For much of the past decade, MENA’s venture ecosystem has focused on one goal: building great companies. In 2025, a second objective moved firmly into view building durable liquidity pathways that support founders, employees, and investors as the ecosystem matures.

2025 Marked the Year Secondaries Moved From “Nice To Have” to Essential Infrastructure

At its core, a secondary transaction is simple: an existing shareholder in a private company sells part of their position to a new investor. No new money goes into the company itself; instead, capital changes hands between investors. In a venture ecosystem that is now more than a decade old, this simple mechanism becomes a powerful recycling engine.

For angels, seed funds, and early strategic investors in MENA, the problem today is not paper returns. It is duration and liquidity. Companies stay private longer, IPO windows are cyclical, and trade exits are lumpy. The result is that early capital gets “stuck” in winners for ten to fifteen years, while new vintages, new founders and new technologies are constantly emerging.

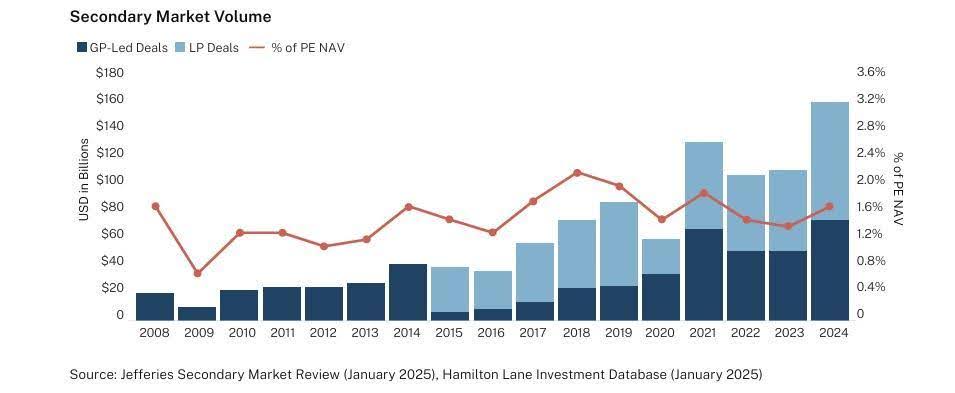

Secondaries solve that bottleneck. By providing targeted liquidity to early backers, employees, and even founders, secondaries convert paper gains into cash, which can then be recycled into the next generation of startups. In the global private markets, this has already become mainstream: secondary transaction volumes for private equity and venture stakes hit roughly 150 to 160 billion dollars in 2024 and are forecast to reach around 175 billion by 2025, with some estimates pointing to $300 billion by 2030.

The economic rationale is compelling for LPs as well. Secondary strategies typically buy into more mature portfolios, skip most of the J-curve and distribute capital faster. Cambridge Associates’ work on secondary funds shows that they reach a DPI of 1.0x materially earlier than other private-equity strategies and can already be around 0.4x DPI in the first five years, which is unusual for traditional buyout and venture funds. Based on that and our own modelling, we highlight that secondary venture portfolios can realistically reach 1.0x DPI in roughly half the time of a typical primary VC fund, with two to five times DPI potential over the life of the vehicle.

“Globally, secondary transactions have cleared at discounts of around 10–15% to the latest reported NAV, according to Jefferies. In MENA, where the secondary market remains structurally under-served, we see wider pricing dislocations, reflecting limited dedicated capital, constrained liquidity pathways, and a younger ecosystem. For disciplined investors, this creates the opportunity to acquire high-quality growth assets at discounts well in excess of global averages, while benefiting from shorter duration as the market institutionalises.” — Key Capital

Finally, Secondaries deliver these benefits without materially increasing risk. Data from Coller and others shows that secondary funds combine competitive median IRRs with the lowest dispersion across private strategies, and an extremely small share of funds losing capital, which aligns with our own analysis that more than ninety eight percent of secondary funds globally have returned over one times DPI.

The Gift of Secondaries: Unlocking Talent & Retention

One of the clearest shifts in 2025 was how secondaries reshaped the role of equity compensation.

The data is unambiguous. ESOPs are now firmly embedded across the MENA startup ecosystem, with over 80% of companies using ESOPs as their primary long-term incentive tool. Yet the liquidity behind that equity remains structurally constrained. More than two-thirds of ESOPs can only be exercised at an IPO or a full or partial exit, and anticipated exit horizons frequently stretch six to ten years, with many companies unable to define a clear timeline at all. In practice, this means that while equity ownership is widespread, the ability for employees to realise value is both delayed and uncertain.

In highly competitive talent markets like the UAE and Saudi Arabia, this creates friction. Employees discount the value of equity they cannot monetise, retention weakens after the early growth phase, and global remote opportunities increasingly offer more liquid alternatives.

Secondaries change this dynamic. When structured responsibly, they allow partial liquidity at key inflection points (Series B, Series C, pre-exit), enable employees to de-risk without fully cashing out, and create a powerful “refill effect” — where teams stay motivated to earn the next vesting cycle. Crucially, they realign founders, employees, and long-term capital around sustained growth rather than premature exits. In 2025, this approach moved from exception to emerging best practice among regional category leaders.

The Gift of Secondaries: Institutional Longevity

Secondaries matter at the platform level. Research from INSEAD highlights a familiar pattern: many strategic and corporate investment arms struggle to survive beyond five to six years, often due to a lack of realised outcomes during slow IPO and M&A cycles.

Secondaries help break this “institutional fatigue cycle” by:

- Delivering interim liquidity even when exit markets are muted

- Allowing capital to be recycled into new strategic bets

- Reducing over-concentration and long-duration exposure

- Making investment platforms more self-funding and resilient

In short, they turn venture investing from a long-dated promise into a more balanced, sustainable engine.

The Secondary Toolkit: Direct, Structured and M&A

The secondary market is no longer a single product. It is a toolkit. In practice, three buckets are most relevant to a MENA tech mandate: direct secondaries, structured secondaries and M&A-linked secondaries.

“Direct secondaries are straightforward share purchases in private companies, usually from existing shareholders such as: Early angels, seed funds and family offices whose fund lives are maturing, Employees with vested options or ESOP allocations, Founders rebalancing personal exposure or simplifying cap tables.” — Key Capital

Common use cases:

- Founder liquidity without sending a “selling founder” signal

- Founder or company buy-backs of early investors at a discount

- ESOP and option clean-ups where unexercised options are warehoused and monetised

- Concentrated exposures (for LPs or founders) that need de-risking without a full exit

Globally, GP led continuation funds are now the fastest growing part of the secondary market, allowing GPs to roll their best assets into new vehicles with fresh capital while giving existing LPs a choice between liquidity and rollover.

The final bucket is secondary liquidity embedded in M&A or strategic transactions. These can take several forms:

- Partial or full sale of a shareholder’s stake as part of a strategic acquisition

- Share-for-share deals where existing investors roll into a combined entity

- Pre-IPO secondaries where existing shareholders sell a portion of their stake to new investors in the run up to a listing

In global markets, as exits have slowed, sponsors increasingly use GP led secondary processes to “re-price” trophy assets, extend hold periods and bring in new long-term capital.

“In MENA, we already see a similar pattern: over the last two years, our analysis indicates more than nine hundred million dollars of secondary transactions across regional champions, often in conjunction with late stage rounds or strategic investments.” — Key Capital

The MENA ecosystem now has the depth to support this: MAGNiTT’s research, highlighted in 2017, already pointed to around 3,000 startups across the region, and more recent database counts show more than 5,500 startups being tracked today. Building on those datasets and our own mapping of funded companies, we estimate there are now roughly three thousand venture-backed and venture-scale companies regionally, more than five hundred that have reached Series A and beyond, and over twenty leading regional funds with vintages maturing in the next four years. This is the moment to use secondaries as a deliberate value-creation tool for both investors and founders.

Secondaries are not just another sleeve in an alternatives allocation. In a maturing MENA venture market, they are the missing recycling mechanism that turns one generation’s paper winners into the next generation’s funded innovation.

Sources and references

- Cambridge Associates, Streamlined Private Investing: Uncovering Growth in Secondaries, 25 May 2023. Cambridge Associates

- Cambridge Associates, When Secondaries Should Come First, 15 August 2017. Cambridge Associates

- Jefferies, Global Secondary Market Review – January 2024. (Jefferies.com)

- Jefferies, Global Secondary Market Review – January 2025. Jefferies.com

- Financial Times, “Investors offloaded record volume of private equity stakes in 2024,” 27 January 2025. Financial Times

- Wall Street Journal, “Private-Market Secondary Deals Hit Record Levels in 2024,” 2025. The Wall Street Journal

- Startup Scene / MAGNiTT, “3,000 Startups in MENA: TechCrunch Spotlights the Middle East’s Entrepreneurial Ecosystem,” 2 May 2017.

- MAGNiTT, MENA Venture Investment data / MENA Data platform (ongoing).

Contributors: Dubai Future District Fund × Key Capital

Key Capital is the first dedicated VC secondaries platform in the Middle East and North Africa, focused on liquidity solutions for technology companies and their stakeholders. We were founded to address a structural gap in the regional ecosystem, where founders, early investors and employees often sit on large paper gains with limited, ad hoc liquidity options and long holding periods.

Through the Key Capital Platform, we execute direct secondaries, founder and employee liquidity programs and bespoke structured transactions that allow early stakeholders to crystallise value while keeping companies on a long-term growth trajectory. Our approach is data driven, partnership oriented and designed to align incentives across founders, existing shareholders and new capital providers, with a core focus on accelerating DPI and institutionalising secondary liquidity in the MENA venture market.