A reckoning year for tech companies

The drop in tech valuations that we first started to see globally in the first half of 2022, driven by an increase in interest rates and inflation around the world (as recapped in a previous post), continued throughout the year.

According to Crunchbase, global venture funding totaled $81 billion in Q3 2022, which was down by 53% year-on-year and by 33% quarter-on-quarter. Further, CB Insights reported that the total number of deals fell by approximately 10% from Q2 to Q3 this year.

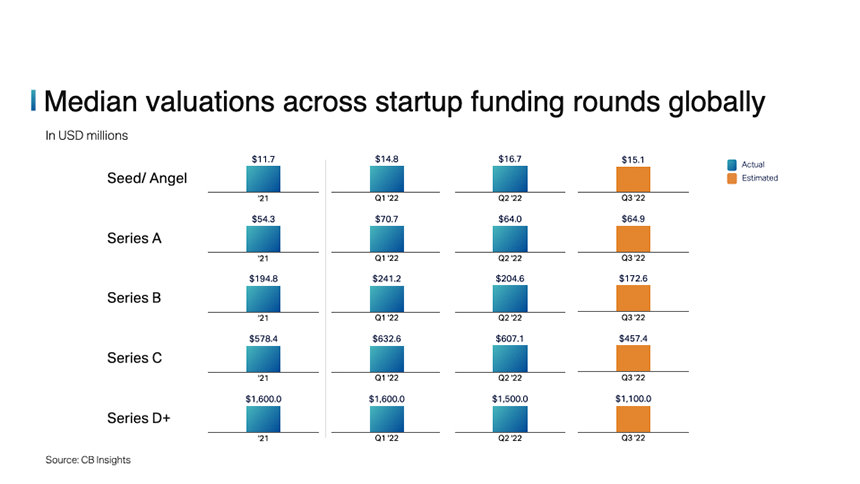

According to CB Insights, this quarter-on-quarter drop is seen across most stages of the startup lifecycle, globally — particularly in late-stage rounds.

The drop in valuations is a result of a reduction in VC deal count and deal size as investors continue to limit their risk exposure given the economic circumstances of high inflation and interest rates.

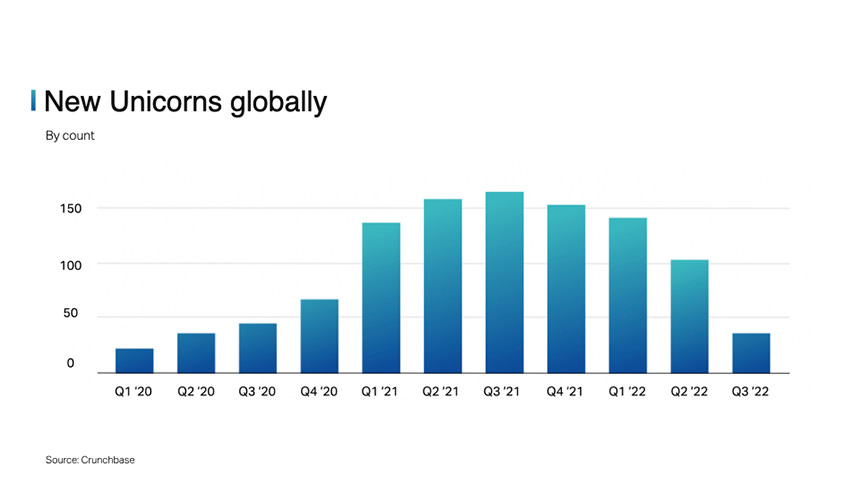

Accordingly, the count of new companies crossing the billion-dollar-plus valuation mark (aka “Unicorns”) has also dropped significantly worldwide to almost early Covid-19 pandemic levels (i.e. Q1 and Q2, 2020), in line with figures reported by Crunchbase.

Et tu, MENA?

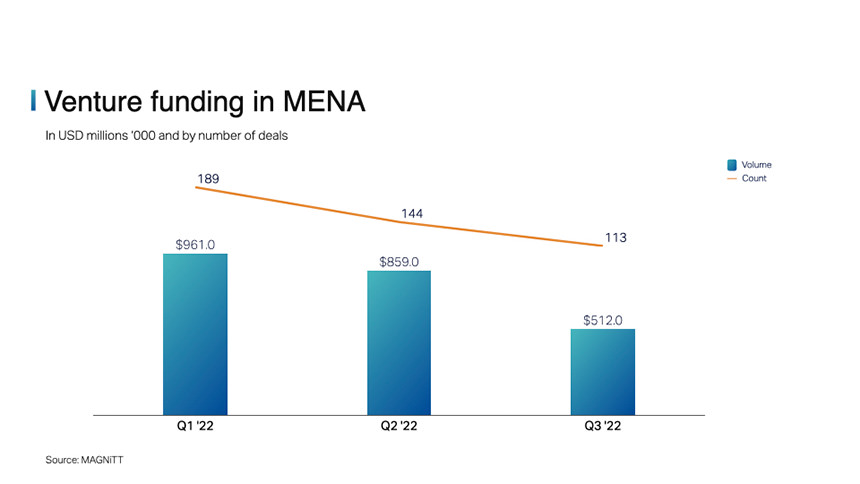

This downward trend across venture capital activity at large has, albeit slightly delayed, become present in the Middle East and North Africa (MENA) region as well. MAGNiTT reported that both the count and size of VC deals had been steadily dropping in the first three quarters of 2022. Last year’s Q3 funding (totaling $512 million — approximately 0.6% of global funding in the same quarter) was down approximately 46.7% from $961 million in Q1 earlier in the year.

This indicates that, while the situation has been somewhat masked by the positive regional economic trajectory, the MENA private markets are prone to the same factors driving the global economy at large; namely volatile public markets, rising inflation levels, and mounting interest rates.

Not all of 2022 has been gloomy

The overall drop in VC activity last year isn’t to say that the sector has seen no successes at all. In spite of this, Crunchbase reports that more than 80 companies around the world doubled their valuations between Q2 and Q3 in 2022. These companies span across a variety of Future Economies sectors including Future of Work, Future of Health, Future of Logistics, and Future of Security.

This gives room for hope that high returns can still be achieved in venture capital. There is also additional room for founders to take note of what has worked well for these companies in these trying times, in order to create somewhat of a playbook for startups during bear markets.

Predictions for 2023

1. Dry powder will compel VC activity

Venture capital firms raised record funds in 2021 and 2022 (according to Crunchbase); and while the rate of deployment of this capital was pulled back in 2022, the amount of dry powder has been building up and is currently at its highest levels (according to Pitchbook). This will, therefore, put pressure on fund managers to deploy capital as we head into 2023. Needless to say, there is a lineup of founders across early and late-stage startups who are ready to accept capital on the demand side.

However, growth expectations will adjust. Moving forward, expectations of private company earnings (including startups) will shift to adjust for the risks that were otherwise buried amidst the hype. This conservative approach by investors can lead to higher discounts and cap rates, when considering venture investments, giving LPs more favorable positions.

2. FinTech will continue to attract investors

Even with a slowdown in venture capital around the world, investments in the FinTech sector continue to outpace other sub-sectors of Tech, both globally (according to TechCrunch) and across emerging markets (according to MAGNiTT). This means that founders who are innovating in the Future of Finance space will continue to see interest from investors next year, provided that their business fundamentals are as solid as their growth plans.

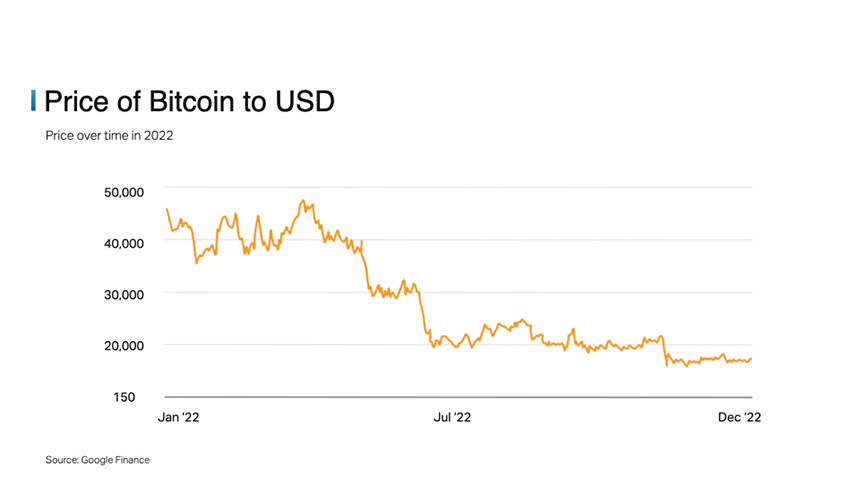

That being said, an emphasis on regulation will come into play in the Future of Finance, given the severe drop in valuations that the crypto markets have suffered in 2022 (the price of Bitcoin alone has dropped approximately 63% in 2022 to a two-year low), spurred by the fall of the Terra-based stablecoin USDT and the collapse of crypto exchange FTX. Therefore, investors’ and the market’s trust in crypto-focused startups will be tested next year.

3. A recession may come into play

As the Fed aggressively raised interest rates in 2022 and prices soared across the world (many countries saw their highest inflation levels in decades), the yield on 10-year treasuries climbed, though the yield on 2-year treasuries rose even faster, causing a yield-curve inversion that’s currently at its deepest level in 40 years. This inverted curve shows that the yield on short-term government bonds exceeds that of long-term bonds (expressing more risk in the short-term), which has been a historical indicator of economic recession.

The impending recession that founders and investors alike have been worried about since the onset of the industry downturn in 2022 may well become a reality in 2023. This will impact investors’ expectations of private company earnings, as individuals and institutions become more cautious about spending with no end in sight for inflation (including rising oil & gas prices, spiked by the Ukraine-Russia conflict) or interest rates coming back down to “normal” levels. Though, in its latest move in December 2022, the Fed increased interest rates at a level less than expected, giving the market somewhat of a breather.

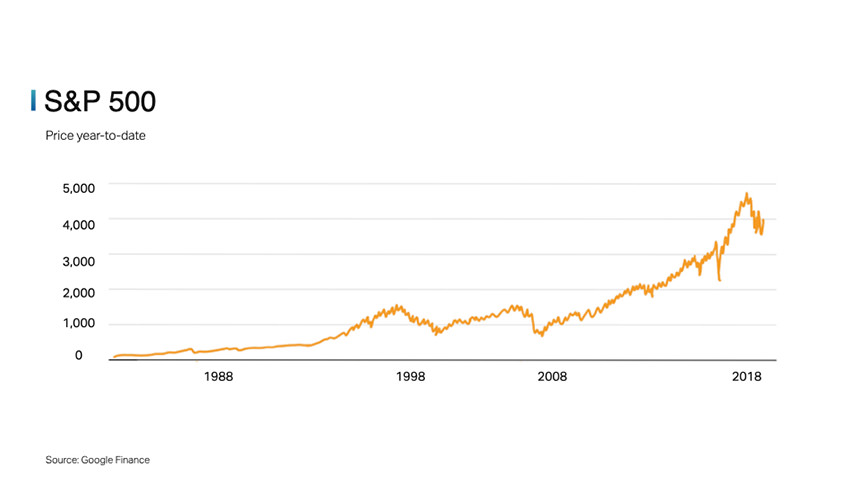

In spite of all this, the slowdown in the stock market throughout 2022 has not been as sharp as other downturns in our lifetime (e.g. the S&P 500 has dropped approximately 15% so far this year from its record high on January 1, 2022, whereas it dropped approximately 52% during the 2008 financial crisis), the recession may be short and result in few casualties.

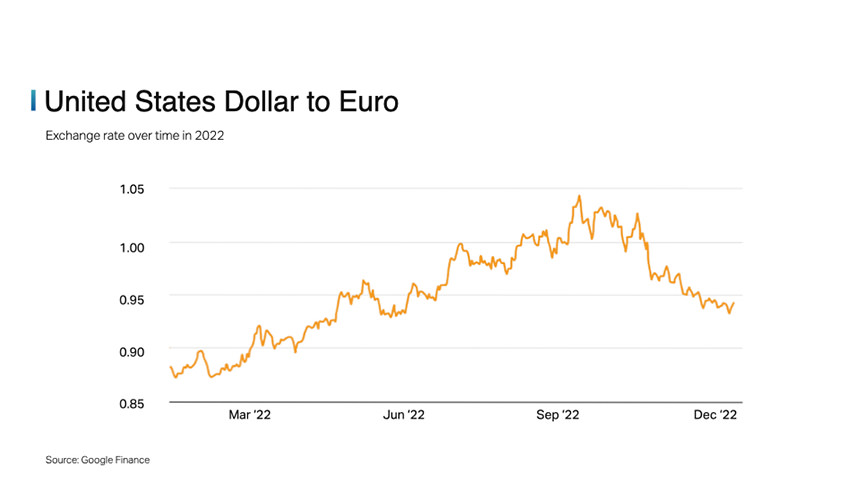

The USD had one of its strongest years ever in 2022, in the first 9 months of the year it rallied 20% — reaching a 20-year high. Additionally, in 2022 the US Dollar beat the British Pound and Euro for the first time in history. It’s since given up some of these gains, but USD-backed currencies such as the UAE Dirham and the Saudi Riyal in the Middle East will continue to ride on the back the strong performance of USD, shielding investors and businesses in the region from the sovereign debt crisis in some emerging markets (such as Sri Lanka), including countries in Europe that utilize the Euro.

We’re looking forward to seeing what 2023 will bring

As DFDF completes its first year of investments, we look forward to growing our portfolio and presence in 2023. As the year progresses we also look forward to seeing how many of our predictions for the year will hold true, and how that will change the landscape of venture capital in the MENA region and beyond.

If you are a VC fund looking for capital partners, or a founder looking for direct investment, we look forward to hearing about your plans for 2023.

Are you an Emirati citizen looking to learn about the inner workings of venture capital firsthand from experts? Don’t miss the opportunity to be a part of DFDF’s first Venture Fellows cohort kicking off in February 2023. Apply to the fellowship program at fellows.dfdf.vc before January 20th, 2023.