Introduction

In the dynamic world of investments, Fund of Funds (FoFs) investing has risen as a strategic beacon, offering a versatile and streamlined approach to investment management. This ingenious concept involves weaving a tapestry of investments across multiple underlying funds, crafting a multi-layered strategy that captures diverse market opportunities while standing as a bulwark against potential risks.

In this blog post, we will take you through our Fund of Funds evaluation process and the vivid panorama of legal structures and jurisdictions that adorn the landscape of venture capital (VC) funds.

Our Fund of Funds Mandate

Our overarching Investment Thesis encompasses deploying capital into both burgeoning startups through direct investments and venture capital funds as Fund of Funds investments. In the realm of the latter, we intend to allocate 60% of our capital designated for FoF investments to regional funds, with the remaining 40% directed toward international funds.

When it comes to regional funds, our focus extends to both emerging fund managers and established VC funds. The former category involves first-time fund managers who possess prior experience in VC investment. These managers present a distinctive vision for their funds, whether in terms of stage, sector, or geographic focus. Additionally, they operate within the UAE and harbor aspirations of expanding their footprint across various Middle East, Africa, and South Asia (MEASA) regions.

Conversely, the latter category encompasses fund managers embarking on their second or subsequent fundraising rounds. These managers have demonstrated strong performance with their initial fund, exhibiting robust governance, a commendable track record of their team, sectorial expertise that is worth spreading, and a notable impact on the regional ecosystem. Operating either from the UAE or other parts of MEASA, these established VC funds bring a wealth of experience to the table.

Mapping the Terrain Further

Further dissecting our Fund of Funds mandate, we delve into the geographic scope of our investments. Currently, we are focused on Stage 1 of a comprehensive three-stage strategy.

Stage 1 (focus area): Our investment focus is primarily directed towards Dubai and UAE-based funds, extending to encompass a broader regional emphasis on the GCC and the Levant.

Stage 2: Our strategy unfolds with an expansion into North Africa, targeting specific countries such as Egypt, Morocco, and Tunisia.

Stage 3: The journey continues as we shift our focus to the Middle East, Africa, and South Asia region. Notably, potential markets like India, Pakistan, and Bangladesh display promising deal flow. Given the limitation of available capital, our investment decisions in this stage are guided by meticulous market mapping and industry-specific analysis.

Our Initial Screening Process

When we receive a fund application, we embark on assessing the pitch deck to determine its alignment with our investment thesis. In instances where there’s a potential fit (or there are less clear areas), we initiate an introductory call or email exchange to gather more information. Once a fund meets our criteria, we move forward into the first phase of diligence.

1. First Phase of Diligence

This step includes reviewing the fund’s deck and dataroom thoroughly, sharing our Due Diligence Questionnaire (DDQ), and conducting portfolio analysis. Note that our DDQ encompasses more than 180 questions, comprehensively covering investment strategy, organization, governance, team composition, fund terms, valuation policy, investment process, and documentation. Our Portfolio Analysis Template is shared with fund managers raising their second fund or beyond, providing a detailed breakdown of past investments.

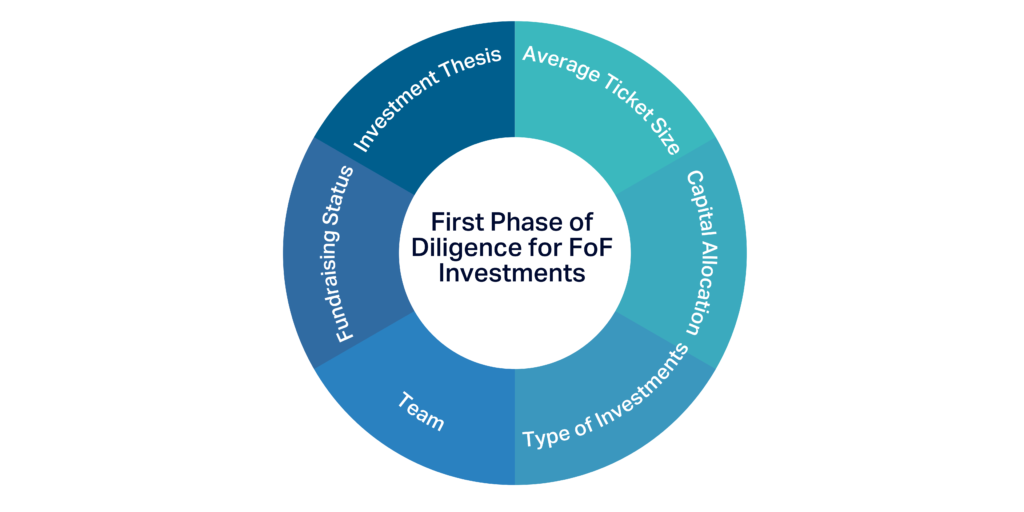

Analysis during this phase includes the following steps:

- Scrutinizing the fund’s investment thesis, including preferred stages, sectors, and geographic focus

- Understanding average ticket size and capital allocation for follow-on investments

- Identifying the type of investments made, such as equity or convertible notes, and whether they lead or co-invest

- Evaluating the fund’s team, their experience, cohesion, and driving factors, with a particular focus on legal aspects such as fund structure and carry distribution. Assessing the legal structure, ownership, and carry distribution to ensure interests are aligned

- Gauging the fund’s fundraising status, including closing stages, timelines, the types of investor commitments (institutional funds, angels, family offices, or corporates), and capital raised

This thorough evaluation process allows us to make informed decisions about which VC funds to invest in, ensuring alignment with our investment focus and criteria.

2. Unveiling the VC Fund Performance Enigma

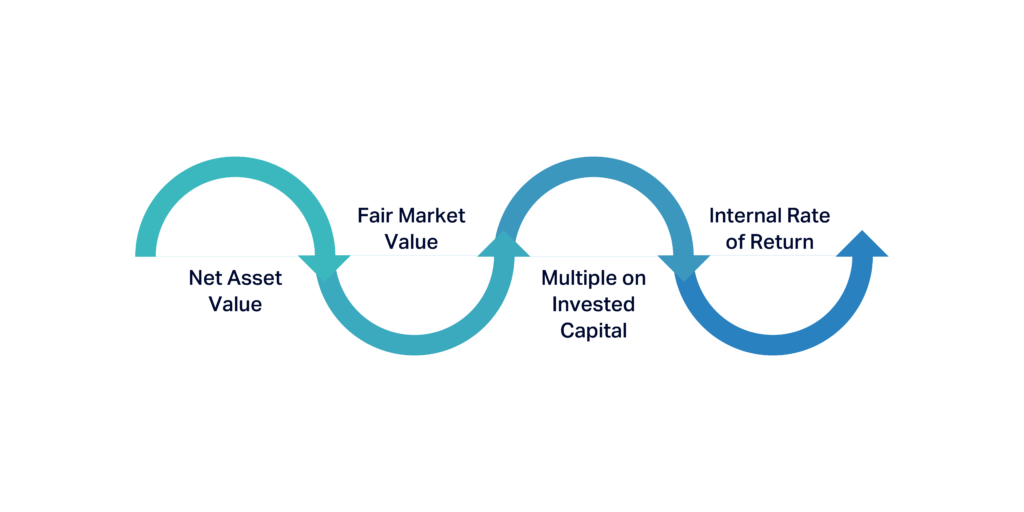

In addition to assessing the team and track record, we conduct a comprehensive evaluation of the fund’s financial and performance metrics. Some of the key metrics examined include the following:

- Net Asset Value (NAV): This metric offers insights into the fund’s assets and liabilities, providing a holistic view of its financial standing

- Fair Market Value: Determining the value of investments at the point of evaluation, providing an accurate snapshot of the fund’s current market position

- Multiple on Invested Capital: By comparing the initial investment cost to the current value, this metric reveals the fund’s performance growth over time

- Internal Rate of Return (IRR): This metric factors in the timing of funding and investments. It places primary emphasis on three key performance multiples:

- Residual Value to Paid In: This ratio represents the invested amount that hasn’t yet been exited or realized, relative to the paid-in capital

- Distributions to Paid In: The ratio of distributed amounts stemming from exited investments, compared to the paid-in capital

- Total Value to Paid In: This metric is the sum of Residual Value to Paid In and Distributions to Paid In. It showcases the current investment value compared to the initial contribution

These meticulous performance assessments empower us to gain a profound understanding of a fund’s financial health and success trajectory, informing our investment decisions.

3. The Tapestry of Portfolio Analysis

Portfolio analysis goes beyond fund performance to include other pivotal factors. It entails a request for a comprehensive list of all fund investments, enabling us to examine crucial breakdowns.

This analysis plays a pivotal role in evaluating the fund’s overall performance and its adherence to its strategy. It provides valuable insights into the fund’s investment choices, risk management strategies, and potential returns.

Part of this analysis involves comparing the actual portfolio breakdown with the fund’s stated investment strategy to ensure consistency. This includes:

- Geographical Breakdown: Understanding the fund’s investment distribution across different regions.

- Sector Vertical Breakdown: Identifying the fund’s focus areas in terms of industry sectors.

- Stage Breakdown: Analyzing the fund’s investments across stages, such as Pre-seed, Seed, Series A, and growth.

Funds are further evaluated based on their investment behavior and portfolio performance:

- Examining the date of investment to understand the fund’s entry timing

- Evaluating the entry valuation to determine if the fund entered at a fair or inflated value

- Analyzing the fund’s ownership size in each portfolio company

- Monitoring the number of write-offs and write-downs in the fund’s portfolio

- Tracking the number of active portfolio companies still performing well

- Recognizing the industry’s rule that some startups may fail while others succeed

4. Calibrating the Portfolio

The portfolio recalibration process ensures transparency and alignment with market practices. It involves reevaluating the fund’s investments based on updated data and valuation policies. Recalibration generally takes place at the end of a specific period, such as the end of year two or quarterly.

The criteria for recalibration include reassessing valuation if there has been a significant price increase and utilizing specific fund-provided data for recalculating portfolio estimates.

The process adheres to market practices and guidelines to ensure consistency and fair valuation, aiming for an accurate and objective evaluation of the fund’s performance. This portfolio recalibration process serves to maintain transparency, ensure fair valuation practices, and gain better insights into the actual performance and returns generated by the fund’s investments.

Unmasking the Second Phase of Diligence

1. Presenting to the Investor Committee

Once a deal has been cleared for consideration by our team, we prepare to present it to the final decision makers — our Investment Committee (IC).

We present these opportunities to the IC through an Investment Committee Memo, a comprehensive document, reflecting the team’s analysis and evaluation, intended to guide the IC’s decision-making process — to help them make a go/no-go investment decision.

2. Post-IC diligence

Once our Investment Committee pushes an opportunity through, the Post-IC diligence begins. This phase involves finalizing the legal due diligence to ensure the fund’s structure and all entities are in place. It also includes conducting reference checks with co-investors, founders, and other LPs, while seeking support from external legal counsel for document review.

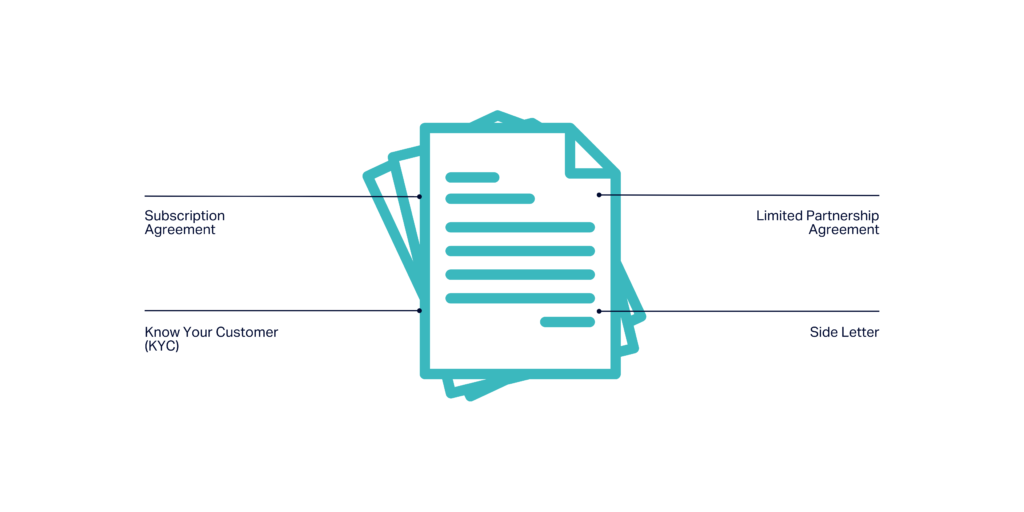

3. Legal Documents

The key documents that we gather when finalizing a FoFs deal Post-IC diligence include the following:

1. Subscription Agreement:

- Outlines the commitment of Limited Partners (LPs) to provide agreed-upon capital to the fund

- Details of commitment amount, drawdown schedule, fees, and other legal and regulatory aspects

2. Limited Partnership Agreement (LPA):

- This crucial document defines rights, responsibilities, and relationships between General Partners (GPs) and LPs

- It encompasses capital commitment, management fees, and profit distribution details

3. Side Letter:

- An optional document used when LPs require specific terms different from those offered in the LPA

- It can modify the terms of the LPA for that specific LP

4. Know Your Customer (KYC):

- Involves collecting information about investors to ensure fund legitimacy, assess regulatory compliance, and determine risk profile

- Extends beyond identifying investors’ identities

These legal documents play a pivotal role in the closing of a FoFs investment deal and help establish clear terms and expectations between GPs and LPs, fostering transparency, compliance, and risk management.

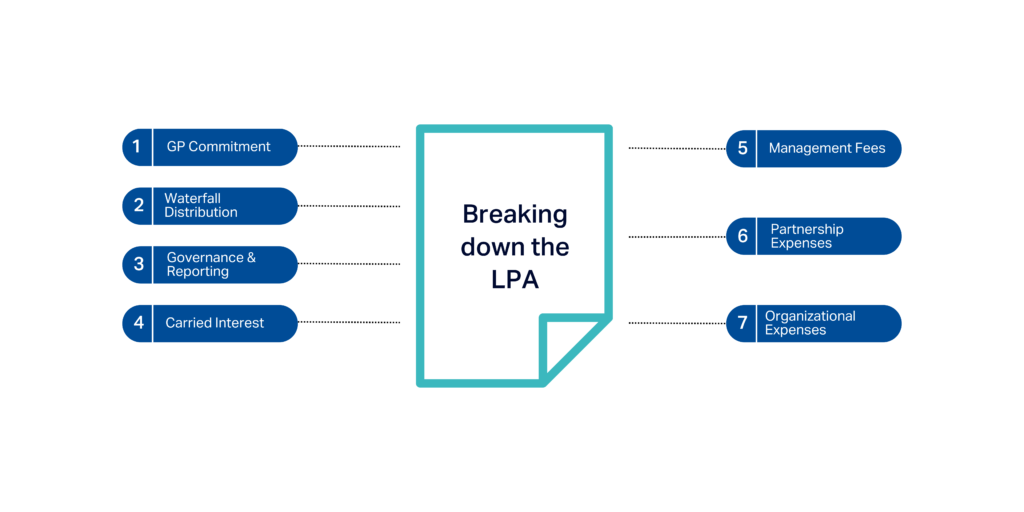

Critical Elements in the Limited Partnership Agreement (LPA)

Limited Partnership Agreements (LPAs) serve as foundational documents defining the relationship between investors and fund managers. They lay out the terms, rights, and responsibilities of both parties, shaping how investment funds are structured, managed, and operated.

Accordingly, LPAs play a pivotal role in the legal due diligence process. Understanding these critical elements helps us assess the alignment of interests, distribution mechanics, and transparency within the fund structure.

The tricky thing is that not all firms follow the same LPA template. In this case, we’d like to delver into some of the critical elements of our LPAs:

1. GP Commitment:

- This refers to the capital amount contributed by General Partners (GPs) to the fund

- Typically ranging from 1% to 2% of the total fund size, it aligns the interests of GPs with Limited Partners (LPs)

2. Waterfall Distribution:

- This determines how capital returns are shared between LPs and GPs

- It can follow a European or American model:

- European model: GPs receive carry after returning the initial capital to LPs

- American model: GPs receive their share of profit on a deal-by-deal basis

3. Governance and Reporting:

- This section covers the structure of the Investment Committee (IC), Limited Partner Advisory Committee (LPAC), and LP information rights

- It is crucial for understanding power dynamics and transparency within the fund

- Quarterly or annual reports fulfill reporting

4. Carried Interest:

- This represents a significant portion of the General Partner’s (GP) profit, acting as a performance incentive

5. Management Fees:

- Annual fees paid to GPs for managing the fund, typically ranging between 1.5% to 2.5% of the total fund size or invested capital

- These fees may start higher and reduce over time based on invested capital post-investment

6. Partnership Expenses:

- Ongoing costs of running the fund, including legal fees, travel, insurance, and due diligence expenses

- These expenses can impact the fund’s overall return and are subject to an annual cap, usually between 0.5% and 2% of committed capital throughout the lifetime of the fund

7. Organizational Expenses:

- One-time costs associated with setting up the fund, usually capped as a percentage of the fund (around 0.5%)

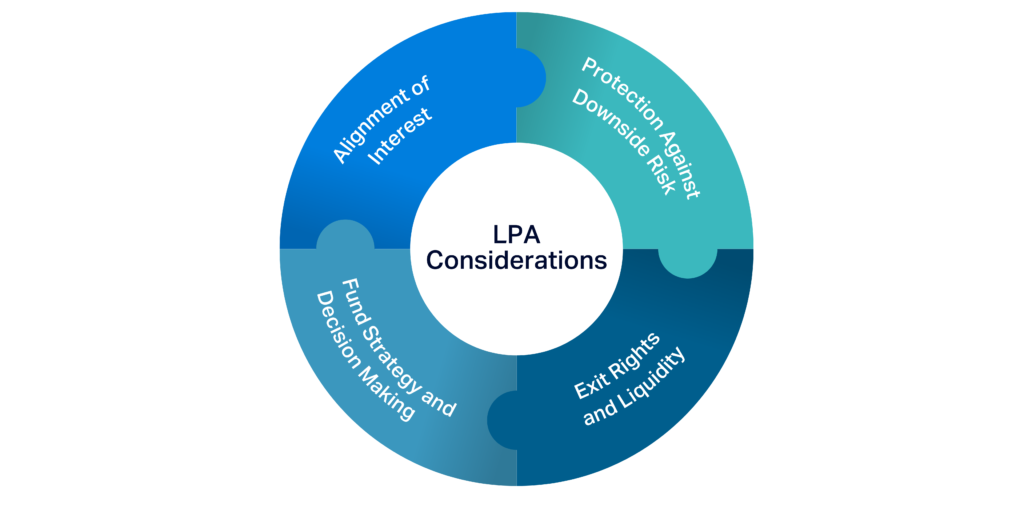

Major Considerations When Reviewing an LPA

Evaluating a Limited Partnership Agreement (LPA) involves weighing numerous aspects, and we focus on four major ones:

1. Alignment of Interest:

- We assess whether the General Partners’ (GPs) economic incentives align with the objectives of Limited Partners (LPs)

- This evaluation is based on factors such as carried interest, waterfall distribution, and information rights

2. Protection Against Downside Risk:

- We check clauses related to liability, indemnity, key person clauses, and defaults to mitigate potential risks

3. Exit Rights and Liquidity:

- Understanding the fund’s exit strategy and terms for liquidating assets is essential

- We assess how remaining assets will be distributed, which is crucial for evaluating potential return on investment

4. Fund Strategy and Decision-Making:

- We seek to understand the fund’s investment strategy and any restrictions on investments

- We determine if the decision-making rights of Limited Partners align with their investment goals

The limited partnership (GP-LP structure) is the most prevalent choice due to its simplicity, segregation of liabilities, and flexibility in managing funds and investments:

- Most common structure

- Involves a General Partner (GP) that manages the fund

- Limited Partners (LPs) directly invest in the fund

- The GP receives a management fee (typically around 2%) from the LPs and the fund

- Liabilities are segregated between the GPs and LPs

Jurisdictions for VC Funds

The most common jurisdictions for incorporating venture capital funds are Delaware (US), Luxembourg, the Cayman Islands, and the UK (including the British Virgin Islands). The choice of jurisdiction can vary based on factors like tax efficiency, regulatory requirements, and LP preferences.

Luxembourg is heavily regulated and may be preferred by European investors for added comfort. Meanwhile, the Cayman Islands are known for their tax efficiency and quick incorporation process. On the other hand, Dubai International Financial Centre (DIFC) is emerging as a jurisdiction for fund incorporation.

Inside Our FoFs Portfolio

As of the date of publishing this blog, our portfolio consists of the following seven FoF investments:

- An early-stage fund, covering the Seed to Series A stages

- A Saudi-based fund operating within the UAE, concentrating on fintech, cybersecurity, and retail sectors. It is an emerging fund manager

- An emerging fund led by first-time fund managers, specializing in early-stage pre-Seed investments

- Based in Dubai with operations in Africa

- Focused exclusively on fintech innovations

- An established fund investing in Seed to Series A stages

- Engages in operations and investments across the Middle East, North Africa, and Pakistan

- Concentrates on fintech platforms and software advancements

- An emerging fund manager initiated by a General Partner formerly at BECO Capital

- Focuses on FinTech, tech software, and AgriTech ventures

- Operates and invests across the Middle East, North Africa, Pakistan, and Turkey

5. MEVP (Middle East Venture Partners)

- Invests across the Seed to Series B stages

- Focuses on diverse sectors within the Middle East and North Africa, with a prominent presence in Dubai

- Boasts more than a decade of active engagement within the VC ecosystem

- Targets Pre-Seed to Series A investments, primarily in FinTech, HealthTech, and other software domains

- Operations span across MENA, North Africa, Turkey, and Pakistan

- An international fund specializing in Seed to Series A investments

- Already established several investments in the region

- Focused exclusively on FinTech companies

Our Invitation to Aspiring Funds and Fund Managers

We extend an invitation to all aspiring funds and visionary fund managers who share our passion for fostering innovation and driving the growth of groundbreaking startups. We are in search of those who dare to dream, those who are committed to supporting promising founders, and those who are dedicated to shaping the future of investment.

Together, we have the remarkable opportunity to not only contribute to the flourishing venture capital landscape of the UAE but also to inspire the entire MEASA region. By joining forces, we can amplify the impact of our collective efforts, nurture entrepreneurial spirit, and usher in a new era of opportunity.

As we embark on this journey together, we invite you to apply and be a part of shaping the dynamic future of investment in the UAE and beyond.