keep them alive for long periods. Value can be created and captured even without venture-backed companies, as users donate to nonprofits that maintain open-source software. DAOs could potentially maintain evergreen funds as well.

What These Companies Do

At its root, consumers of any business trade the value they wish to accrue for money in return. The customer believes that the product or service being offered has more value than the money exchanged to receive it. The seller, of course, believes the inverse. If this were not the case, all things being equal, the exchange would never happen. To paraphrase Peter Thiel, a company’s goal is to create some value X and then capture Y% of X.

More often than not, these open-source companies are simply raising the bar for themselves by having the software be totally available and opening themselves up to competitors. But very often what happens is a company builds a product. The company then invests in marketing to build a community around the technology. As businesses adopt the technology, the company benefits as it acquires some mix of consulting and enterprise revenue. Ideally, the company later uses that revenue to improve the product and therefore the business and the open source world.

The key insight is these communities and accretive benefits have real value. There are many posts to be found on how users have found tremendous value in open source software projects. The users of these projects keep them alive for long periods of time. Not all of the Linux ecosystem projects are run by venture-backed companies, but they don’t need to be for value to be created and captured. Users donate to the nonprofits that maintain this open source software, and it stands to reason that evergreen funds could be maintained by DAOs.

Even if there are investors involved, it’s worth recognizing that, of course, this doesn’t always work out. I highly recommend this fantastic blog post from the CEO of rethinkDB on why they failed to compete with open source company MongoDB.

For posterity; let’s highlight the lifecycle we’ve defined so far:

- Software is developed, and some value is created

- The code is given away for free and enters the market

- A community develops around the project

- The community gradually captures the value

- Through a company maintaining it, the value created is gradually captured and compounded into improving the software product or service.

The Value Created by Open Source Companies

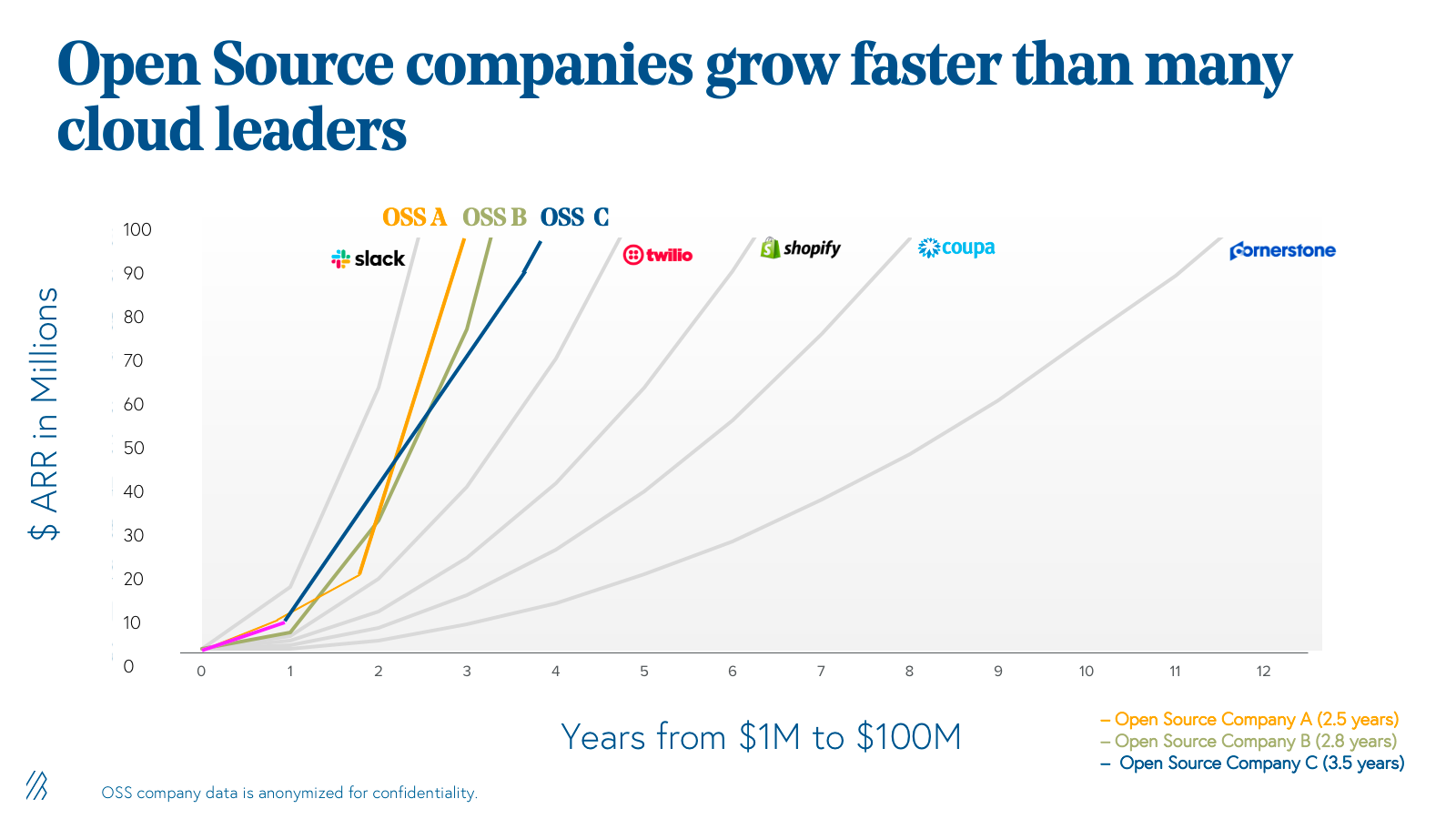

Interestingly, not only can community-driven open source projects grow, they grow and accrue value faster than many large cloud businesses.

Here’s a comparison from bessemer venture partners of three top open source SaaS companies and their growth timelines, compared to similar cloud companies:

It makes sense that these services would grow quickly, indicating that developers like open source. As it’s given away for free, giving back can serve personal localized incentives for companies and developers looking to build a reputation.

As a related side, Bessemer’s breakdown of open source SaaS investing is fantastic. We believe many of those lessons apply to open-source DAOs as well — more on that to follow.

What is a DAO?

To understand DAOs, let’s first get familiar with NFTs (non-fungible tokens). NFTs are provable representations of digital ownership that cannot be modified by anyone other than the owner. When combined with the composability of software, interesting things can happen.

Once we have the notion of unique token ownership, we can write code to interact with users based on the tokens they hold. We can create and modify these relationships dynamically. A DAO is a decentralized, autonomous organization that can use software to automate investment decisions by token holders and manage the rights of different tokens. A DAO-owned gym, for example, could be launched using this approach.

DAOs offer an efficient means of verifying and auditing investment decisions, and the open-source software acts as the source of truth, eliminating disputes. The question then becomes, how can the funds be utilized by these organizations?

If you wanted to make a private club 50 years ago (for example, a gym), I could probably build the business like this:

- You start an LLC by filing articles of incorporation with your local secretary of state and get a reply in two weeks.

- You’d make some membership cards.

- You’d sell $100 memberships to gym members and investors for some fixed or ongoing fee.

- Now you, the owner, would take this money and organize the purchase of a venue, get some equipment, and hire some staff to offer the service to the members.

Now, imagine you wanted make a private club today as a DAO, you could probably go about it like this:

- You’d write a smart contract and publish it online in 2 hours.

- You’d make 1,000 NFTs and sell each one for $100 on the blockchain.

- Everyone then buys this NFT and becomes part of this group.

- Now the collective has $100,000, and the group can vote on how to use the pooled funds.

This is a DAO — a decentralized, autonomous organization. A DAO can use software to mediate the automation of investment decisions by all the token holders and also use software to handle what rights different tokens have. I could also use a DAO to launch a gym using the stack I just described.

At the end of the day, the DAO is a much more efficient means of verifying and auditing investment decisions of capital, and because the open source software is the source of truth there is no means for disputes. All that remains is the question of what to use the money for in these “organizations.”

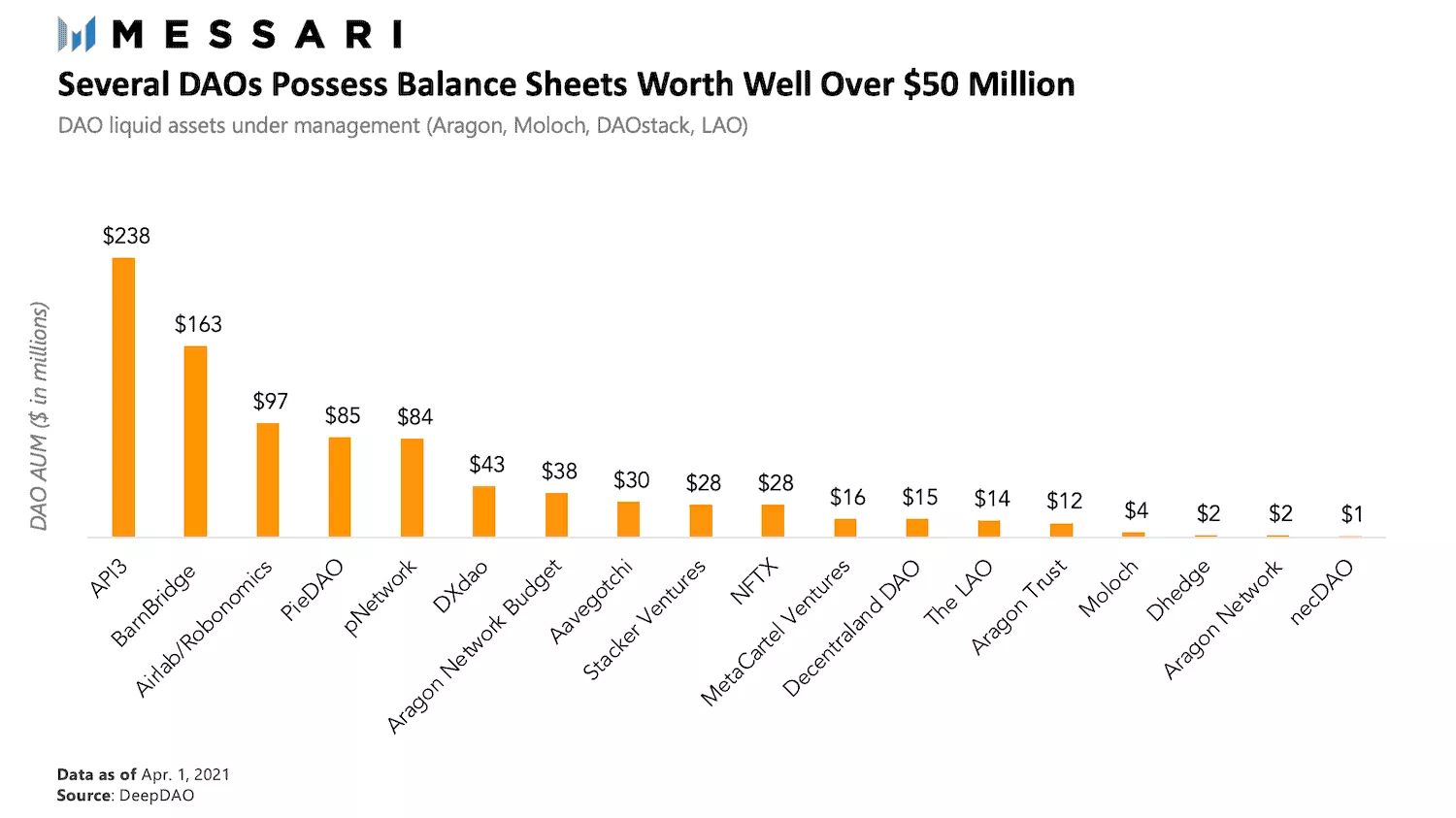

If all of this sounds a bit too theoretical for you, I’d encourage you to reconsider. According to data published by DeepDAO, the balance sheets of many DAOs have gotten above USD 2M which is more than most seed rounds!

Source: Underscore VC and their portfolio company Messari

So now that we understand that the technology can be built and trusted with millions under management (and the capital is ready to deploy), now the question remains to ask: What to use the funds for?What if the funds were used for the development of an open-source product? A scenario where not only the product itself is open-source, but the governing entity that creates it is also open-source as is the case with DAO.

Case Study: Browser-based blockchain wallets

Let’s use a good open-source example that’s incredibly simple — a chrome extension!

To set some baseline definition — a “wallet” is a software tool that manages your private key and allows you to sign and submit transactions to the blockchain you’re interacting with. Metamask is an example that was built for the Ethereum ecosystem.

If you’ve never heard of Metamask, I highly recommend you stop reading this and download a crypto wallet to learn more about the technology. Consensys, the owner of Metamask, is now valued at around $7B and shares the same founder as Ethereum. A similar company was built for the Solana blockchain, called Phantom. This venture-backed company also reached a $1B valuation quite quickly.

The crypto-savvy perspective here, however, is that there’s no real reason that the ownership of these crucial software tools should be in private hands to begin with. The software could be made completely open-source, and only needs a community to be interested in using it, just like many other communities that use crypto products today. A DAO could be created with a majority of the tokens vested in the original creators.

Enter, Tally Ho!. This tool is the first project to logically follow this trend. This organization has built a completely open-source version of Solana’s Phantom wallet. Given that both are SaaS tools available to anyone, they can compete on even footing. The biggest differences are that the code is freely available online, and the DAO tokens are the ones that appreciate in value instead of shares in the venture-backed private company.

The benefits (or at least promises) of this model when compared with traditional venture backend SaaS are theoretically as follows:

- The code is freely available.

- Anyone can invest in any stage open source products at any ticket size.

- Liquidity for any and all investors at all stages of product growth.

- Any token holder can vote in the direction of the product along with the DAO.

- More innovation happens in the ecosystem as software tools become more available and composable.

- The DAO has significant capital available to invest in product development.

While it will certainly happen in some software markets more than others; I see no reason that every software tool can’t be reorganized and funded using this approach.

To take the example further, there’s no reason a new database couldn’t be implemented tomorrow if there was a willing group of individuals to buy the tokens to fund the development and build the tools. If there is a group of people who believe that a better implementation of PostgreSQL could be developed, a DAO could be created, a repository linked to it, and a token sale issued. All funds supplied by project backers on the contract could be routed into things like stablecoin market-making on a decentralized protocol to fund development in perpetuity. With some improvements in infrastructure, the same could be done for things like a DAO-owned Salesforce, a DAO-owned fork of Redis, and many others.

With this new tool for capital generation, not only could a motivated group fork an open-source project, which happens all the time, but entire software service businesses could be forked and taken in new directions.

Could you imagine if someone could look at the source code for MongoDB Atlas, fork the entire codebase, and automatically deploy a helm chart for the entire product (with integrated crypto payments!) on another cloud provider? The possibilities could be incredible for developing new ideas and reducing costs.

Dubai as a Launchpad for DAOs and Web3 Startups

The UAE has positioned itself as a welcoming home for crypto. Regulations have been introduced to provide a legal framework for crypto businesses to operate within, and supportive ecosystems have been established. The emergence of forkable capital structures around software projects is expected to be a significant shift in venture-backable open-source software. The MENA region has the potential to be at the forefront of this movement.

Note: Valuation numbers are sourced from PitchBook, but they are not essential to prove the argument.